Baker Hughes reported on Thursday that the number of oil and gas rigs in the US fell again this week by 62, falling to 602, with the total oil and gas rigs clocking in at 420 fewer than this time last year.

Over the last four weeks, oil and gas rigs combined have shed a total of 190 rigs.

The number of oil rigs decreased for the week by 58 rigs, according to Baker Hughes data, bringing the total to 504—a 329-rig loss year over year. It is the fewest number of active oil rigs since December 2016.

The total number of active gas rigs in the United States fell by 4 according to the report, to 96. This compares to 189 a year ago.

After holding steady for the better part of this year so far, the steep downward trajectory of the active rig count over the last four weeks indicates that the widespread stay-at-home orders that have decimated oil demand has finally spilled over into the number of rigs.

The EIA’s estimate for the week is that oil production in the United States fell to 12.4 million barrels of oil per day on average this week, which is 600,000 bpd off the all-time high. It is the lowest production level since September last year.

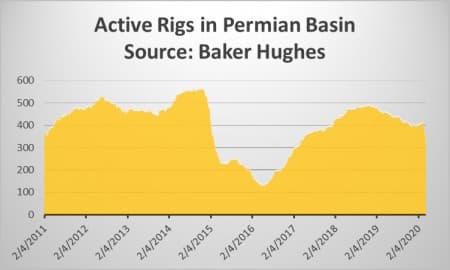

The number of rigs in the most prolific basin, the Permian, fell by 35 this week to 316, compared to 464 rigs one year ago. This is the fewest number of active oil rigs in the basin since March 2017.

The WTI benchmark at 10:35 am was trading at $22.76 (-9.9%) per barrel—roughly $4 less than last week levels despite OPEC reaching a deal to cut oil production by 10 million bpd.

The Brent benchmark was trading at $32.48 (-4.14%)—down by just over $1 per barrel from last week’s levels.

Canada’s overall rig count decreased by 6 rigs as well this week, to a total of just 35 rigs. Oil and gas rigs in Canada are now down 31 year on year.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- Oil Spikes After Algeria Says OPEC+ Cuts Could Reach 10 Million Bpd

- Pandemic And Price Crash Force Gulf Oil Producers To Take On Debt

- Huge Inventory Build Halts Oil Price Rally