Diogenes the Cynic was once asked by one of his students whether a man should buy or rent. His reply was typical Diogenes, but still unexpected, "Whichever he chooses, he shall regret it."

And that is the quagmire in which Americans currently finding themselves. A critical housing shortage is rapidly taking hold across the country. It’s a vicious cycle: Rents are rising because people are renting for longer, and they are renting for longer because they are having a hard time finding another home they can afford.

Meanwhile, home valuations have rendered ownership out of reach for all but the wealthy and upper middle-classes living the rest with no choice other than to rent.

Unlike the eccentric and ascetic Greek philosopher who was content to live in a weather-beaten tub, the average American has to pay through his nose for a place to lay his head. The national average rent hit $1,405 in June 2018, a 2.9-percent year-over-year increase and all-time high, according to Yardi Matrix data.

A good 88 percent of the nation’s 250 largest cities recorded rent increases over the past 12 months. Only 2 percent were lucky enough to record a drop, while 10 percent remained unchanged. Manhattan had the biggest increase over the past year after a long period of stagnating or falling rents.

Economy and Oil Boom Pushing Rents Up

Perhaps unsurprisingly, the 20 sharpest increases were recorded in small cities where strengthening economies and population migration drove prices up.

Related: Asia Is Leading The Renewable Energy Race

High demand for two-bedroom and three-bedroom apartments has been the main driver of rent increases in 2018. In June, however, studio apartments also started posting notable increases, suggesting that the crisis cuts now across the board.

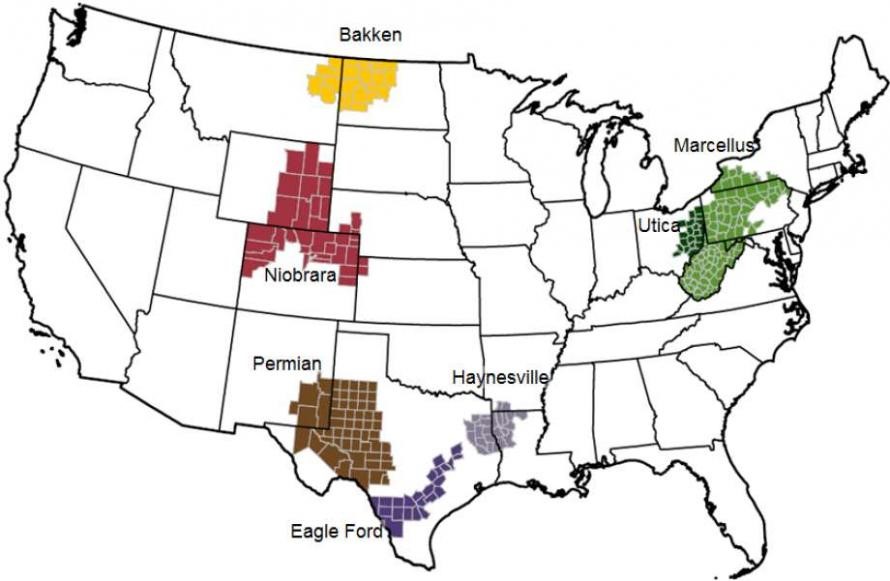

But nowhere have rents risen as spectacularly as they have in the oil-industry hubs of the Midland, Permian Basin and Odessa. The latest data shows that June rents in Midland shot up 40 percent compared to June 2017, while Odessa rents ballooned an average 36.6 percent.

(Click to enlarge)

Rising oil prices in West Texas have resulted in a sharp economic upswing that has led to higher employment, higher wages, increased spending at restaurants, hotels, car dealerships and higher cost of housing and other essentials.

This parched land straddles the biggest oil-producing rock formations in the entire country, making it the epicenter of a massive growth binge that clearly reveals the tight link between higher employment, rising wages and general price inflation. After a two-year crash, crude oil prices began to recover in mid-2017 and crossed the $60 a barrel ceiling this year.

Related: The Critical Chokepoint That Could Send Oil To $250

Still, oil remains far cheaper than at the peak of the 8-year boom in North Dakota’s Bakken oil patch, which supercharged the city of Williston.

The oil boom in the Permian Basin, stretching from West Texas to eastern Mexico, is mainly being driven by fracking technology that enables drillers to extract much more oil from previously inaccessible locations.

According to Dallas Fed economist Michael Plante, $60 is like the new $100. Breakeven costs have now plunged to as low as $25 per barrel, meaning shale energy companies no longer need oil to hit $100 or more to make lots of money. You can therefore expect the trend of price inflation and higher rents in the oil basin to accelerate.

By Alex Kimani for Safehaven.com

More Top Reads From Oilprice.com:

- What Trump’s Tweet Actually Means For Oil

- This Country Is Far Ahead Of Its Renewables Targets

- Mexico Likely To Keep Making The World’s Biggest Oil Hedge