Oil stocks have continued to show a peculiar disconnect from the commodity they track, with oil equities staging a powerful rally even as oil prices have fallen sharply since the last OPEC meeting. Over the past two months, the energy sector’s leading benchmark, the Energy Select Sector SPDR Fund (NYSEARCA: XLE), has climbed 34% while average crude spot prices have declined 18%. XLE now boasts a 61.2% return in the year-to-date, the best of any U.S. market sector. According to Bespoke Investment Group via the Wall Street Journal, the current split marks the first time since 2006 that the oil and gas sector has traded within 3% of a 52-week high while the WTI price retreated more than 25% from its respective 52-week high. It’s also only the fifth such divergence since 1990.

The U.S. oil majors have not disappointed, either: over the past two months, Exxon Mobil Corp. (NYSE: XOM) has gained 35.3%; Chevron Corp. (NYSE: CVX) is up 30.6%, ConocoPhillips (NYSE: COP) has climbed 30.1%, Phillips 66 (NYSE: PSX) has rallied 45.3% while Marathon Petroleum Corp. (NYSE: MPC) has returned 40.3%. This trend rings true even for shorter timeframes, with all the stocks here being in the green over the past five trading sessions with the exception of COP which is down 0.5%.

There’s a method to the madness, though.

Source: Wall Street Journal

Strong Earnings

Robust earnings by energy companies are a big reason why investors are still flocking to oil stocks.

Third quarter earnings season is nearly over, but so far it’s shaping up to be better-than-feared. According to FactSet’s earnings insights, for Q3 2022, 94% of S&P 500 companies have reported Q3 2022 earnings, of which 69% have reported a positive EPS surprise and 71% have reported a positive revenue surprise.

Related: Saudi Arabia And Iraq Reiterate Their Support For A Production Cut

The Energy sector has reported the highest earnings growth of all eleven sectors at 137.3% vs. 2.2% average by the S&P 500. At the sub-industry level, all five sub-industries in the sector reported a year-over-year increase in earnings: Oil & Gas Refining & Marketing (302%), Integrated Oil & Gas (138%), Oil & Gas Exploration & Production (107%), Oil & Gas Equipment & Services (91%), and Oil & Gas Storage & Transportation (21%). Energy is also the sector that has most companies beating Wall Street estimates at 81%. The positive revenue surprises reported by Marathon Petroleum ($47.2 billion vs. $35.8 billion), Exxon Mobil ($112.1 billion vs. $104.6 billion), Chevron ($66.6 billion vs. $57.4 billion), Valero Energy ($42.3 billion vs. $40.1billion), and Phillips 66 ($43.4 billion vs. $39.3 billion) were significant contributors to the increase in the revenue growth rate for the index since September 30.

Even better, the outlook for the energy sector remains bright. According to a recent Moody's research report, industry earnings will stabilize overall in 2023, though they will come in slightly below levels reached by recent peaks.

The analysts note that commodity prices have declined from very high levels earlier in 2022, but have predicted that prices are likely to remain cyclically strong through 2023. This, combined with modest growth in volumes, will support strong cash flow generation for oil and gas producers. Moody’s estimates that the U.S. energy sector’s EBITDA for 2022 will clock in at $$623B but fall to $585B in 2023.

The analysts say that low capex, rising uncertainty about the expansion of future supplies and high geopolitical risk premium will, however, continue to support cyclically high oil prices. Meanwhile, strong export demand for U.S. LNG will continue supporting high natural gas prices.

In other words, there simply aren’t better places for people investing in the U.S. stock market to park their money if they are looking for serious earnings growth. Further, the outlook for the sector remains bright.

Whereas oil and gas prices have declined from recent highs, they are still much higher than they have been over the past couple of years hence the ongoing enthusiasm in the energy markets. Indeed, the energy sector remains a huge Wall Street favorite, with the Zacks Oils and Energy sector being the top-ranked sector out of all 16 Zacks Ranked Sectors.

Share Buybacks

Further, earnings in the sector are likely to remain high due to high levels of share buybacks. Oil and gas supermajors are on course to repurchase their shares at near-record levels this year thanks to soaring oil and gas prices helping them to deliver bumper profits and boost returns for investors.

According to data from Bernstein Research, the seven supermajors are poised to return $38bn to shareholders through buyback programmes this year, with investment bank RBC Capital Markets putting the total figure even higher, at $41bn.

In 2014, when oil was trading over $100/barrel, we only saw $21 billion in buybacks. This year’s figure easily outpaces the 2008 number.

But here’s another interesting thing: Big Oil’s capex and production have remained mostly flat despite reporting record second-quarter profits.

Data from the U.S. Energy Information Administration (EIA) shows that Big Oil companies have mostly downshifted both capital spending and production for the second-quarter. An EIA review of 53 public U.S. gas and oil companies, responsible for about 34% of domestic production, showed a 5% decline in capital expenditures in the second-quarter vs. Q1 this year.

Cheap Energy Stocks

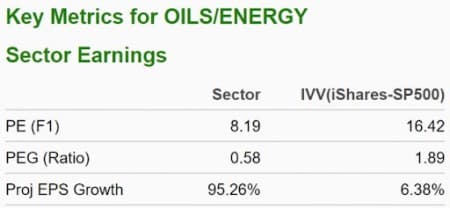

Another surprising finding: energy stocks remain cheap despite the huge runup. Not only has the sector widely outperformed the market, but companies within this sector remain relatively cheap, undervalued, and come with above-average projected earnings growth.

Image Source: Zacks Investment Research

Some of the cheapest oil and gas stocks right now include Ovintiv Inc. (NYSE: OVV) with a PE ratio of 6.09; Civitas Resources, Inc. (NYSE: CIVI) with a PE ratio of 4.87, Enerplus Corporation (NYSE: ERF)(TSX: ERF) has PE ratio of 5.80, Occidental Petroleum Corporation (NYSE: OXY) has a PE ratio of 7.09 while Canadian Natural Resources Limited (NYSE: CNQ) has a PE ratio of 6.79.

By Alex Kimani for Oilprice.com

With interest rates heading higher in the USA and hyperinflation raging away now globally expect these stock prices along with so many others to surge.

Long #ibm International Business Machines

Strong buy