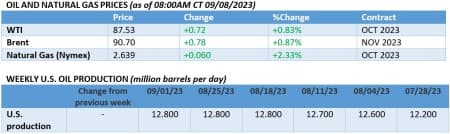

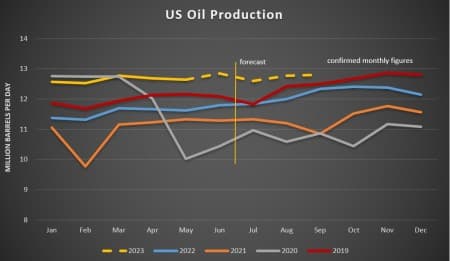

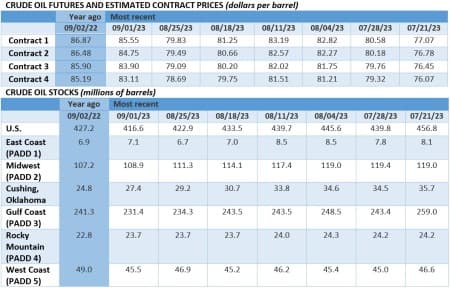

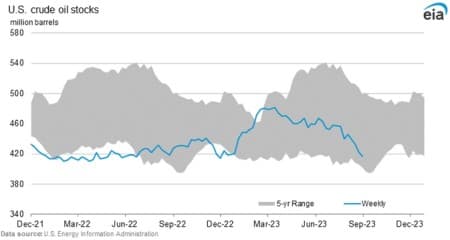

While Saudi Arabia's pledge to extend production cuts and Russia's pledge to extend export cuts may have made headlines, it is the continued inventory draws in the U.S. that are tightening markets.

Friday, September 8th, 2023

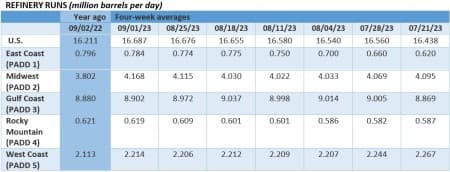

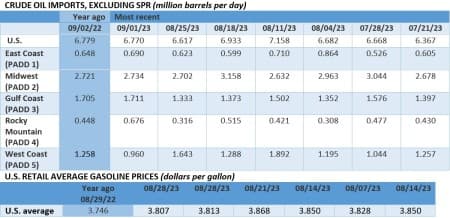

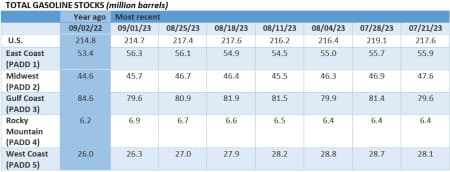

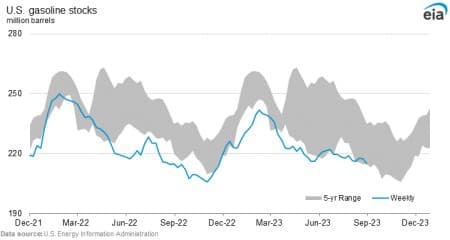

Whilst market sentiment was capped by weaker-than-expected macroeconomic data from China earlier this week, the fourth consecutive crude inventory draw in the United States combined with another week-on-week drop in gasoline stocks provided firm support for ICE Brent to stay around $90 per barrel. The extension of Saudi and Russian supply and export cuts until December 2023 didn’t materially change global balances, but it reiterates the bullish narrative of tight supply further down the road.

White House Cancels Alaskan Drilling. The Biden administration canceled the last remaining oil and gas leases along the coast of the Arctic National Wildlife Refuge, claiming the Trump-era lease sales were “seriously flawed” and were based on legal deficiencies, much to the ire of Alaskan authorities.

Kurdistan Demands Its Money. The regional government of Iraqi Kurdistan called on Baghdad to disburse allocated funds to the semi-autonomous region amidst a complete halt in oil flows (some 400,000 b/d) out of Ceyhan, with federal authorities stopping transfers to Erbil in July.

Jet Fuel Costs Seen Spiking Amidst Higher Prices. Several US airline companies have warned of the negative impact of higher jet fuel prices, with United Airlines (NASDAQ: UAL) stating fuel costs have climbed by 20% since mid-July, exposing them to lower H2 revenues as they don’t hedge against fuel costs.

Colombia Delays First-Ever Offshore Wind Auction. Colombian authorities postponed the country’s first-ever licensing round for offshore wind farms two months after the previous Energy Minister Irene Velez stepped down due to influence peddling, saying tender documents need to be finalized.

India Puts a Premium on Gas Supplies. India is set to ramp up purchases of natural gas after Delhi asked utility companies to expedite completion of power plant maintenance and maximize generation as unusually dry weather combined with weak hydro and wind output led to the worst outages in 16 months.

French Nuclear Power Surges Back to Strength. French electricity generation overcame the 30-year lows seen last year and fell back in line with national power firm EDF’s target of 300-330 TWh, having repaired 11 out of 16 reactors most susceptible to stress corrosion in 2023 to date.

Canada’s Pipeline Giant Goes Big on M&A. Canada’s leading midstream firm Enbridge (TSE: ENB) agreed to purchase three utility companies – East Ohio Gas, Questar Gas and Public Service of North Carolina – for a total of $14 billion from Dominion Energy (NYSE:D), doubling its gas distribution business.

European Firms Lose Hope in US Wind. The world’s largest offshore wind farm developer Orsted (CPH: ORSTED) stated it would be ready to walk away from wind projects in the United States unless the Biden Administration provides more support amidst soaring interest rates and less tax credits.

Platinum Market Facing Record Deficit. According to the World Platinum Investment Council, the precious metal will record a much bigger supply deficit in 2023 as previously expected, coming in at a record 1 million troy ounces, driven by stagnant South African supply and high demand.

Middle East Doubles Down on Carbon Capture. ADNOC, the national oil company of the UAE, announced it would develop the Habshan CCUS project, seeking to capture and permanently store 1.5 mtpa of CO2 in deep geological formations starting from 2026.

Shell Interest Lifts Venezuela’s Gas Outlook. UK-based energy major Shell (LON:SHEL) and the national gas company of Trinidad and Tobago are close to investing $1 billion in Venezuela’s 4.2 TCf Dragon gas project, following 10 years of on-and-off negotiations derailed by PDVSA’s lack of funds.

Canada’s Oil Producers Confirm Delay Fears. Canadian Natural Resources (TSE:CNQ) confirmed rumors that the Trans Mountain Pipeline oil pipeline will be delayed until at least Q2 2024 due to the operator’s route deviation request that would require the government to approve a new 0.8-mile route divergence.

Spanish Major Swaps Oil for Wind. Having sold its Canadian assets to local gas firm Peyto E&D for $468 million, Spanish oil major Repsol (BME:REP) entered the US onshore wind market by buying renewable developer ConnectGen for $768 million, taking over its pipeline 20 GW of wind farms, quadrupling its capacity.

Prelude LNG Goes for Maintenance Amidst Strikes. Energy major Shell (LON:SHEL) chose to bring forward planned maintenance at its Australian Prelude FLNG facility, also opting for a shorter period of 2-3 months instead of a year-long turnaround, to take advantage of stronger winter gas demand.

By Michael Kern for Oilprice.com

More Top Reads From Oilprice.com:

- The Oil Market Hasn’t Felt The Full Impact Of Saudi Arabia's Cuts Yet

- Oil Prices Falling Back But Set For Another Weekly Gain

- Chevron LNG Workers Begin Strike