Oil prices are on course for yet another weekly gain, fueled in part by supply concerns and in part by growing optimism about a 'soft landing' for the U.S. economy.

Friday, 28th July 2023

The strength of the US economy has added fuel to the recent rally in oil prices, with the 2.4% quarter-on-quarter growth in Q2 prompting many to believe again in the possibility of a soft landing. Even though China’s hoarding of crude does not necessarily look good for the upcoming months as Chinese refiners might suddenly start buying significantly less than they do now and start running down stocks, there’s so far very little immediate downside to ICE Brent ending the week around $83-84 per barrel and posting another week-on-week gain.

Saudi Aramco to Build Pakistan Megarefinery. Four Pakistani state-owned companies signed a memorandum of understanding with Saudi Aramco (TADAWUL:2222) to build a 300,000 b/d refinery in Gwadar, doubling the embattled country’s refining capacity for an estimated cost of $10 billion.

Greenpeace Picks Another Fight Against UK Oil. Environmental campaign group Greenpeace took the UK government to court over its holding of the 2022 exploration licensing round, saying the authorities failed to assess end-use emissions from future hydrocarbon production.

Cargo of Iranian Oil Stuck Off US Coast, Unwanted. The Suez Rajan, a Marshall Islands-flagged tanker that was confiscated by the US Navy two months ago for allegedly carrying Iranian crude, remains anchored off Galveston since late May as both ship agents and refiners refuse to accept or refine it.

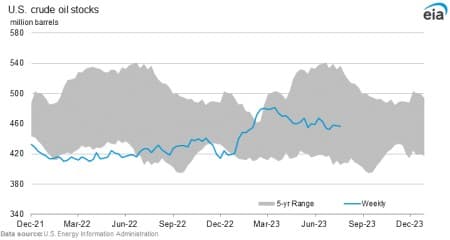

Chinese Oil Stockpiles Shoot Through the Roof. Boosted by all-time high imports of Russian crude and year-on-year doubling Iranian flows, China has amassed almost 1 billion barrels in crude inventories, the highest level of stocks in almost three years, potentially drawing from them in H2.

Germany’s Hydrogen Strategy Creates Another Import Dependence. Germany has updated its hydrogen strategy this week, admitting that it would need to import up to 70% of its hydrogen demand, forecast at 95-130 TWh in 2030, sticking to its policy of becoming climate-neutral by 2045.

UN Starts Removing Oil from Decaying Supertanker. The United Nations started the removal of more than 1 million barrels of crude stranded on a decaying tanker called Safer, which moored off the Yemeni coast for more than 30 years and was completely abandoned after the onset of civil war in Yemen in 2015.

TotalEnergies Not Afraid of Uganda Backlash. French oil major TotalEnergies (NYSE:TTE) said it had started commercial drilling at its Tilenga oil field in the western part of Uganda, seeking to launch production in 2025 despite mounting environmental challenges warning of habitat devastation.

Court Decision Greenlights Key US Pipeline. The US Supreme Court granted the operator of the Mountain Valley Pipeline, a longtime-planned gas conduit running through Virginia, the right to build a 3.5-mile section through the Jefferson National Forest, dealing a blow to years of environmentalist protests.

Teck Divestment of Coal Assets Still on the Table. The CEO of Canada’s Teck Resources (NYSE:TECK) stated that the company is still considering a range of proposals including a partial sale of its coal business, leading many to believe that Glencore’s $8.2 billion bid for the assets is not yet fully rejected.

Heat Sends US Power Prices Soaring. As US electricity prices soar amidst a crippling heatwave, taking PJM Western prices to the highest since February, the operator of the Midwest’s power grid was forced to declare a level-one emergency in 13 states stretching from Illinois to New Jersey.

Pentagon Spearheads Gallium Mining Drive. The US Defense Department is expected to issue first-time mining awards for the production of gallium to US or Canadian companies by the end of this year amidst Chinese curbs on gallium exports, a key component in Navy radars and missile defense.

TC Energy Plans 2024 Pipeline Spin-Off. Canada’s leading pipeline operator TC Energy (TSE:TRP) will spin off its oil pipeline business into a separate entity in the second half of 2024, seeking to focus its core activities around natural gas and low-carbon energy, sending its stock 10% down on the week.

BP Lands Another LNG Supply Deal. UK energy major BP (NYSE:BP) signed a long-term LNG supply deal with Austria’s OMV (VIE:OMV), delivering 1 million tonnes of LNG to the Gate LNG terminal in the Netherlands or other selected destinations, with first cargoes expected from 2026.

Saudi Arabia Doubles Down on Metals. Saudi Arabia’s sovereign wealth fund Maaden agreed to purchase a 10% stake in Vale’s base metal business for $3 billion, beating rival bidders Mitsui and Qatar Investment Authority to diversify their portfolio away from fossil fuel investments.

By Michael Kern for Oilprice.com

More Top Reads From Oilprice.com:

- TotalEnergies Misses Forecasts As Q2 Earnings Plunge By 49%

- Cobalt Prices Rally As Battery Demand Booms

- Why The World Just Can’t Kick Coal