The diverse drivers of expanding renewable energy and demand for liquefied natural gas (LNG) are in turn stimulating demand for stainless steels and aluminum.

Perversely, the growing competitiveness of renewable energy is making the use of natural gas less economic for baseload power generation. However, according to a Bloomberg report, the rise of variable renewable energy sources is expanding LNG’s role in providing flexible power generation to balance the electricity grid in many major economies.

The use of LNG in the industrial and transport sectors is also pushing up gas demand, particularly in Asia where environmental concerns are finally having an impact on policy.

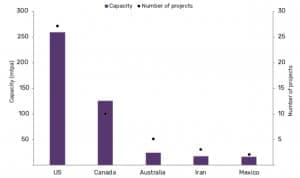

Markets like South Korea, Japan, Europe and particularly China are increasing LNG consumption as major new LNG facilities come on-stream and costs fall. According to global data, global LNG liquefaction capacity is set to expand by 117% over the next four years from 419 million tons per annum in 2018 to 907 million tons per annum by 2022. Not surprisingly, with its abundant natural gas supplies arising from the shale market, North America leads in terms of planned and announced capacity growth, contributing some 82% of the total, the news release reports.

Source: GlobalData

All this LNG requires both liquefaction and transport, driving demand for stainless steels, nickel alloys and aluminum. Indeed, the LNG market has proved one of the bright spots for stainless steel and nickel alloys badly hit by a collapse in investment in the oil industry following several years of declining crude oil prices.

The market now faces the prospect of renewed interest from the oil sector following substantial rises in the crude price over the last year and ongoing long-term investment in LNG facilities, both onshore and for marine transport. Related: How Important Are Egypt’s Gas Discoveries?

Although there are likely to be ebbs and flows in LNG demand — and, therefore, investment over the coming decade — the consensus remains that the market will continue to grow as domestic production of natural gas in southeast Asia and Europe declines and import demand, therefore, rises.

Source: Bloomberg

Liquefaction facilities at the point of export and decompression facilities at the market of destination are contributing to demand for 5000 series aluminum alloys, particularly in the U.S., Australia and the Middle East.

While the construction of LNG carriers, which is dominated by the shipyards in South Korea and China, is creating demand for high-quality stainless steels and special nickel alloys, like Invar.

LNG expansion has quietly played its part in the gradual rise in nickel prices over the last two years, despite most of the attention being taken by the electric vehicle battery market and renewables.

By Ag Metal Miner

More Top Reads From Oilprice.com:

- Can Trump Counter Soaring Gasoline Prices?

- The European Nation Turning Its Back On Russian Gas

- This Country Just Started Pumping Oil For The First Time Ever