For the first time ever, Oilprice.com is releasing its annual Top 50 Oil & Gas Companies report to readers. This 5-part series includes an in-depth financial and geopolitical analysis of each company, including their greatest strengths and biggest risks. This year, a limited number of our Global Energy Alert subscribers will get the chance to see which company topped the list!

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

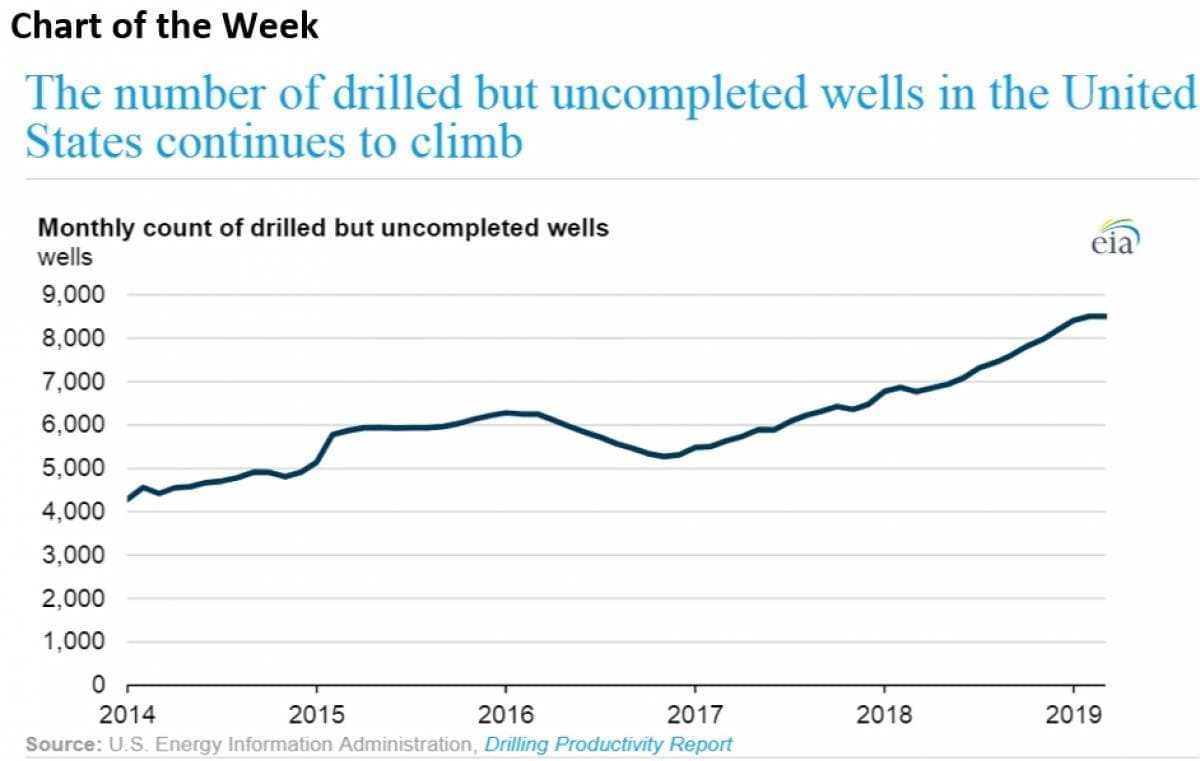

- The number of drilled but uncompleted wells (DUCs) has continued to increase, rising to 8,504 as of February 2019, roughly 25 percent higher than a year earlier.

- The completion process includes “casing, cementing, perforating, hydraulic fracturing, and other procedures required to produce crude oil or natural gas,” as the EIA puts it.

- DUCs have climbed rapidly since 2016 due to multiple factors, including low oil prices; bottlenecks for a variety of services, such as frac sand or fracking crews; and pipeline constraints.

Market Movers

• Lion Point Capital, a hedge fund, disclosed a 6.3 percent active stake in Carrizo Oil & Gas (NASDAQ: CRZO) and said that shareholders of the E&P would benefit from a merger.

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

- The number of drilled but uncompleted wells (DUCs) has continued to increase, rising to 8,504 as of February 2019, roughly 25 percent higher than a year earlier.

- The completion process includes “casing, cementing, perforating, hydraulic fracturing, and other procedures required to produce crude oil or natural gas,” as the EIA puts it.

- DUCs have climbed rapidly since 2016 due to multiple factors, including low oil prices; bottlenecks for a variety of services, such as frac sand or fracking crews; and pipeline constraints.

Market Movers

• Lion Point Capital, a hedge fund, disclosed a 6.3 percent active stake in Carrizo Oil & Gas (NASDAQ: CRZO) and said that shareholders of the E&P would benefit from a merger.

• BP (NYSE: BP) approved an expansion of its Thunder Horse project, which will add 50,000 barrels of oil equivalent per day by 2021.

• Kosmos Energy (NYSE: KOS) said it would sell down its interest in offshore Mauritania and Senegal to 10 percent. Its share price rose by 5 percent on the news.

