Fossil fuels have been the dominant source of energy for global economic prosperity for over 150 years.

In 2016, fossil fuels overwhelmingly account for over 85 percent in global total primary energy consumption (TPEC)—but what role will they play in 2040 and beyond? There’s an ongoing debate among various agencies, researchers and academia whether the role of fossil fuels will significantly diminish.

The innovation in fuel cells, electric vehicles and the significant decline in cost of solar and wind power are fossil fuels’ greatest challenges. How much of fossil fuels’ share will be taken by renewable sources by 2040, and is it substantial enough to undermine the role of oil and gas industry, or is there no need to worry?

The oil industry is transforming due to the auto industry’s structural shift from internal combustion engine (ICEs) to electric vehicles (EVs), reducing global demand. But this will create additional electricity demand. In 2016, out of the global total population of 7.3 billion, more than 1.5 billion (20 percent) people are without electricity, and over billions only for a few hours. In order to meet the power demand of global population, the industry will need trillions of dollars in power generation, transmission and distribution system. Naturally, trillion-dollar investment is required here.

History shows us that countries with higher per-capita energy consumption experience stronger economic growth. This relationship is even stronger with electricity consumption. So for global economic prosperity, power is the prerequisite for takeoff. Coal still remains the dominant source of electricity generation. However, under the umbrella of the Paris Accord, all countries—particularly the major coal-consuming countries for power generation, like China and India—plan to shift toward clean energy.

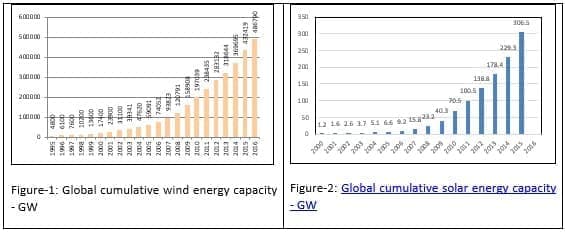

As such, general perception is that natural gas gets a free ride since it’s replacing coal. However, the speedy developments of renewables, particularly wind and solar, seems to dash this perception. During this learning-curve journey, global wind and solar energy capacities respectively increased from 59 GW and 5.6 GW in 2005 to 486 GW and 306 GW in 2016, backed by a substantial decline in prices (Figure-1 & 2).

(Click to enlarge)

Natural gas resources are located far from the major consumption centers—43 percent alone in the Middle East, and Africa at 7.6 percent. In contrast, consuming countries are located in developed areas, and now the thrust is shifting to Asia. The Asian region, where 60 percent of world population resides, has the capacity to consume the bulk of natural gas; however, it’s constrained by its availability, infrastructure and transport expense. In 2016, out of 3543 bcm total global natural gas consumption, 69 percent was locally consumed, 31 percent traded as pipeline (737 bcm) gas and LNG (347 bcm). Furthermore, the natural gas spot market is in its infancy, therefore the bulk of gas is sold under long-term contracts.

Related: What Will Drive The Next Oil Price Crash?

In contrast to natural gas reserves, almost all the countries are endowed with enormous sun and wind resources. Renewables nurtured on the laps of government subsidies have matured, and prices have significantly declined (Figure-3). For example, take the recent announcement of record-low auction prices as low as three cents per kilowatt-hour, including India, the United Arab Emirates, Mexico and Chile. Global average generation costs are estimated to further decline for 2017-2022. We also recently learned that auction prices indicate much steeper possible cost reductions, ranging from $30-45/MWh for solar PV (India, Mexico, United Arab Emirates, Argentina) to $35-50/MWh for onshore wind (India, Morocco, Egypt, Turkey, Chile). Therefore, natural gas should no longer expect to get a free ride as it gears up to substitute coal. Instead, it should brace for stiff challenges from renewables.

(Click to enlarge)

Despite challenges and constraints, the role of natural gas in TPEC is up from 24 percent (2016) to 30 percent (2040), but the biggest gainer will likely be a renewable that’s likely to go up from 3 percent in 2016 to around 12 percent to 15 percent in 2040.

One can argue the 12 percent or 15 percent numbers, but it’s certain that the penetration of renewables in power generation undermines other sources of energies.

