Sales of certain diesel models are in free-fall as Norwegians turn to Tesla and other makers of premium electric vehicles (EV), Rystad Energy finds.

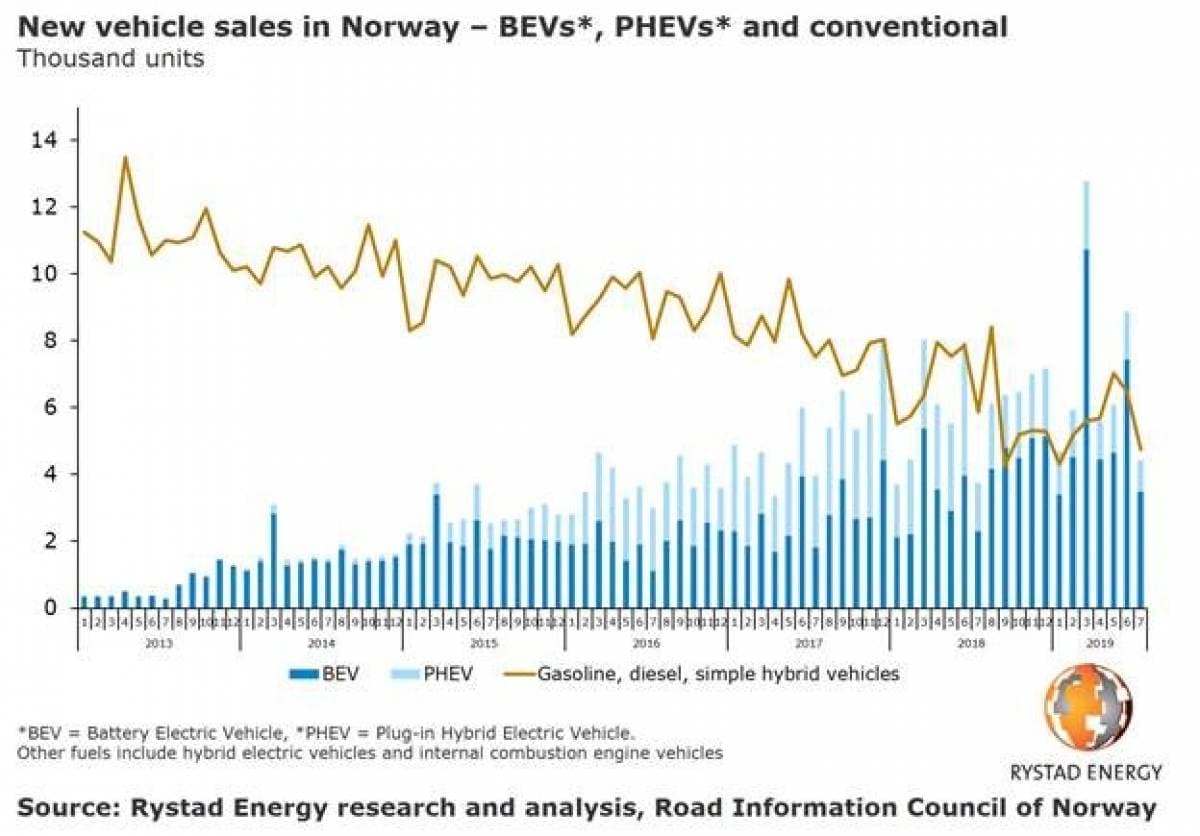

Norway is leading the global shift towards private EV transportation, with the highest EV ownership per capita in the world. More than one in two new cars sold in country this year run fully or partially on electricity.

The biggest loser so far? The premium diesel car.

According to Rystad Energy, the independent energy research firm, sales of some diesel car models are down more than 95% over the last six years.

For instance, Volvo’s top diesel models – the V40, V70 and XC60 – dropped from close to 9,000 units sold in 2013 to around 400 in the first half of 2019.

On average, the market share of diesel and gasoline vehicles stood at 60% and 29%, respectively, in 2013, but fell to just 32% and 17% in the first half of 2019.

“This adoption of electric vehicles has resulted in a dramatic decrease of traditional gasoline and diesel vehicle sales, with the steepest decline seen in the diesel segment,” says Artyom Tchen, senior analyst on Rystad Energy’s oil markets team. “High-range battery electric cars have reduced the sales of high-end diesel vehicles, primarily SUVs and sedans, which are also the most energy-consuming private vehicles on the market.” Related: China’s Ultimate Play For Global Oil Market Control

These sales trends have resulted in a modest yet continuous year-on-year drop in transportation consumption of diesel and gasoline in the country, dropping an average of 2% every quarter since the beginning of 2018.

“Diesel demand in the country is especially at risk as the adoption of fully electric vehicles continues, displacing traditional vehicle sales,” Tchen added. “But surprisingly, this quick adoption has resulted in only a modest decrease in gasoline and diesel consumption in the transportation sector. The link between higher EV penetration and transportation fuel oil demand is not significantly correlated in Norway just yet.”

In the first half of 2019, electric vehicle sales in Norway expanded to 55% of total personal vehicle sales, a market which hovers around 150,000 units sold per year. This is a huge leap forward from a market share of only 6% in 2013 and a healthy increase from 49% last year. As in years past, the main factors behind this increase are a handful of consumer benefits offered with the purchase of an electric vehicle, including generous tax reductions.

As for the steep decline for new diesel vehicles, two factors are at play. A high proportion of vehicles sold have traditionally been mid- and high-end diesel models which would naturally take the biggest hit in terms of market share. Secondly, sales reductions of new diesel vehicles are tied closely to consumer fears concerning potential restrictions or even a ban against diesel vehicles in the country. Gasoline vehicle sales suffer relatively less, and declines there are spread across both high-end and mid to low-end segments. Sales of plug-in hybrids have also decreased steeply, with Norwegians preferring fully electric vehicles.

More Top Reads From Oilprice.com:

- The Fastest Growing Energy Producer In The World

- Gas Flaring “Running Rampant” In The Permian

- China Prepares Its “Nuclear Option” In Trade War

It's becoming much harder to simply dismiss EVs as an immaterial driver of demand erosion.