Oil prices have remained largely rangebound over the last month as bullish and bearish factors continue to counterbalance each other.

Friday, March 8th 2024

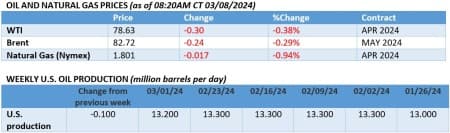

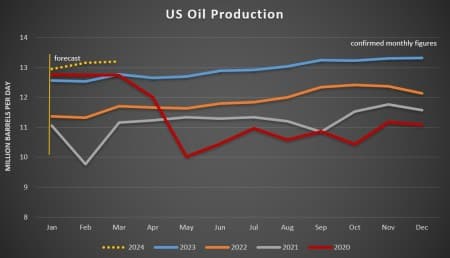

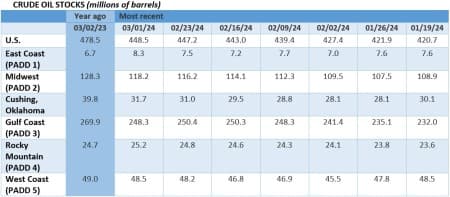

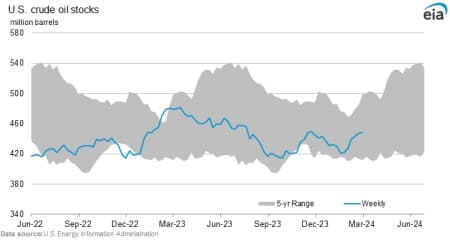

The flatlining of oil prices continued this week despite positive trade data coming out of China and impressive Indian oil demand, with a continued build-up in US crude inventories and skepticism vis-à-vis OPEC+’s extended voluntary cuts offsetting that positive momentum. The last time ICE Brent futures settled outside of the $80-85 per barrel bandwidth was on February 7, suggesting the end of this week will mark a month-long sideways drift for oil.

Saudi Arabia Transfers 8% in Saudi Aramco. Saudi Arabia transferred an 8% stake in Saudi Aramco (TADAWUL:2222) worth more than $160 billion to the country’s Public Investment Fund, widely seen as corporate reorganization before the NOC’s public offering later in 2024.

First Casualties in Houthi Shipping Attacks. Three sailors have died in the Houthi’s attack on the Greek-owned, Barbados-flagged dry bulk tanker True Confidence, which struck some 50 nautical miles off the coast of Aden, marking the first casualties since the Red Sea warfare began.

Related: This Could Be A Gamechanger For Natural Gas In Europe

Turkey Eyes Somalia’s Offshore Oil. Turkey signed an offshore oil and gas cooperation deal with Somalia, one of the last offshore frontiers completely untapped due to civil strife and regional separatism, hoping to start seismic surveying as soon as this year.

Santos Hindered Again by Lawsuits. Leading Australian oil producer Santos (ASX:STO) is facing legal challenges again, less than two months after pushing through with its Barossa project, with an indigenous group appealing the approval of the $2.4 billion Narrabri gas project, claiming the climate impact wasn’t adequately assessed.

Chinese Oil Major Mulls UAE Expansion. China’s state-owned oil firm Sinopec (SHA:600028) is reportedly in talks with trading company Montfort to purchase its 65,000 b/d Fujairah refinery, one of the region’s largest producers of VLSFO, less than a year after Unipec sold it to Montfort.

ADNOC, Saudi Aramco Move into US LNG. The Middle East will be investing in US LNG soon, with Saudi Aramco (TADAWUL:2222) reportedly in talks for Sempra’s Port Arthur LNG project whilst the UAE’s ADNOC is mulling an offtake deal with NextDecade’s (NASDAQ:NEXT) Rio Grande LNG.

Exxon Takes Guyana Row to Arbitration. US oil major ExxonMobil (NYSE:XOM) has initiated arbitration proceedings with the International Chamber of Commerce to assert its pre-emption rights on Hess Energy’s assets in Guyana’s offshore Stabroek block, pitting it against Chevron.

ENI Posts Huge Oil Discovery in Ivory Coast. Italy’s offshore-focused oil producer ENI (BIT:ENI) announced it had struck oil with its Murene-1 exploration well offshore Ivory Coast, with a recoverable resource potential that could be up to 1.5 billion barrels of oil equivalent.

China’s EV Sales Continue to Linger. China’s electric vehicle sales slowed down to 18.2% in January-February after posting a 20.8% growth rate for all of 2023, with market leader BYD prompted to discount even more and export 19% of its cars overseas, the highest ratio ever.

Related: 2 Companies That Could Help Europe Win Its Energy War With Russia

Germany Steers Clear of Rosneft Refinery Nationalization. The German government extended its trusteeship over Rosneft-owned refineries in the country for another six months, stopping short of expropriating the Russian state oil company’s assets.

China Hope Lifts All Base Metals. Copper, lead, nickel, tin, and aluminum have all posted notable week-on-week gains, up by 2-4% with lead seeing the strongest growth, as a weakening dollar and better-than-assumed Chinese demand improved sentiment in the markets.

Arson Attack Debilitates Tesla’s German Plant. Following what seems to be a deliberate arson attack by a far-left organization called the Volcano Group, Tesla’s (NASDAQ:TSLA) Berlin factory halted production and will be without electricity until March 17.

Chevron Restarts Drilling in Orinoco Belt. US oil major Chevron (NYSE:CVX) restarted drilling works at the Petroindependencia field in Venezuela’s oil-prolific Orinoco Belt, with a peak capacity of 400,000 b/d, hoping to increase its output in the country to 250,000 b/d by next year.

By Michael Kern for Oilprice.com

More Top Reads From Oilprice.com:

- This Could Be A Gamechanger For Natural Gas In Europe

- Oil Prices May Yet End the Week on a High Note

- U.S. Seeks Semiconductor Supremacy with New Funding Initiatives