An advantage of renewables is that there’s not necessarily a huge upfront capital investment in the transmission system. Solar panels and wind farms can provide electricity to the community without big investments in their transmission systems, especially when populations are scattered in developing countries, thus overcoming the hurdle of transmission cost/constraint.

Oil’s share will be hit hard, and could shrink from 33 percent in 2016 to around 25 percent in 2040 due to EVs and increasing ICE efficiency. Coal, once the dominant source in power generation, could decline from 28 percent in 2016 to 20 percent in 2040. Regardless, many countries with abundant coal resources and limited alternative sources will carry on as usual.

Availability and competitive prices are important. For example, in the United States, due to the shale gas boom’s big difference, power generation from coal down dropped from 53 percent in 2007 to around 30 percent in 2016. As such, the role of fossil fuels is expected to drop from 85.6 percent in 2016 to around 75 percent in 2040. The role of hydro and nuclear should remain at their current level of about 7 percent and 6 percent in 2040.

For natural gas to gain strong footing and capture market share of 30 percent in TPEC requires a lot of innovation and outside-the-box strategy. Rather than selling big LNG quantities, they should consider smaller quantities (like selling to grocery stores rather than wholesale markets). In order to achieve this strategy, they need to look back at history—rather than looking for big trains like 7.8 MTPA and larger, companies should look for smaller size trains, LNG carriers, and even FSRUs to meet the demand of a large number of smaller customers.

Related: Blockchain And The $3.6 Trillion Infrastructure Crisis

Along with power and industrial sectors, the natural gas industry should focus on marine fuel (particularly the shipping industry) and look for markets in Africa, Central America, and South America rather than focusing only on traditional Asian markets.

It’s time to create demand for natural gas where resources are located rather than only looking at the capital-intensive export options. A sizable natural gas reserve (7.6 percent) is located in Africa. Over 16 percent of the global population resides there, with most generally deprived of power—still struggling to take off. The regional per capita energy consumption is around 15 million btu, compared to Asia’s 50, with developed regions close to 200.

There’s much potential in Africa, Central America, and South America. It will require a strategy to create opportunities via investments in integrated projects in these areas with rich resources and poor economies, which could then generate increased regional economic activity. At last, these countries could finally utilize their indigenous energy resources.

By Dr. Salman Ghouri

More Top Reads From Oilprice.com:

- Brent Spikes As This Major Pipeline Breaks Down

- Are NatGas Prices About To Explode?

- Panama Canal Can’t Handle U.S. LNG Boom

Hardly a day goes by without another media report about the impending demise of the ICE as petroleum-powered cars and trucks are replaced by super-clean EVs. Except it isn’t true.

Some experts are now saying that widespread electric vehicle use could spell the end of oil. The tipping point, they reckon, is 50 million EVs on the roads. This they believe could be reached by 2024.

Let us look at the facts. Currently, electric and hybrid cars combined number under 2 million cars out of 1.477 billion conventional vehicles (ICE) on the roads worldwide in 2015, or a negligible 0.14%. By 2040 the total number of ICEs is projected to reach 2.79 bn according to US Research. Let us also assume that by 2040 there will be 100 million EVs on the roads or 3.58% of the global fleet of ICEs.

By 2040, the global demand for oil is projected to reach 46.6 billion barrels (bb) annually of which 90% or 41.9 bb will be used to fuel 2.79 bn ICEs. Average annual consumption by an ICE will accordingly be 15 barrels per vehicle.

Bringing 100 million EVs on the roads would, therefore, reduce the global oil demand

for transport by only 1.5 bb, or 3.6%. This will neither be the end of oil as some experts are suggesting nor a tipping point.

A tipping point for oil could only be reached once 1.4 bn EVs (50% of the projected global number ICEs in 2040)) are on the roads by then. This is impossible to achieve within that time frame. One then can only guess how many decades will have to pass before the entire global car fleet of conventional cars is replaced by electric cars.

Moreover, there will be a need for trillions of dollars of investment to expand the global electricity generation capacity in order to accommodate the extra electricity needed to recharge 100 million EVs.

In conclusion, I would say that a post-oil era is a myth. Oil will continue to rein supreme in global use and also in transport through the 21st century and may be far beyond.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London