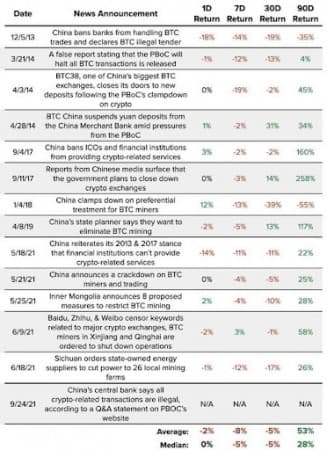

Several weeks after Beijing's seemingly final ban in a long series of crackdowns on bitcoin trading, when the PBOC said that all crypto-related transactions are illegal which ironically backfired spectacularly and helped spark the latest surge in cryptos...

... China is now scrambling to contain other, far more conventional conduits for potential capital flight.

On Friday, China's Industrial and Commercial Bank of China (ICBC) said it will restrict certain types of retail businesses involving foreign exchange and commodities trading. The move by China’s biggest bank and reported by Reuters, comes alongside a range of actions by regulators to curtail financial risks that include dampening commodity price rises, banning cryptocurrency transactions and restricting property speculation. The bank’s restrictions also come as global energy prices have surged in response to power shortages in China and some other parts of the world.

ICBC said in a statement that starting Oct 17 it will suspend new account openings for so-called “account forex business”. Under this business, individuals can trade forex against the yuan for speculative or hedging purposes, and cannot withdraw or transfer the foreign currencies from the trading accounts, a move which may be aimed at avoiding cross-border (mostly USD) FX exposure, allowing local traders to gain exposure to foreign currencies without actually holding the currency.

Then, starting from Nov 14, existing clients will be barred from opening new trading positions.

ICBC will also stop taking in new clients from Oct 17 in a similar trading business involving energy, base metal, agricultural products and precious metal indexes, ICBC’s statement said.

“Risk is high these days in global forex and commodities markets, so please pay attention to controlling risks,” the bank said.

Reminding the world for the nth time that in a centrally-planned economy market access can be shut down at the flick of a switch, in recent months ICBC and other banks, including Bank of China and China Merchants Bank closed foreign exchange trading businesses that had let individual clients bet on non-yuan currency pairs.

It wasn't immediately clear if China was more concerned about containing the damage retail investors could sustain should the market tank, or were more worried about a potential capital flight via the FX channel, but Chinese banks have been burnt by risky investment products in the past. Last year, Bank of China’s clients suffered losses in a crude oil-linked product after a slide in oil prices.

Last month, Reuters reported that Chinese regulators have been tightening control over the country’s currency market. In response, one of the more remarkable developments was that Chinese brokers had dropped currency forecasts to avoid angering regulators!

“Brokerages in China have dropped detailed currency forecasts from their research notes, or have restricted access to them, underlining the growing sensitivity in the financial sector to a regulatory clampdown on speculative investment. Their disappearance follows pressure to avoid stockmarket forecasts as well as a ban by authorities on publishing commodity prices, amid a series of sprawling crackdowns that are re-shaping China's economy and upending financial markets….analysis of months of notes from four brokers in China shows once-detailed forecasts for the Chinese currency against the dollar have now vanished or grown fuzzy, with precise predictions replaced by ranges or vague statements.

Reuters also noted that “It also comes at a delicate moment for the yuan, which China has sought to promote as a global reserve currency but which is tightly managed by the central bank and has been stubbornly firm recently despite a broadly strong dollar. The market effect of publishing only generalized forecasts is unclear, particularly as foreign institutions continue to offer precise ones.” Also, Chinese clients can apparently access FX projections *privately*. Yet are those two gaps - foreign/domestic, private/public - to remain or close, and if so in which direction?

In other words, first price forecasts are banned, then retail trading, soon all institutional exposure to FX and commodities will be taboo too, leaving companies unable to hedge exposure and really setting of a chain of dominoes that will end with catastrophic consequences after the next violent move in the underlying securities where cross-asset hedges used to provide at least some protection from sharp drawdowns for highly levered positions.

And as an aside, if China's ongoing crackdown forces (highly) levered institutional funds to unwind some or all of their exposure, then watch out below.

By Zerohedge.com

More Top Reads from Oilprice.com:

- A Very Predictable Global Energy Crisis

- The Real Reason OPEC+ Refused To Boost Production Further

- WTI Oil Price Breaks $80 For The First Time Since 2014