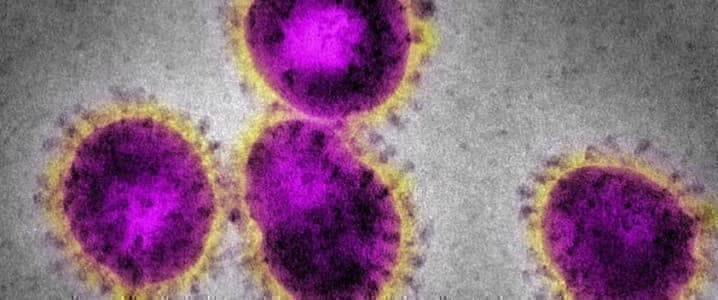

Oil prices plummeted early on Monday as a new strain of the coronavirus in the UK, found to be spreading faster among people, prompted tougher lockdowns in Britain and many European countries banning flights from the UK.

As of 8:41 a.m. ET on Monday, WTI Crude was plunging by 4.20 percent to $47.04, and Brent Crude was down by 4.17 percent on the day at $50.12, after briefly slipping to below $50 a barrel.

The steep correction on the oil market, as well as on all European equity markets, followed the news out of the UK that a new mutated strain of the coronavirus is spreading faster in London and southeast England.

The UK introduced on Saturday a new highest-alert lockdown level, Tier 4, for London and areas in southeast England, in which people must not leave or be outside of their home or garden except where they have a ‘reasonable excuse’ such as going to work that cannot be done from home, medical reasons, or fulfilling legal obligations. Basically, more than 15 million people in England are again under the same restriction levels as the nationwide lockdown in November.

France closed on Sunday evening all its borders with the UK for 48 hours, while many European countries banned flights from the UK, sparking renewed fears that travel bans and low fuel demand would further delay the long-awaited oil demand recovery.

In addition, the Arab Gulf states Saudi Arabia, Kuwait, and Oman are shutting their borders and suspending commercial flights because of the new virus strain.

“These developments being another sign that the market may have to go through a prolonged period before the vaccine rollout eventually supports a recovery in fuel demand and the price of oil,” John Hardy, Head of FX Strategy at Saxo Bank, said on Monday.

By Tsvetana Paraskova for Oilprice.com

ADVERTISEMENT

More Top Reads From Oilprice.com:

- Mexico Is Quietly Pushing Out Foreign Oil Investors

- Oil Jumps On Crude Inventory Draw

- Goldman Turns Bullish On Oil: Sees $65 Brent In 2021