Oil markets have been heavily influenced by the U.S. this week, first by news it was lifting sanctions on Venezuela, then by reports it would be refilling its SPR, and then early on Friday morning by news that a U.S. warship had intercepted missiles fired from Yemen. Volatility remains high in oil markets and both WTI and Brent are headed for another weekly gain.

Friday, October 20th, 2023

The US government has been one of the key oil market players this week, announcing both the easing of Venezuelan sanctions and a potential US SPR replenishment. While the first of those two announcements sent oil prices lower, news of the U.S. potentially refilling its oil reserves then sent prices spiking. Meanwhile, the Israel-Gaza crisis continues to escalate, stoking fears that it may spread into a wider regional war, with the geopolitical risk premium adding further upside to prices. As of Friday morning, WTI was trading above the $90 per barrel mark and ICE Brent was nearing the $94 per barrel mark.

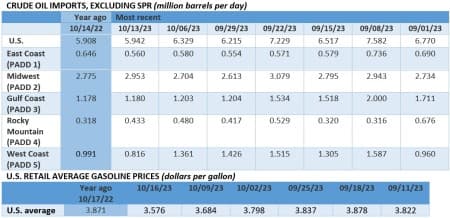

White House Starts Replenishing SPR. The US Department of Energy announced it would seek to buy 6 million barrels of crude oil for delivery to the Strategic Petroleum Reserve in December-January, adding that it seeks to sign purchase contracts at $79 per barrel or less.

US Starts Sanctions Squeeze on Iran. The US Treasury Department issued a new set of sanctions against Iran, targeting 11 individuals and 8 companies involved in missile and drone production, refraining from slapping additional restrictions on Tehran’s oil sector.

US Warship Intercepts Missiles Fired From Yemen. Three missiles fired from Yemen were intercepted by a U.S. warship in the Red Sea. Brigadier General Pat Ryder said that while they could not be certain as to the targets of the missiles, they were potentially heading in the direction of Israel.

Shell Signs LNG Megadeal with Qatar. UK-based energy major Shell (LON:SHEL) signed a 27-year term deal with QatarEnergy that would see Qatar deliver as much as 3.5 million tonnes LNG per year to Rotterdam’s Gate import terminal starting from 2026.

Greenpeace Loses its UK Oil Challenge. Environmental group Greenpeace lost a legal challenge in the UK High Court after the court found the British government’s decision to authorize new licenses for oil and gas exploration in the North Sea was lawful, following four years of no lease sales.

Venezuela Gets 6-Month Sanctions Clearance. The US government will temporarily lift some of the key sanctions targeting Venezuela’s oil industry, allowing Western companies to carry out transactions with PDVSA for six months in return for the Maduro regime’s pledges to hold fair elections.

BHP Sheds Major Coal Assets. Australia’s BHP (NYSE:BHP), the largest mining company globally, agreed to sell its Daunia and Blackwater coking coal mines in Australia for $3.2 billion to Whitehaven Coal, extending its gradual withdrawal from fossil fuels towards energy transition metals.

French Firm Suspect of Sanctions Busting. French engineering firm Technip (EPA:TE) saw its shares plunge almost 15% on Thursday after the country’s leading newspaper Le Monde said the company failed to comply with EU sanctions by continuing to supply equipment to the Arctic LNG 2 project in Russia.

Chesapeake Eyes Takeover of Gas Peer. US natural gas-focused producer Chesapeake (NASDAQ:CHK) reportedly reached out to its peer Southwestern Energy (NYSE:SWN) for a potential takeover for $12 billion including debt, a deal that could create the US’ largest gas producer by market value.

Yuan-Settled Trades Get More Frequent. China’s national oil company CNOOC (HKG:0883) completed a yuan-settled LNG trade with France’s Engie (EPA:ENGIE) through the Shanghai Petroleum and Natural Gas Exchange, the fourth such trade on record as China seeks to expand its currency into commodities.

White House Loosening Venezuela Sanctions. The energy minister of Trinidad and Tobago confirmed the US granted a license amendment allowing the island nation to jointly develop the offshore Dragon gas field in Venezuelan waters, with future production feeding Trinidad’s LNG terminal.

China Optimism Lifts Iron Ore. With China reporting above-expectations 4.9% growth in Q3, sentiment in the metals market was buoyed as iron ore futures extended their rally and the most-traded Dalian futures contract rose to $120 per metric tonne, also boosted by lowest stocks since 2016.

Devon Energy Joins the Exxon Drive. Oklahoma-based shale producer Devon Energy (NYSE:DVN) is exploring major acquisition targets in the wake of the Exxon-Pioneer deal, with market rumors suggesting a move could be made towards Marathon Oil (NYSE:MRO) or privately held CrownRock.

European Gas Prices Rise on War Risks. Fears of a wider regional war in the Middle East are starting to weigh on natural gas markets, too, as benchmark TTF futures jumped to €52 per MWh ($17.5 per mmBtu) on the back of a deteriorating outlook for Egypt’s LNG exports into the winter.

By Michael Kern for Oilprice.com

More Top Reads From Oilprice.com:

- The U.S. Plans To Buy 6 Million Barrels Of Oil For The SPR At $79

- Oil Prices Set For A Weekly Gain As The War Premium Returns

- Oil Prices Climb As U.S. Warship Intercepts Three Missiles Fired From Yemen

Refilling the SPR isn’t a given. At present there is no spare oil for sale in the market so finding 6.0 million barrels to add to the SPR in a tight market will be extremely difficult and will still be a drop in the ocean. The SPR will never ever be refilled to its previous level.

Dr Mamdouh G Salameh

International Oil Economist

Global Energy Expert