Goldman Sachs has flipped on their bearish natural gas stance to a bullish one.

Goldman's Samantha Dart's reasoning behind the view shift is due to a combination of factors including "supply disruptions, shipping delays, and strong LNG demand, supported by heavy nuclear maintenance in Japan and a cold start of the year in NE Asia, have significantly tightened the LNG market."

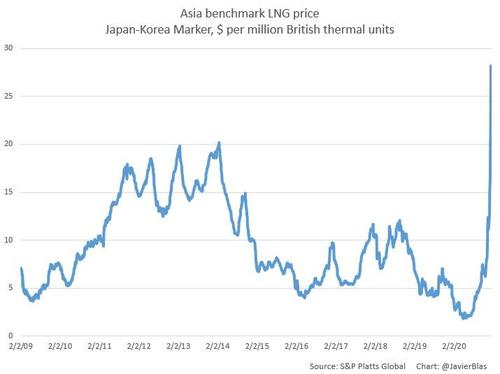

Prices of the supercooled fuel in especially Asia have reached astronomic heights in recent days. The most critical LNG markets are in Asia and Europe, which comes as a polar vortex split that has dumped Arctic air in both regions, boosting natgas prices.

Goldman points out LNG Asian benchmark JKM has jumped to a fresh all-time high of $32/mmBtu today as the "market struggle to ration demand while supply takes weeks to move incremental Atlantic Basin supply into Asia."

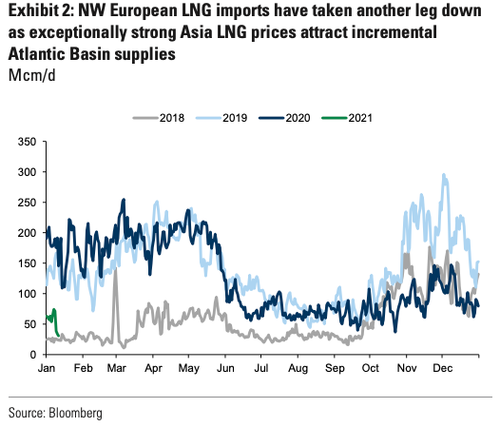

While LNG prices are soaring in Asia, cold weather in Europe has led to the Dutch Title Transfer Facility (TTF) physical short-term gas and gas futures contract to soar 29% higher to $9.43/mmBtu in the last two days. Goldman suggests that "even deeper-than-expected drop in NW European LNG deliveries, we now see European balances even tighter." Related: The Pandemic Could Lead To A Major Oil Supply Crunch

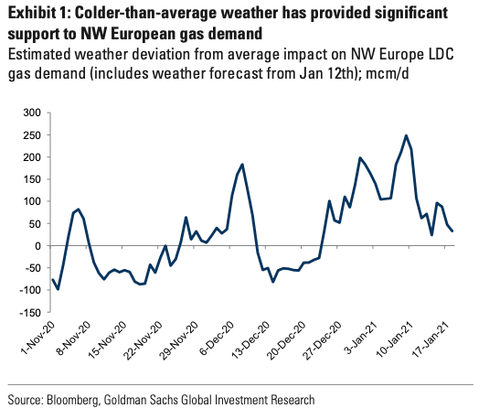

Colder-than-average temperatures have provided significant support for European natgas demand.

"TTF price forecasts skewed to the upside," Goldman said, adding that it's due to "weather-driven tightness realized thus far."

We see risks to our revised TTF price forecasts skewed to the upside as, given the LNG and weather-driven tightness realized thus far, we believe that even a warm turn to the weather would not be enough to take this year's storage path towards a capacity breach. This effectively eliminates the risk that TTF may need to sell off this winter to once again close the US LNG export arb.

Hence, with warm weather risks less relevant, we update our weather scenario analysis to focus on colder-than-average scenarios only. Importantly, our previous iteration of this analysis had already shown the explosive potential for TTF prices. -Goldman

Colder weather in Europe has also resulted in Spanish natgas prices hitting a record high.

On Monday, British wholesale gas prices surged to their highest levels since December 2018, or about a two-year high, due to colder weather.

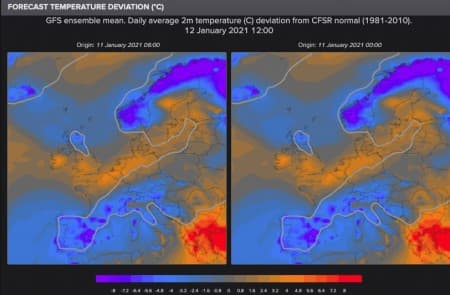

Forecast temperature deviations for Europe show much of the continent will continue experiencing colder than average temperatures for the month.

The colder weather in Europe has driven power prices to record highs. About 40% of the electricity consumed in the continent comes from fossil fuels, such as natgas.

In the UK, day-ahead 5-6pm electricity prices just zoomed to an all-time high many, many, but really many times above normal auction levels (see 2010-2021 chart below). pic.twitter.com/aB5l8Qiqlz

— Javier Blas (@JavierBlas) January 12, 2021

While natgas prices are surging in Asia and Europe, US LNG export arbitrage continues to widen.

Goldman "believes this provides no incremental tightening of US gas balances, as we already expected US liquefaction facilities to operate near capacity throughout the year."

Supposedly, the smartest people in the room also believe there will be "significant upside to NYMEX gas prices this summer to help correct what we see as a 2.5 Bcf/d imbalance in the market through Oct21. Accordingly, we maintain our $3.25/mmBtu 2021 summer US gas price forecast vs. forwards at $2.80."

And that surging cost could be coming home soon, as BAMWX's Hinz has pointed out, high impact cold and storminess across the eastern US and Canada is next?

By Zerohedge.com

More Top Reads From Oilprice.com:

- Oil Bulls Are Back

- Asian Buyers Rush To Secure North Sea Oil After Saudi Surprise Cut

- Oil, Gas Rigs Increase For Seventh Straight Week