The U.S. suffered though multiple bouts of severe cold in the last few weeks, but the weather has done very little to rescue low natural gas prices.

Henry Hub gas prices have been wallowing below $3/MMBtu for much of this winter, after briefly trading at multi-year highs late last year. Low prices are remarkable for several reasons. First, the U.S. entered the peak winter demand season with gas storage at its lowest level in 15 years. Indeed, a thin cushion of gas sitting in storage helped spark the price rally in November.

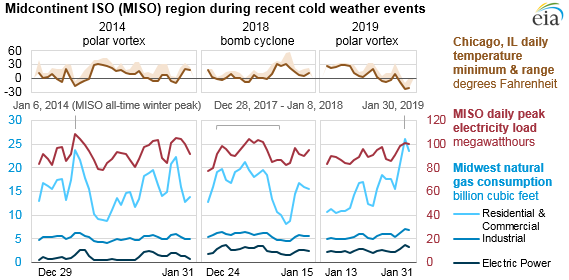

But the price spike was fleeting, a notable development for a second reason. Demand soared to new heights this winter, particularly during bouts of extreme cold. Gas consumption broke record highs in late January after half of the U.S. suffered through a deep freeze. Residential/commercial consumption in the Midwest reached 26 Bcf on January 30, an all-time high.

(Click to enlarge)

However, prices continued to slide as January gave way to February. While spot Henry Hub prices traded at $3.50/MMBtu in mid-January, a month later they had plunged to $2.60/MMBtu.

Prices have edged up a bit since then, but with the end of winter in sight, there is little prospect of a major rebound. “With roughly six weeks left in the winter season, the chance of meaningful storage scarcity is rapidly declining, so storage holders have less incentive to hold onto gas and purchase gas on the spot market instead,” Barclays wrote in a note. “Also, our model shows a more balanced market next month with withdrawals of a mere 2 Bcf/d or so, which would be the fifth-smallest on record.”

The investment bank lowered its first quarter pricing forecast to $2.78/MMBtu, down from a previous estimate of $2.98/MMBtu. Related: Venezuela Fails To Sell Its Heavy Crude Amid Dwindling Supply

Barclays admitted that inventories are tighter than expected, sitting 362 bcf below the five-year average for this time of year. “However, the ongoing price slide amidst supportive storage suggests that this is not enough to arouse bullish interest anymore in the March or April 2019 contracts. Volatility has died down, too,” Barclays analysts noted. The market, apparently, “has moved on.”

The shale gas industry continues to ramp up production, while ongoing gains in associated gas in the Permian have added new supplies. Yet, much hinges on the “de-bottlenecking of the Permian,” which would allow gas – some of which is being flared – to find a way to market. The Marcellus and Utica shales too are hoping for more pipelines, which would allow for another step up in drilling.

The pace of production gains will have an “outsize impact on price strength next winter.” Coming out of this winter, lower-than-expected inventories means that storage levels will be lower heading into next winter. That puts a lot of onus on the so-called “injection season” to replenish stocks. Related: Thailand Pivots To Renewables As Gas Dries Up

Barclays’ baseline projection is for the U.S. to end the injection season in the fall with storage levels at 3.4 trillion cubic feet (Tcf), a little below the five-year average of 3.7 Tcf. But the investment bank also laid out a scenario in which production exceeds expectations. “All else equal, a 3 Bcf/d shift in summer production would add about 600 Bcf to our call for end-October stocks, pushing it towards historical highs north of 4 Tcf. This storage level would markedly lower the chance for storage scarcity and, thus, high prices next winter,” the bank said.

(Click to enlarge)

Of course, there is no guarantee that production growth surprises on the upside. Interestingly, the same pressure on oil companies, which has them coming under fire from shareholders demanding a focus on profits, even at the expense of growth, is also occurring for gas drillers. For instance, Cabot Oil & Gas Corp. “reiterated its preference for [free cash flow] generation over volume growth,” Morgan Stanley said in a research note. Cabot lowered its 2019 production guidance from a 20 to 25 percent range down to just 20 percent. Other shale drillers posted similar revisions, which, to be sure, are rather modest, but are notable given the industry’s history.

Still, lower prices and volatility are an indication that the market is rather unconcerned about adequate supply for the foreseeable future.

By Nick Cunningham of Oilprice.com

More Top Reads From Oilprice.com:

- Oil Inches Higher Ahead Of Inventory Data

- Saudi Oil Production Lags Behind Peers In The Mid-East

- Hydrogen Cars Struggle To Compete With Electric Vehicles