With steel and aluminum tariffs only a week away, should we fear the trade war reaper and economic decline, or is this all much ado about nothing? It depends who you ask: Economists are as polarized as their political counterparts on the issue.

Making good on a campaign promise to deal with “unfair” global trade deals, Trump recently signed two proclamations imposing a 25-percent tariff on imported steel and a 10-percent tariff on imported aluminum as a “matter of domestic and economic security”.

The tariffs will take effect on 23 March, but Canada and Mexico have been exempted as long as they play nice over NAFTA.

The president said that it was necessary to take action against nations that have been dumping cheap steel and aluminum in the American market. This will ostensibly reduce foreign competition and make it sensible for companies to buy American-made steel and aluminum, thus protecting local industries and jobs.

The Organisation for Economic Co-operation (OECD)--the west’s leading economic think tank--has warned that Trump’s tariffs will likely to escalate to a tit-for-tat trade war that could derail ongoing global economic recovery, which has reached its highest level in seven years.

OECD acting chief economist Alvaro Pereira is calling for an alternative to America’s excess steel problem. He thinks there is a collective solution that would safeguard rules-based international trading.

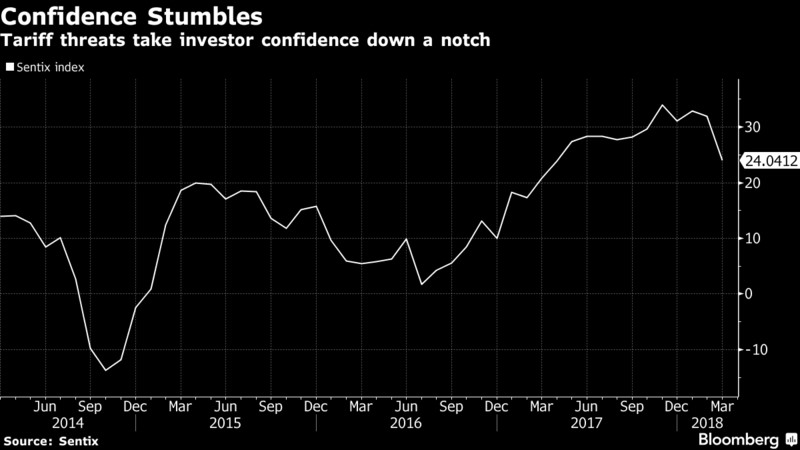

The negative sentiments have been reverberating across the markets too, with investor confidence in the euro-area slipping to its nadir in almost a year:

(Click to enlarge)

Source: Bloomberg

Even without a trade war, some fear that the effect of higher production costs across a number of strategic industries will have a detrimental effect on the economy, and accomplish exactly the reverse for jobs. Related: Heavy Sweet Crude Is Heading For A Supply Crisis

Trump, of course, disagrees with the mounting criticism of economists. From the president’s perspective, it’s all very simple, and tweetable:

''When a country (USA) is losing many billions of dollars on trade with virtually every country it does business with, trade wars are good, and easy to win. Example, when we are down $100 billion with a certain country and they get cute, don’t trade anymore-we win big. It’s easy!''

He’s not alone. Some experts agree with the tariff move.

While acknowledging that trade wars are bad, a majority of economists polled by Bloomberg expect the steel and aluminum tariffs to have minimal impact on the economy.

The economists expect the tariffs to result in a small decrease in U.S. jobs, a minor increase in inflation and a negligible impact on economic growth.

But not everyone’s so sure, and history is full of lessons that could have been learned.

America's last trade war is roundly blamed for greatly exacerbating the Great Depression. The Smoot-Hawley Act of 1930 was originally meant to protect farmers, but quickly degenerated into a tool for lawmakers to slap taxes and tariffs on all manner of good in exchange for votes. Several countries, including Canada, hit back with their own retaliatory tariffs leading to a jaw-dropping 40% drop in U.S. exports in just two years.

The biggest tariffs imposed on a U.S. government happened in 2009 when then-president Barack Obama implemented tariffs on Chinese tire imports in a bid to protect local industries.

The Peterson Institute for International Economics, however, later found that the tariffs saved 1,200 tire jobs but led to the loss of 3,700 retail jobs thus clearly indicating how tariffs can protect jobs in some industries but inadvertently lead to bigger job losses in other sectors.

Related: UK Looks To Ditch Russian Gas After Spy Scandal

The winners and losers—on a national level—are lining up on the respective sides of the fence as the tariffs near their imposition day.

Chief among the alarm-sounders is the oil and gas industry, which has seen better times. The industry fears the tariffs will make it prohibitively expensive to build drilling equipment, pipelines and refineries. Why? Because they need a special type of steel that can’t be found domestically.

From the oil and gas industry’s perspective, the tariff plan is a “job-killing” one that flies directly in the face of America’s goals of energy independence.

The auto and aerospace industries, along with manufacturing and construction industries are also staunchly against the tariffs—and all expect to see unsustainable increases in production costs.

As economists stand their ground on either side of the tariff divide, whether beneficial to the U.S. economy or not won’t become clear for some time.

By Charles Benavidez for Safehaven.com

More Top Reads From Oilprice.com:

- The Truth About Aramco’s $2 Trillion Valuation

- Canada Is Facing A Heavy Crude Crisis

- Bearish News Fails To Subdue Oil Prices