Cryptocurrency mining has frequently been lambasted for being an energy-intensive process. Four years ago, Nature Climate Change warned that Bitcoin mining alone could push global warming over the 2ºC catastrophic threshold in just 14 years if adoption rates matched those by other broadly used technologies.

And now the world’s second-largest cryptocurrency, ethereum, is about to make a radical technological shift that will cut its carbon footprint by 99%. Ethereum is ditching the 'proof of work' model utilized in the mining process of most cryptocurrencies including bitcoin for a new one called 'proof of stake.'

This is how the ethereum team describes the radical makeover:

Proof-of-stake (PoS) is the consensus mechanism that Ethereum will use after The Merge. Ethereum is moving off of proof-of-work (PoW) to proof-of-stake because it is more secure, less energy-intensive, and better for implementing new scaling solutions. While it has always been the plan to transition to proof-of-stake, it is also more complex than proof-of-work, and refining the mechanism has taken years of research and development. The challenge now is to implement proof-of-stake on Ethereum Mainnet. This process is called "The Merge"

Let’s have a look at the crypto mining process to get an idea what the ethereum camp is talking about.

Crypto Mining 101

For some crypto buffs, critics who squawk at the vast amounts of energy supposedly consumed by crypto mining and how it contributes to climate change are little more than churlish, pedantic party poopers.

In one camp are the PoW (Proof-of-Work) maximalists who argue that bitcoin and ethereum are the “most secure public chains” as measured by hashrate, but denying that bitcoin is an energy hog.

In the other camp are crypto apologists (such as CoinShare) who concede that crypto mining are indeed power-hungry processes, but immediately go on the defensive by claiming that most of the energy is derived from renewable sources.

The carbon footprint by crypto mining is all about how much electricity miners consume when trying to solve those arcane computational problems.

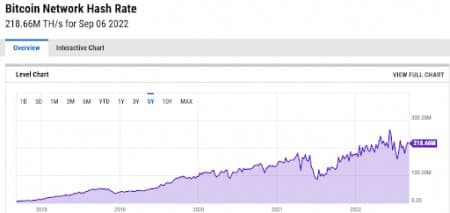

The bad news: bitcoin and ethereum hash rates have increased exponentially over the past few years, with the bitcoin network now claiming 218.66M TH/s while ethereum’s is lower at 918.79 TH/s

Source: Y-Charts

By necessity, the most secure cryptographic networks such as bitcoin and ethereum are also the most energy intensive since they rely on heavy resource consumption to defend their networks from malicious attackers. PoW projects, like bitcoin, rely on mining to secure their blockchains and require the hashing power to continue even after every coin has been mined. Less resource-intensive networks do not employ such rigorous processes and are, consequently, almost certainly less secure.

Mineable coins belong to the PoW category, of which CoinMarketCap lists several hundreds. These are the main culprits as far as energy guzzling is concerned. Non-mineable coins such as Ripple, EOS, Stellar, Tezos, NEO and NEM are more energy efficient as they don’t require tons of energy to validate transactions and secure the network as their PoW brethren.

And now to the million-dollar question: how much energy do bitcoin and ethereum mining suck off our power grids every year?

Available data varies quite a bit depending on whom you ask, and is, quite frankly, all over the place.

Digiconomist uses the portion of mining revenues spent on electricity costs to estimate power consumption. Using this method, the organization estimates that bitcoin mining consumes 128.61 TWh per year, comparable to the annual power consumption of the United Arab Emirates, Argentina, Sweden, Norway and Ukraine. The Cambridge Bitcoin Electricity Consumption Index estimates bitcoin power demand at 10.76 GW, which works out to 94.26 TWh per year. For context, global electricity consumption is ~23,800 TWh per year.

Interestingly, ethereum’s power consumption is not far off bitcoin’s, with Digiconomist placing it at 79.79 TWh per year. It’s also worth noting that ethereum’s power consumption has increased nearly 10-fold over the past five years.

It’s possible to estimate the energy consumption of other altcoins by checking out their hash rates and making assumptions about the type of mining rigs deployed and their respective efficiencies. However, those figures could be wildly off the mark. As very rough back-of-napkin math, it’s logical to estimate that bitcoin and ethereum mining account for ~60% of crypto mining energy, with other cryptos sharing the rest. That would place total energy by cryptocurrency mining at ~350TWh/year, or 1.5% of global electricity consumption. Regarding CoinShare’s bold claim that the bitcoin network sources nearly three quarters of its energy from renewable sources, the actual figure is closer to 30%.

The long and short of it: bitcoin and crypto mining are definitely playing a significant part in global warming, and ethereum’s shift to a Proof-of-stake (PoS) model that will only consume 1% of the electricity consumed by PoW model makes plenty of sense. It’s also likely to put other cryptocurrencies including bitcoin under a lot of pressure to follow suit. Indeed, this pressure has already begun: last year, Tesla founder Elon Musk announced his company would no longer accept bitcoin payment for its electric cars, due to the currency's large carbon footprint.

By Alex Kimani for Oilprice.com

More Top Reads From Oilprice.com:

- OPEC+ Cuts Production Despite Resistance From Russia

- Can OPEC+ Keep Oil Prices Above $90?

- Putin Threatens Complete Energy Cut Off To West If Price Caps Are Imposed