U.S. West Texas Intermediate and international-benchmark Brent crude oil futures are in a position to close higher for the week. Most of the gains occurred early in the week when prices spiked higher on worries over tightening conditions. A larger than expected draw on U.S. crude also helped underpin prices.

The markets hit their highs of the week after concerns were raised over future demand due to issues with emerging currencies, and the economic impact of a prolonged trade war between the United States and China.

Weekly Timeline

At the start of the week, the catalysts for higher prices were worries about tighter supply conditions once Washington’s sanctions against Iran’s crude oil exports kick in beginning in November, and stable U.S. production due to a flattening of the rig count last week.

Firstly, there are new signs that several major Iran customers like India, Japan and South Korea were already scaling back on purchases of Iran crude. These countries are complying with the U.S. mandate to stop all Iran oil purchases or face severe financial penalties.

Secondly, according to energy services firm Baker Hughes, U.S. energy companies cut two oil rigs last week, bringing the total count to 860. Furthermore, there is evidence that the U.S. rig count has been flattening for nearly four months, after mounting a huge recovery since 2016.

Prices continued to soar at mid-week on the back of a private industry report showing declines in U.S.…

U.S. West Texas Intermediate and international-benchmark Brent crude oil futures are in a position to close higher for the week. Most of the gains occurred early in the week when prices spiked higher on worries over tightening conditions. A larger than expected draw on U.S. crude also helped underpin prices.

The markets hit their highs of the week after concerns were raised over future demand due to issues with emerging currencies, and the economic impact of a prolonged trade war between the United States and China.

Weekly Timeline

At the start of the week, the catalysts for higher prices were worries about tighter supply conditions once Washington’s sanctions against Iran’s crude oil exports kick in beginning in November, and stable U.S. production due to a flattening of the rig count last week.

Firstly, there are new signs that several major Iran customers like India, Japan and South Korea were already scaling back on purchases of Iran crude. These countries are complying with the U.S. mandate to stop all Iran oil purchases or face severe financial penalties.

Secondly, according to energy services firm Baker Hughes, U.S. energy companies cut two oil rigs last week, bringing the total count to 860. Furthermore, there is evidence that the U.S. rig count has been flattening for nearly four months, after mounting a huge recovery since 2016.

Prices continued to soar at mid-week on the back of a private industry report showing declines in U.S. crude inventories and as looming sanctions against Iran threaten to tighten supply. Additionally, top producer Russia raised concerns about the vulnerability of the global crude market.

Russians Call Markets “Fragile”

Russian energy minister Alexander Novak on Wednesday said, “This is huge uncertainty on the market – how the countries, which buy almost 2 million barrels per day of Iranian oil will act. The situation should be closely watched, the right decisions should be taken.”

Novak said geopolitical risk and supply disruptions shared the blame for the global oil markets “fragile” condition.

Novak also said, “It is related to the fact that not all countries have managed to restore their market and production.” Traders suggested he was referring to outages and falling production in Venezuela and Mexico.

However, he did add that “Russia has potential to raise production by 300,000 barrels per day (bpd) mid-term, in addition to the level of October 2016.”

WTI and Brent crude oil hit their highs for the week following the release of a bullish U.S. Energy Information Administration weekly inventories report.

Prices Hit by Bearish IEA Report

Prices began to retreat on Thursday after the International Energy Agency that said global oil supply hit a record high in August despite lower production from Iran and Venezuela. According to the IEA, global oil supply grew by a record 100 million barrels per day (bpd) in August.

The IEA also said that higher output from OPEC managed to more than offset seasonal declines from non-OPEC members. The IEA forecasts non-OPEC production to grow by 2 million bpd in 2018 and 1.8 million bpd in 2019, characterized by “relentless growth led by record output from the U.S.”

In other news. August saw OPEC’s crude supply hit a nine-month high of 32.63 million bpd, despite concerns over falling production and slashed access in major producers Venezuela and Iran. Higher volumes from Nigeria and Saudi Arabia as well as increased production in Libya and Iraq served to outweigh these drops.

By the end of the week, traders were also talking about demand worries. Although the IEA warned that the oil market was tightening and world demand would reach 100 million bpd in the next three months, it also said global economic risks were also mounting.

