Oil prices have had a tumultuous week since the US launched a drone attack in Baghdad, killing Iranian General Qassem Soleimani. With tensions peaking after the US and Iran traded missile attacks, oil markets priced in a risk premium. However, as long as the flow of oil barrels to the market is not affected, Rystad Energy continues to see a downward risk to prices, with further pressure on OPEC to implement even deeper production cuts in order to keep Brent oil prices around $60 per barrel through 2020.

“It is important to look beyond the rhetoric of the headlines and focus on market fundamentals – including the continued rise of non-OPEC oil supply led by US shale, and flat demand growth – which all points to a surplus, not a deficit, in oil balances in 2020,” says Bjørnar Tonhaugen, Head of Oil Market Research at Rystad Energy. “Prospects of Brent prices slipping below $60 per barrel – even in the midst of an intense geopolitical flare up in the Middle East – are entirely plausible.”

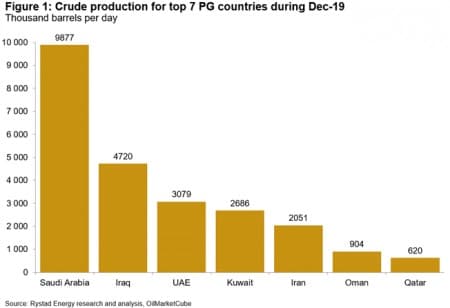

Oil prices still react dramatically to news of tensions in the Persian Gulf, although less dramatically now than they would have before the US shale revolution. The importance of the region for oil markets is obvious, given that seven Gulf countries alone – Saudi Arabia, Iraq, UAE, Kuwait, Iran, Oman and Qatar – produced around 24 million bpd of crude oil in December 2019.

“With the regime in Tehran under heavy sanctions, Iran is no longer an official major global oil producer. This means the real risk of a conflict between the US and Iran gets pushed to neighboring Iraq, where 5,000 American troops are stationed and where Iran is wrestling for political power. Any proxy war played out in Iraq would put the country’s nearly 4.7 million bpd of crude oil and condensate production as risk,” states Tonhaugen. Related: IEA: The Oil Glut Is Going Nowhere

However, one key reason that geopolitically-driven oil price swings are now more subdued relates to the stabilizing effect of US shale oil production on global oil supplies. The stellar growth of shale has introduced a significant counterweight to the market, as it helps to absorb disruptive events such as the September drone attack on Saudi Arabian oil infrastructure and the geopolitical tensions that followed the assassination of General Soleimani.

Rystad Energy forecasts that the ‘call’ on OPEC (in other words, the market demand for OPEC oil) will average about 28.3 million bpd during the final nine months of 2020. By comparison, OPECs actual production in December 2019 was 29.6 million bpd, and the cartel’s new implied production target for the first quarter of 2020 is 29.2 million bpd.

By Rystad Energy

More Top Reads From Oilprice.com:

- Three Ways Oil Companies Can Prevent An Investor Exodus

- Low Gas Prices Crush Appalachia Shale Boom

- Operating Costs In Oil & Gas Are Falling Globally And This Country Is Leading

Rystad Energy’s claim that it continues to see a downward risk to prices with oil prices at $60 a barrel through 2020 is not only flawed but it can’t be substantiated. On the contrary, if the de-escalation of the trade war gains momentum in 2020, oil prices could be projected to average $73-$75 a barrel in 2020 or 11%-14% higher than 2019.

A continued de-escalation will definitely stimulate the global economy, accelerate the depletion of the glut in the market and also enhances global demand oil demand and therefore oil prices.

Both a continued de-escalation of the trade war and an accelerating slowdown of US shale oil production will be the most important bullish factors in 2020.

Despite the EIA’s well known hype, US oil production is overstated by at least 2 million barrels a day (mbd) and, therefore, US production averaged 10.3 mbd in 2019 and not 12.3 mbd as the EIA claimed and is projected to decline to under 10 mbd or in 2020. This means that the US may need to import up to 11 mbd in 2020 let alone contributing to non-OPEC oil supply growth in 2020.

Another flawed claim is that fundamentals – including the continued rise of non-OPEC oil supply led by US shale, and flat demand growth – all point to a surplus, not a deficit, in oil balances in 2020. In fact, non-OPEC supplies will be at least 350,000 barrels a day (b/d) less in 2020 than in 2019 because of the slowdown in US production and also a decline in Norway’s production.

Iraq has indeed become a major battle ground between Iran and the United States for influence over the country with both using asymmetric warfare to bolster their positions.

This dates back to the aftermath of the US invasion of Iraq in 2003. While the United States won the military battles, it lost the war. The winners were China and Iran. China has emerged as the biggest investor in Iraq’s oil industry and also the largest buyer of Iraqi crude oil and Iran gained the political upper hand in the country.

President Trump may have intended by his latest misadventure in Baghdad to curtail the growth of Iran’s influence in Iraq and assert the United States’. His tactics will most probably cost him Iraq thus giving Iran a significant strategic victory. If Iraqi oil production is disrupted in the process, It will be a worthwhile price for Iraq to pay for the eviction of US military presence from its territory. Moreover, it would be a tragic irony if America’s misjudgement led to a greater Iranian control of Iraq. This will be eventually followed by the withdrawal of all American forces from the Middle East leaving it to China and Russia, Iran and Turkey to fill the political vacuum that will ensue.

A third faulty claim by Rystad Energy is that one key reason that geopolitically-driven oil price swings are now more subdued relates to the stabilizing effect of US shale oil production. Nothing is further from the truth. The real reason is the big glut in the market which has been augmented to 4.0-5.0 mbd during almost two years of trade war. The glut has been big enough to undermine OPEC+ production cuts, nullify the impact of geopolitics and outages on oil prices and even absorb the loss of half of Saudi oil production as well as the recent exchange of missiles between the US and Iran.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London