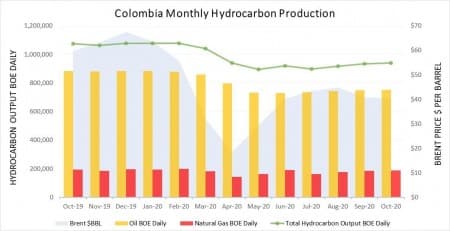

The last year has been rough for Colombia’s economically vital petroleum industry. Toward the end of 2019 and at the start of 2020 government and industry bodies were expecting a strong 2020 for the country’s hydrocarbon sector. The Andean country’s peak industry body the Colombian Petroleum Association (ACP – Spanish initials) initially anticipated a notable 23% year over year increase in investment to just shy of $5 billion. It was anticipated that would lead to an average daily production during 2020 of 890,000 barrels daily. Despite this optimism, exploration and production activity collapsed due to the twin-impact of the country’s COVID-19 lockdown and sharply weaker oil prices. By May 2020 Colombia’s oil production had fallen off a cliff plunging to a multi-year low of 742,000 barrels daily. Natural gas output also declined, dropping to a low of 827 million cubic feet daily during April and then rising slightly to an average of 939 million cubic feet daily for May. At the end of April 2020, the Colombian energy ministry predicted 2020 oil production would be 17% lower than originally forecast. The latest data indicates that petroleum production will average less than 800,000 barrels daily for 2020. Nonetheless, the latest positive news, notably the rollout of a coronavirus vaccine, has spurred on a renewed sense of optimism for energy demand and oil prices. This was responsible for the international Brent benchmark soaring by over 28% over the last three months to be trading at around $50 per barrel. Those developments will give Colombia’s economically vital hydrocarbon sector a solid lift going into 2021. Production has been steadily ratcheting upward since the April and May 2020 lows reaching a daily average of 751,374 barrels of crude and 1,091 million cubic feet of natural gas during October 2020.

Source: Colombia Ministry of Mines and Energy, U.S. EIA.

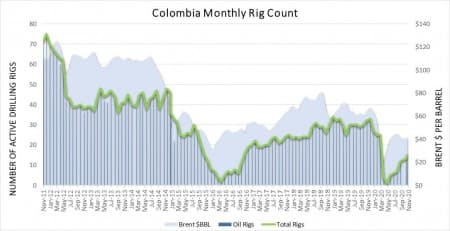

Growing activity is reflected in the Baker Hughes rig count, which after bottoming at one active drilling rig during May has risen steadily to 13 operational rigs at the end of October and 15 for November.

Source. Baker Hughes and U.S. EIA.

There is every indication that these trends will continue. Colombia’s energy ministry announced last month that the hydrocarbon sector will attract (Spanish) investment of at least $3.4 billion during 2021, with more than half of that bound for offshore oil and natural gas projects. While that is certainly a positive development the project amount is still less than the estimated $3.97 billion invested during 2020 and $4.03 billion for 2019. This indicates that a petroleum industry recovery to pre-pandemic levels maybe some way off.

Related: Oil, Gas Rigs Increase For Fourth Week In A Row

Despite existing headwinds, there are signs activity in Colombia’s energy patch is heating up. In late November 2020, Colombia’s petroleum industry regulator the National Hydrocarbon’s Agency (ANH – Spanish initials) announced Canacol Energy and Parex Resources would sign contracts for four blocks, two each, after the last energy auction. The agency is pushing ahead with another energy auction, slated for early 2021, where up to 60 onshore and offshore blocks will be offered as it focuses on boosting investment in oil and natural gas as part of the national government’s plan to recover from the substantial impact of the COVID-19 pandemic on the economy. The fact that crude oil is Colombia’s single largest export, accounting for 23% of all exports by value for the first 10 months of 2020 and over 3% of GDP, makes it crucial for the national government to attract further energy investment and boost oil as well as natural gas production.

This is of even greater importance when it is considered that Colombia’s economy has been severely impacted by the COVID-19 pandemic. GDP since the start of 2020 has shrunk significantly. For the first nine months of 2020, it plunged (Spanish) 8% year over year and could continue to fall unless the central government in Bogota acts to blunt the fallout from the pandemic and restart economic growth. The IMF expects Colombia’s GDP to contract by just over 8% during 2020 but that number could be even worse if oil prices do not keep rising to see Brent reach at least $55 per barrel. The importance of that number cannot be stressed enough, not only is it greater than after-tax production costs of $40 to $45 per barrel pumped in Colombia but it means all major upstream oil producers can operate profitably. State-controlled Ecopetrol and leading privately owned upstream oil producers Frontera Energy, Parex, Gran Tierra Energy, and Canacol could ratchet-up spending on exploration and development activities.

This is particularly important because Colombia, unlike many of its neighbors, possesses low hydrocarbon reserves with a limited production life. In April 2020, the energy ministry announced (Spanish) Colombia had just over two billion barrels of proven oil reserves with a 6.3-year production life and just over three trillion cubic feet of natural gas which will last eight years. That stresses the urgent need for Colombia to boost its hydrocarbon reserves, which can only be achieved through additional significant investment in exploration. The Andean country’s considerable oil potential is highlighted by the U.S. Geological Service estimating that Colombia has undiscovered oil resources of up to 15 billion barrels across its three main onshore basins. On a promising note for Colombia’s oil industry and investors, Moody’s Investor Services noted the 2021 outlook for Colombia’s oil and natural gas industry was generally stable despite the persistent risk of attacks on oilfields and infrastructure by illegal armed groups.

By Matthew Smith for Oilprice.com

More Top Reads From Oilprice.com:

- Mexico Is Quietly Pushing Out Foreign Oil Investors

- Oil Jumps On Crude Inventory Draw

- Goldman Turns Bullish On Oil: Sees $65 Brent In 2021