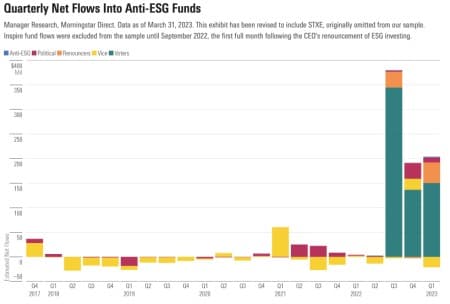

The investor pushback against "woke capitalism" has led to the proliferation of funds that market themselves as opposed to environmental, social, or governance (ESG). A new report via Morningstar reveals even though anti-ESG funds gained momentum in late 2022, popularity for the funds has since waned.

Morningstar said anti-ESG funds peaked at around $377 million during the third quarter of 2022, more than five times the previous quarterly record. Total new deposits fell to $188 million in the fourth quarter and were about the same in the first three months of 2023.

Over April and May, the funds only took in about $58 million, Morningstar spokesperson Erin Parro told Reuters. She said the current trend into anti-ESG funds "seems like a drizzle" compared with the rush last year when GOP lawmakers vilified ESG moves at BlackRock and Vanguard.

"Although there's been a lot of talk about anti-ESG funds, it's not clear that they have staying power," Morningstar's Alyssa Stankiewicz and Mahi Roy wrote in the report.

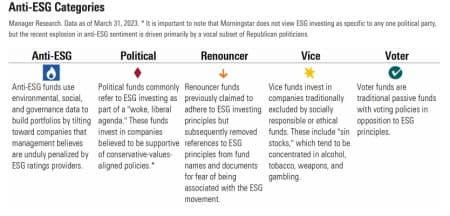

Morningstar groups anti-ESG funds into five categories: Anti-ESG, Political, Renouncer, Vice, and Voter.

One of the top anti-ESG funds, Strive US Energy ETF, received $300 million in the month after it launched last August. Strive co-founder Vivek Ramaswamy stepped away from executive chairman earlier this year to run for US president.

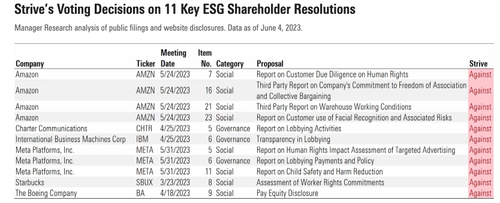

Morningstar pointed out that Strive has voted against eleven key ESG shareholder resolutions in top publicly traded companies this year. These resolutions included pay equity, freedom to unionize, lobbying activities, and working conditions.

Despite the slowing interest in anti-ESG funds, the 27 anti-ESG funds Morningstar tracked had total assets of $2.1 billion at the end of the first quarter. A year earlier, the figure was around $282 million.

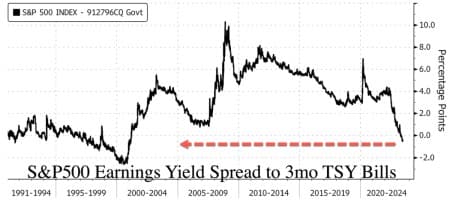

It's hard to say if the waning interest is because anti-ESG is just a fad or if stocks, in general, are out of favor with investors because the earnings yield on benchmark equity indexes has now fallen below that on three-month bills for the first time since the Dot-Com bubble.

By Zerohedge.com

More Top Reads From Oilprice.com:

- ‘Nuclear Diesel’ Could Become A Gamechanger In Energy Markets

- Saudi Arabia’s Crude Oil Exports Dropped To A Five-Month Low In April

- WTI Drops As Demand Fears Take Over Markets