Australian lithium miners Galaxy Resources (ASX:GXY) and Orocobre (ASX:ORE) have agreed to a merger that would create a $3.1 billion (A$4bn) company, set to be the world’s fifth largest producer of lithium chemicals, the refined form of the raw material used to make electric vehicle (EV) batteries.

The business combination, the biggest mining sector deal of the year so far, will unlock significant synergies for the new company, the miners said.

“The logic of this merger is compelling,” Orocobre chairman, Robert Hubbard, who becomes deputy chairman of the yet to be formally named new company, said in the media statement.

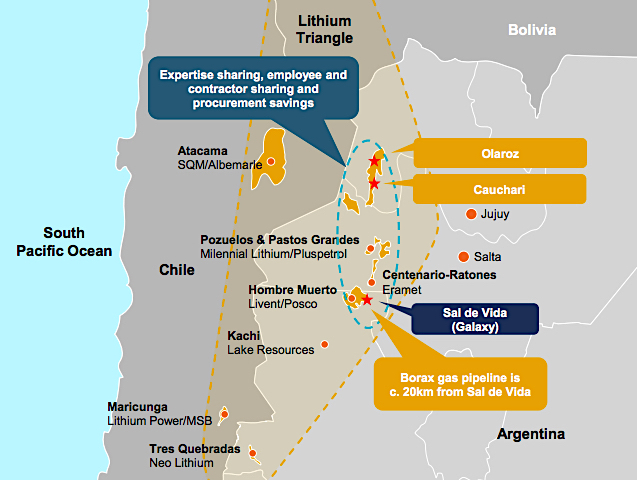

Orocobre produces lithium carbonate at its Olaroz operation in Argentina, while Galaxy has a mine in Australia and growth projects in Canada and South America.

The deal values Galaxy at about A$3.53 a share, a 2.2% discount to Friday’s close, and has the backing of both company boards.

Orocobre will offer 0.569 of its shares for every Galaxy share and will own 54.2% of the merged company, with Galaxy holding 45.8%. Orocobre was advised on the deal by UBS, while Galaxy’s adviser was Standard Chartered.

“The merger consolidates the combined group’s position in Argentina and will give us significant operational, technical and financial flexibility to deliver the full value of our combined portfolio,” Martín Pérez de Solay, current chief executive officer and managing director of Orocobre, said. Related: The War For Control Of Mexico’s Energy Industry

“From Galaxy’s perspective, we were looking for a partner which had deep in-country Argentinian experience and we’ve got that in Orocobre,” said Simon Hay, Galaxy’s CEO, who will take on the role of president of international business at the new company.

The only lithium chemical firms that would have a bigger market capitalization than the merged Orocobre and Galaxy are China’s Ganfeng Lithium, Albemarle, SQM and Tianqi. The next biggest companies are Australia’s Pilbara Minerals, US firm Livent and Canada’s Lithium Americas.

Hot market

News of the merger comes as prices for the raw material used in EV batteries are soaring. It also coincides with a change of heart about the commodity’s outlook by investment bank Macquarie (ASX: MQG)

Analysts at the bank said last week they expected lithium prices to rise by between 30% and 100% over the next four years.

It also follows updates by both Orocobre and Galaxy Resources. Orocobre said last week that production of lithium carbonate from its Olaroz lithium operations in Argentina was sold out until the end of June 2022, although more would be available in the second half of the year as an expansion comes on line.

Galaxy Resources, in turn, raised resource estimates for its Sal de Vida project in Argentina, providing a detailed plan to produce lithium carbonate at the asset.

The deal, expected to be complete in mid-August this year, sets the head office of the combined in Buenos Aires, Argentina, while its corporate headquarters will be on the Australian East Coast.

By Mining.com

More Top Reads From Oilprice.com: