We’ve all heard about campaigns urging institutions, wealthy individuals, and world leaders to divest from fossil fuels. On the surface, it makes a lot of sense: in order to keep global temperatures from rising more than 1.5 degrees Celsius over pre-industrial averages, which scientific consensus has demarcated as a necessary threshold to avoid the worst effects of catastrophic climate change, somewhere between two-thirds and four-fifths of the Earth's remaining fossil fuels must remain in the ground. While the act of divestment and the reasons behind it seem simple enough, however, the reality--as always--is more complicated. First of all, divestment campaigns are generally based on a two-pronged set of reasoning: moral and financial responsibility. But the reality is that divestment alone is not going to successfully defund the fossil fuels industry.

One of the pitfalls of divestment campaigns is that when morally and environmentally conscious investors decide to sell off their shares in a company that is ethically dubious, there will always be another investor with no ethical hangups and an eye for opportunism to step in and buy up those shares at a discount. In fact, these “sin-vestors” are fantastically successful. One such opportunistic “sin stock” fund, the Barrier Fund (formerly known as the Vice Fund) “has beaten the S. & P. 500 by an average of nearly two percentage points per year since 2002” according to a 2015 report by the New Yorker. In fact, for this reason, divestment not only stands to potentially make no economic impact on the company it’s targeting, but could even wind up doing more damage than good. “By divesting from unethical companies, ‘ethical’ investors may effectively transfer money to opportunists like the Barrier Fund, who will likely spend it less responsibly than their ‘ethical’ counterparts.”

Related: Oil Rig Count Ends Twelve Week Streak Of Gains As Oil Prices Slip

While piecemeal divestment may not work, however, at a large enough scale it can make a genuine financial impact. Royal Dutch Shell Plc, for example, ruminated in its 2017 annual report that divestment “could have a material adverse effect on the price of our securities and our ability to access equity capital markets.”

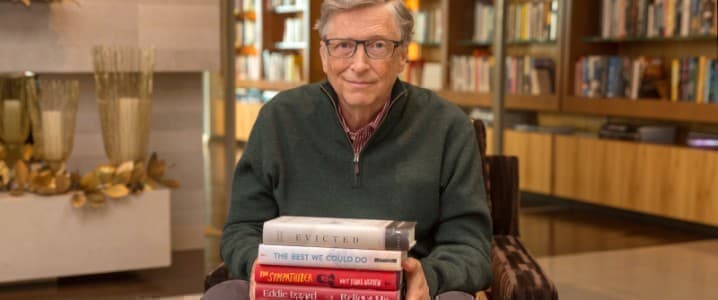

And while the financial aspect of divestment is not as cut-and-dry as it may initially seem, the moral aspect is pretty black and white. That’s what finally got Bill Gates, the third richest man in the world, to pull his money out of fossil fuels in 2019. “I don’t want to profit if their stocks prices go up because we don’t develop zero-carbon alternatives,” he writes. “I’d feel bad if I benefited from a delay in getting to zero [emissions],” Gates wrote in his new book, How to Avoid a Climate Disaster.

While on the surface Gates’ own moral dilemmas may not seem as impactful as targeting a fossil fuel extraction company’s funding, this kind of ethical debate is actually the biggest potential victory for a divestment campaign. Divestment may not be able to sharply decrease a company’s stock price, but it can harshly damage a company’s public perception and create lasting social stigma that can and will make a difference in that company’s conduct.

So yes, divestment, especially when paired with other climate-conscious initiatives and ESG investing, is worthwhile. Unfortunately, it’s not so easy to do. “Divestment isn’t a straightforward process,” Bloomberg Green reports. “That’s why activists calling on large institutions and rich people to stop supporting fossil fuels tend to allow up to five years for full extrication from carbon-heavy industries.”

Gates’ divestment experience is a perfect example of the sticky business of extracting oneself from fossil fuels when the economy itself is still predominantly carbon-based. While Gates was able to sell off most his direct oil and gas holdings with relative ease, at the end of 2019 the Gates Foundation (a separate entity from Gates’ own $137 billion of private wealth) still had about $1.2 billion of its total $40 billion endowment tied up in funds that may indirectly hold some stocks in fossil-fuel companies, and over $100 million still directly invested in oil and gas stocks and bonds, including Exxon Mobil Corp., Chevron Corp. and BP Plc. What’s more, Gates still has significant investments in extremely carbon-intensive sectors such as Signature Aviation Plc, the single-biggest operator of private-jet bases on Earth.

But while Bill Gates illustrates how difficult, complex, and slow divestment can be, he also exemplifies its potential benefits. When a man with as much of a public profile and respected financial scruples as Gates makes headlines highlighting the importance of furthering clean energy innovations and keeping fossil fuels in the ground, the world listens.

By Haley Zaremba for Oilprice.com

More Top Reads From Oilprice.com:

- Is This Oil Rally The Start Of Something Much Bigger?

- Texas Winter Storm Highlights The Importance Of Fossil Fuels

- What The Media Isn’t Telling You About Texas Blackouts

Even Michael Shellenbeger, the prominent climate activist who was nicknamed by Time magazine as ‘Hero of the Environment’ found himself forced to apologize on behalf of the environmentalists for the climate alarmism they had propagated over the past three decades and also for misleading the public about the imminent existential threat of climate change. Whilst admitting that climate change is happening, he said it’s just not the end of the world. It’s not even our most serious environmental problem.

Let us hope that other environmental activists and divestment campaigners will learn a lesson from Michael Shellenberger and stop pressurizing the global oil industry and everyone else to divest of their oil and gas assets when this would cause considerable damage to the global economy and to the livelihood of millions of people.

Take for instance the case of London Heathrow airport. This international airport directly employs 75,000 people and supports another 230,000 jobs and also contributes 10% to the United Kingdom’s GDP. It is one of the most important contributors to the British economy. It badly needs a third runway so as to expand its aviation activities which promise to enhance its contribution to the British economy. And yet, excessive and militant pressure from environmental activists have so far thwarted every attempt by the government to add a third runway. This is a case when militancy and dogmatism prevailed.

The greatest service the global oil industry can contribute to the environment is to reduce emissions in its production of oil and gas rather than divesting itself of the assets that have sustained it for decades.

Bill Gates is a great philanthropists helping people of many poor countries around the world. Rather than wasting his time about divesting his oil and gas assets, he and other billionaires could put part of their wealth to a better and more immediate cause by providing anti-COVID vaccines to poor countries who can’t afford them rather than worry about climate change issues that may or may not happen hundred years from now.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London