Oil markets are once again focused on looming demand weakness, capping oil prices despite rising tensions in the Middle East.

Chart of the Week

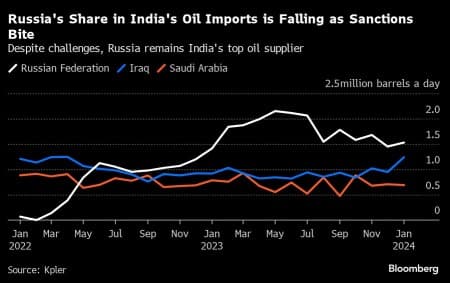

- As India holds its second-ever India Energy Week in Goa, the world’s leading oil exporters have flocked to discuss new fields with a country that is poised to overcome China next year as the world’s fastest-growing source of oil demand.

- Prime Minister Narendra Modi pledged that India would see an investment of $67 billion in its energy sector over the next 5 years, seeking to almost double its refining capacity from 254 mtpa to 450 mtpa by 2030.

- India’s 2070 net zero target provides Delhi with more time to prepare for a renewables-based future, with PM Modi expecting clean energy (including nuclear) to account for 50% of generation by 2030.

- The energy week has been marked by the huge participation of Russian companies as Russia remains the largest oil supplier to India accounting for one-third of imports, although Saudi Arabia and the UAE have been increasingly visible, too.

Market Movers

- Canada’s offshore regulator NLOPB confirmed that Norway’s Equinor (NYSE:EQNR) Cambriol G-92 discovery in offshore Newfoundland contains some 340 million barrels of oil, one of the top finds of 2023.

- French energy major TotalEnergies (NYSE:TTE) is exploring the sale of a 50% stake in a portfolio of wind and solar projects in Europe and the United States, seeking to share the brunt of higher capital costs.

- US LNG developer Tellurian (NYSEAMERICAN:TELL) is reportedly exploring the sale of its Haynesville upstream business to boost the financing of its embattled 27.6 mtpa capacity Driftwood LNG project.

Tuesday, February 06, 2024

Oil prices have been trending sideways over the past couple of days, dropping lower last week upon rumors that a Gaza ceasefire is imminent, and failing to bounce back significantly despite tensions running high in the Middle East. Saudi Aramco’s timid OSPs for March might cap the upside for price recovery as the markets are focused on looming demand weakness again. That said, should Blinken’s Middle East trip fail to yield any discernible results, the geopolitical premium might kick in again.

BP Caps Spending, Boosts Buybacks to Win Over Investors. UK oil major BP (NYSE:BP) posted higher-than-expected Q4 earnings, with profits declining slightly to $3 billion as the firm’s new management capped capex this year to $16 billion and promised $14 billion in share buybacks in 2024-2025.

Shell Signs Term Deal with Dangote. UK energy major Shell (LON:SHEL) agreed to build a gas supply facility in Nigeria to feed a fertilizer plant owned by Aliko Dangote, Africa’s richest man who is also building the continent’s largest refinery, signing a 10-year deal to be sourced from the Iseni field.

China Tightens Rules for Carbon Emitters. The Chinese government tightened rules for the country’s industrial polluters as it seeks to extend carbon allowances to the aluminum and cement industry this year, cutting future carbon allocations in case companies withhold or misreport emissions.

Germany to Spend $17 Billion on Hydrogen Subsidies. The German government announced its plans to subsidize gas power plants to be reconfigured for hydrogen, allocating $17 billion for that purpose and aiming for at least 10 GW of capacity that could be fully switched to hydrogen in 2035-2040.

TotalEnergies’ Namibia Portfolio Shines Brighter. France’s oil major TotalEnergies (NYSE:TTE) has made another commercial discovery in Namibia’s ultra-deepwater offshore zone, with the Mangetti-1X exploration well expanding the drillable territory of the multi-billion-barrel Venus giant find.

Billionaires’ Favourite Miner Finds Copper. KoBold Metals, a metal mining startup backed by Bill Gates and Jeff Bezos, has reportedly found a huge copper deposit in the African country of Zambia, the largest deposit in a century, with a potential to produce 400,000 tonnes per year at its peak.

Rare Earths See Promise in H2 2024. Market analysts are turning increasingly bullish on rare earth prices into the second half of this year, with China poised to lower production quotas and EV demand for permanent magnets flipping rare earth elements such as praseodymium oxide into deficit.

Poland’s Refinery Sale to Saudi Could Be Below Value. The Polish Audit office found that as the previous Morawiecki government merged two national oil companies PKN Orlen and Lotos, the sales of Lotos assets to Saudi Aramco and others might have been some $1.25 billion below market value.

China Boosts LNG Imports Ahead of Lunar New Year. Chinese buyers bought 7.77 million tonnes of LNG in January, the fifth highest monthly reading on record and up 28% year-on-year, stocking up on liquefied gas before the Lunar New Year holidays amidst JKM prices still below $10 per mmBtu.

As World Cools to ESG, EU Set to Tighten Emission Targets. The European Commission is set to recommend tighter greenhouse gas emission targets for the EU, cutting emissions by 90% by 2040 from 1990 levels, and testing the political appetite for even more drastic climate change measures.

Venezuela Agrees to Dragon Terms. Shell has settled production terms with Venezuela’s PDVSA on the 350 MMCf per day Dragon gas field that straddles the border of Venezuela and Trinidad and Tobago, pledging 45% of the project’s gross income to Venezuela in return for the guarantee that Trinidad takes all gas volumes.

Petrobras Seeks Downstream Expansion Under Lula. Currently operating 11 refineries in Brazil with a total distillation capacity of 1.85 million b/d, Brazil’s national oil company Petrobras (NYSE:PBR) pledged to increase refining capacity by another 25% over the next four years.

Qatar Clinches Bangladesh LNG Supply Deal. QatarEnergy and the US-based LNG developer Excelerate Energy (NYSE:EE) signed a 15-year term supply deal to deliver 1 million tonnes of LNG to Bangladesh starting from January 2026, another supply agreement from the North Field expansion.

By Michael Kern for Oilprice.com

More Top Reads From Oilprice.com:

- U.S. and Iran Locked in a Dangerous Game of Brinkmanship

- GM Auto Dealers Call for More Hybrids As EV Market Stumbles

- Robust Non-OPEC Oil Supply Might Cap Oil Prices

What is true, however, is that oil prices aren’t reflecting the solid market fundamentals and the robust global oil demand. The reason is continued and deliberate talking down of oil demand orchestrated by the United States in order to depress oil prices for the benefit of its stagnating economy and the refilling of its SPR.

Dr Mamdouh G Salameh

International Oil Economist

Global Energy Expert