Oil started out the week seeing some volatility and choppy trading, awaiting more signs of a clear direction.

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

- The EIA forecasts that total global liquids inventories will rise by an average of 200,000 bpd in 2018, followed by a slightly larger surplus in 2019 at 280,000 bpd.

- However, the estimate is a rough one, with so many factors at play. Iran sanctions are set to take effect in a week, and the EIA assumes the loss of 1 mb/d of Iranian production relative to the April 2018 peak at 3.8 mb/d.

- Furthermore, it is unclear how OPEC will react to the losses.

- Meanwhile, the EIA assumes U.S. production will grow by 1 mb/d next year.

Market Movers

• YPF plans to spend $4 billion to $5 billion per year through 2022 in an effort to increase oil and gas production, with a target of 5 to 7 percent production growth per year.

• Petrobras and a consortium including BP (NYSE: BP) and CNPC began drilling on its first well in the Peroba subsalt area in offshore Brazil. The block could hold as much as 5.3 billion barrels of oil.

• Cabot Oil & Gas (NYSE: COG) saw its share price jump when it reported higher realized natural gas prices and gains from asset sales. Cabot’s stock rose nearly 6 percent despite missing earnings expectations.

Tuesday October 30, 2018

India, China and Turkey still buying Iranian oil. With just days to go before U.S. sanctions on Iran go into effect, it appears that India, China and Turkey are still resisting demands from Washington to eliminate purchases. Reuters reports that there is tension within the Trump administration over how hard to press these countries, with one camp, led by national security adviser John Bolton, pushing for zero tolerance, and others more in favor of offering some waivers. Several top importers are still set to buy some Iranian oil in November. “We have told this to the United States, as well as during Brian Hook’s visit,” a source from the Indian government told Reuters, referring to the U.S.’ special envoy. “We cannot end oil imports from Iran at a time when alternatives are costly.”

Related: Iran’s Worst Nightmare Is Coming True

Concerns over global economy weigh on crude. Crude oil posted steep losses over the past two weeks, the result of growing concerns about the health of the global economy. Other commodities, including copper, have also seen volatility. “It is often said that when stock markets sneeze, commodities catch a cold. This adage was on full display last week as a global rout on equity gauges dragged the energy complex lower,” PVM Oil Associates strategist Stephen Brennock said to Reuters.

Market in wait-and-see mode. With Iran sanctions set to take effect in a few days, the market is awaiting further clarity. Saudi Arabia and Russia have vowed to cover any supply shortfall, but Iran’s oil exports likely won’t go to zero. “I expect investors will take a wait-and-see stance this week before the return of sanctions on Iran and U.S. midterm elections,” Makiko Tsugata, a senior analyst at Mizuho Securities Co., told Bloomberg. Even though Iran is set to lose a significant portion of its exports, “if both Saudi Arabia and Russia boost output and U.S. production continues to rise, we could have a supply glut.”

Russia ill-prepared for IMO rules. Rules from the International Maritime Organization (IMO) set to take effect in 2020, which will lower the allowed concentration of sulfur in marine fuels, pose an enormous threat to Russia. Russia is the world’s largest exporter of sulfurous residual fuel oil and it is ill-prepared to comply with the regulations. “Russia’s oil segment appears to end up among the biggest losers financially,” IHS Markit Ltd.’s senior research analyst Alexander Scherbakov said, according to Bloomberg. There’s “no chance for them to be 100 percent prepared.”

Hedge funds continue to cut bullish bets. Hedge funds and other money managers continued to liquidate their bullish positions on crude oil futures, a sign that investors are increasingly pessimistic about the trajectory for oil prices. The ratio of long to short positions fell to 6:1, down from 12:1 at the end of September, according to Reuters.

Fossil fuel subsidies on the rise again. Global subsidies on fossil fuels rose in 2017 for the first time in years, according to the IEA. After declining by half between 2012 and 2016, subsidies began to creep up again last year as oil prices rose. The IEA says that the value of total subsidies around the world increased by 12 percent in 2017 to more than $300 billion.

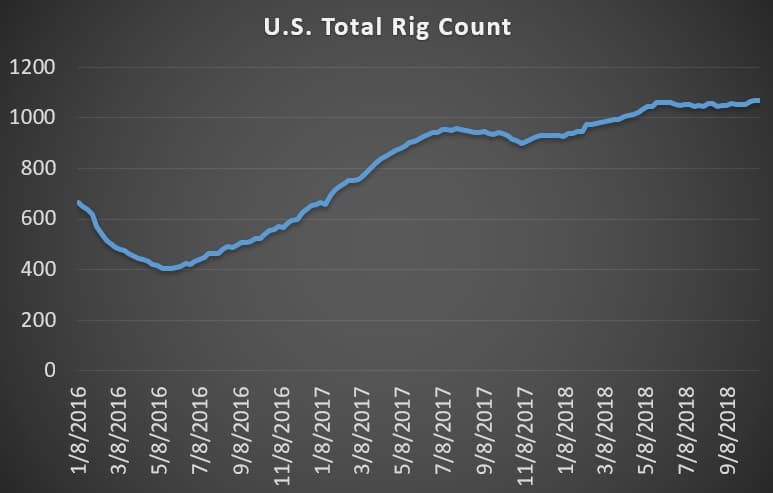

Moody’s: High levels of debt a “drag” on oilfield services. U.S. oilfield services and drilling companies’ high debt levels “are unsustainable over the long term without a substantial improvement in cash flow,” according to a new report from Moody’s Investors Service. “US oilfield services and drilling companies' high debt levels will continue to constrain their credit quality in 2019 and beyond,” said Sreedhar Kona, a Moody's Senior Analyst. “The largest firms are significantly better positioned to regain their credit strength next year than the smaller ones, though the threat of balance sheet restructuring will persist, particularly for the latter.” An increase in North American drilling activity will help land-focused OFS firms, Moody’s said, such as Schlumberger (NYSE: SLB), Halliburton (NYSE: HAL) and Baker Hughes (NYSE: BHGE). Related: The Quiet Swing Producers: Iraq, Libya, Nigeria

Gasoline tax in California up for a vote. California passed a 12-cent-per-gallon tax on gasoline last year to help fund transit priorities, but the issue is going to be put before the state’s voters next week. A referendum, if passed, would repeal the tax. The latest polling has a plurality of voters in favor of keeping the tax.

Uber proposes fee in London to fund EV effort. Uber has proposed a 15-pence-per-mile fee on trips in London to help raise money for drivers to switch to electric vehicles. The fee is expected to raise $260 million by 2025, and the revenue will go to incentives for drivers to switch to EVs.

Washington State considers carbon tax. Washington State is hoping to become the first in the U.S. to pass a carbon tax. Voters will decide on the measure next week on election day. The oil and gas industry has poured millions of dollars into the state to defeat the proposal.

PDVSA makes bond payment. Venezuela’s PDVSA made a $949 million bond payment on principal and interest due on a 2020 bond, the only one of its debt issuance not in default, according to Argus Media. The payment saves PDVSA from seeing its U.S.-based subsidiary Citgo put at risk from investor claims.

By Tom Kool for Oilprice.com

More Top Reads From Oilprice.com:

- The Great Biofuel Swindle

- Why Is Canadian Crude Selling For $20?

- Trade War Puts The Brakes On U.S. LNG Dominance