Weekly Technical Analysis

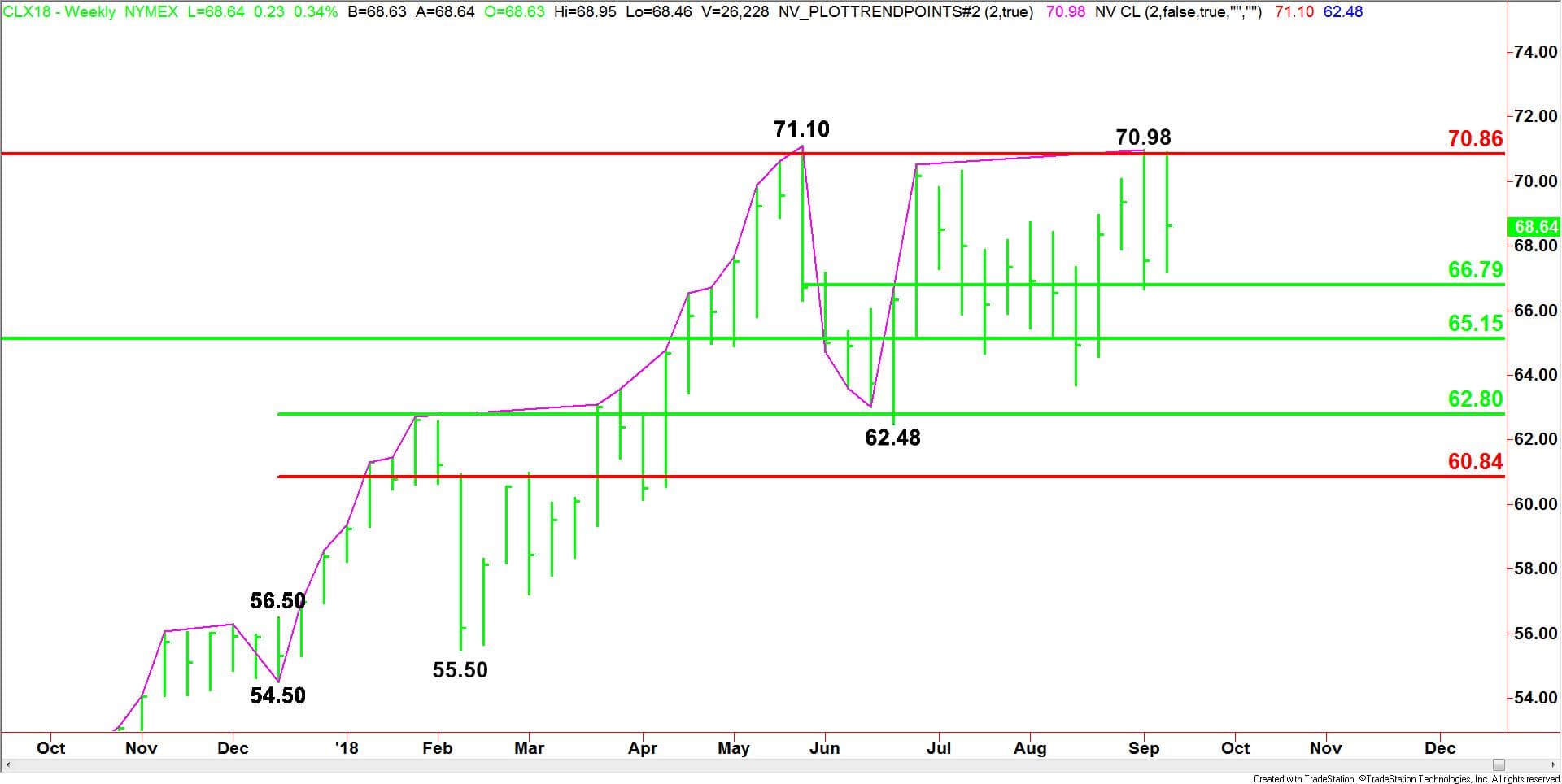

(Click to enlarge)

The main trend is up according to the daily swing chart. A trade through $71.10 will signal a resumption of the uptrend. A trade through $62.48 will change the main trend to down.

The short-term range is $71.10 to $62.48. Its 50% level or pivot is $66.79. This price level is support. It is also controlling the short-term direction of the market.

The main range is $54.50 to $71.10. Its 50% to 61.8% retracement zone is $62.80 to $60.84. This zone is support. It stopped the selling at $62.48 during the week-ending June 22.

The major long-term retracement zone is $65.15 to $70.86. This zone is controlling the longer-term direction of the November WTI crude oil futures contract. The market has been trading inside this range for about 17 weeks.

Forecast

The hedge funds are long crude oil. They have been buying the dips and lightening up the rallies. If there is going to be a breakout in the WTI futures contract then the professionals are going to have to be willing to buy strength on a breakout over $71.10.

The weekly chart indicates there is a lot of room to the upside over $71.10. In order to sustain a move over this level, the bulls are going to need a good story and better-than-average volume. Otherwise, we’re doomed to more rangebound trading.

With the Iran sanctions beginning on November 1, it looks as if the November WTI crude oil futures contract is going to be rangebound until then. Furthermore, just remember, the longer a market sits in a range the greater the size and duration of the breakout.