Tuesday May 7, 2019

Oil prices seesawed at the start of the week, falling initially on Monday after President Trump reignited the trade war, only to rebound on fears of rising U.S.-Iran tensions. Oil dropped sharply again in early trading on Tuesday, following news that Saudi Arabia would send more oil to Asia.

Trump threatens new tariffs on China. The oil markets are on edge after Trump issued a threat to hike tariffs at the end of this week. He blamed China for slow-walking trade talks, and said that the 10 percent tariffs on $250 billion worth of goods would rise to 25 percent, while a 25 percent tariff on a further $350 billion worth of goods would also go into effect. Related: There’s Tremendous Room For Growth In Offshore Oil & Gas

Iran to restart part of nuclear program. Iran will restart parts of its nuclear program in response to relentless pressure from the U.S. and the Trump administration’s own withdrawal from the 2015 nuclear accord. President Hassan Rouhani said that Iran would reduce some of its “minor and general” commitments. Iran also said it would take “reciprocal actions” to the U.S. withdrawal from the agreement. The development comes shortly after the U.S. sent warships to the region as a “message” to Iran.

Saudi Arabia said it would step up shipments to Asia. Oil fell after Saudi Arabia said that it would increase shipments to Asia to offset declines from Iran. Sources told Bloomberg that India may see an additional 200,000 bpd from Saudi Arabia.

Nigeria oil outage. Oil facilities in Nigeria’s Nembe region have been temporarily shut down due to protests. Leaks along the Nembe Creek Trunkline, one of two major pipelines for Bonny light, had previously forced a shut down. The latest outage will keep Bonny light under force majeure.

Anadarko switches to Occidental offer. In an effort to beat out Chevron (NYSE: CVX) in its pursuit for Anadarko Petroleum (NYSE: APC), Occidental Petroleum (NYSE: OXY) sweetened its offer by offering more cash instead of stock. The revised offer of $76 per share will breakdown to $59-per-share in cash. That offer comes on top of the promise by Berkshire Hathaway to invest $10 billion into the combined company, as well as the agreement between Occidental and Total SA (NYSE: TOT) for the French oil company to buy up Anadarko’s African assets for $8.8 billion. On Monday, Anadarko said it was convinced, and announced that the Occidental offer was the “superior proposal.” It is unclear if Chevron will up the ante.

Barclays under pressure from investors over fossil fuel financing. Asset managers including Hermes Investment Management, Sarasin & Partners, EdenTree and Folksam sent a letter to Barclays CEO Jes Staley, calling on the bank to reduce lending to fossil fuel companies, according to the Wall Street Journal. The letter specifically calls for an end of financing for new coal and oil sands projects. Related: Middle East Oil Giants Are About To Upend Oil Trading

IEA: Renewables investment flattened out last year. The IEA said that investment in renewables stagnated last year. “After nearly two decades of strong annual growth, renewables around the world added as much net capacity in 2018 as they did in 2017, an unexpected flattening of growth trends that raises concerns about meeting long-term climate goals,” the IEA wrote. Last year, the world added 180 GW of renewable energy, the same increase as the year before and the first time since 2001 that net capacity additions did not expand year-on-year. The IEA said that level of growth is only about 60 percent of what is needed for the world to hit its climate targets in the long run.

Utilities could profit from Green New Deal. While much of the fossil fuel industry opposes the Green New Deal, the utility industry could profit from a major policy push towards renewables. Solar and wind are “great for utility credit quality” because they offer a fixed return on the assets, according to the analysts led by Andy DeVries, as reported by Bloomberg. Also, any Green New Deal legislation would likely result in faster deployment of electric vehicles, which could offer a growth market for utilities.

Keystone XL construction delayed for another year. TransCanada (NYSE: TRP) said that recent legal setbacks in U.S. courts meant that the company missed the construction window on the project for this year. TransCanada also said that it was changing its name to TC Energy Corp.

Jordan Cove LNG hits roadblock. Regulators in Oregon denied Jordan Cove LNG a water quality permit, which puts the project in limbo. The project is one of a few proposed LNG export projects for the Pacific Coast.

Pioneer beats estimates. Pioneer Natural Resources (NYSE: PXD) beat first-quarter earnings estimates, while also announcing that it had sold its Eagle Ford assets in order to become a pure-play Permian producer. Pioneer’s share price jumped nearly 2.5 percent on the news.

Turkey to drill in Mediterranean. The U.S. and the EU have expressed concerns about Turkey’s plans to drill in an area claimed by Cyprus. A string of major natural gas discoveries over the past decade has led to a flare up in tensions between Cyprus and Turkey.

Trump to put tariffs on China’s EVs. The Trump administration is expected to target China’s electric vehicles with tariffs, and some analysts think the levees will stick around. “I expect that President Trump will keep tariffs on electric cars as high as he possibly can,” Michael Dunne, CEO of consultancy ZoZo Go, said at an industry event, according to Bloomberg. “He can see all this capacity gathering in China, and they’re bound to want to export to the U.S., so ‘let’s not make that easy.’”

By Tom Kool for Oilprice.com

More Top Reads From Oilprice.com: