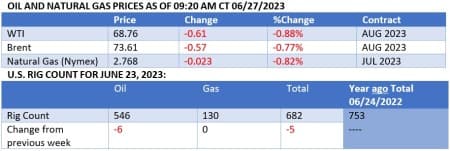

Oil prices fell on Tuesday morning as markets continued to focus on sluggish U.S. demand despite geopolitical uncertainty in Russia and promises of more robust economic stimulus measures from China.

Chart of the Week

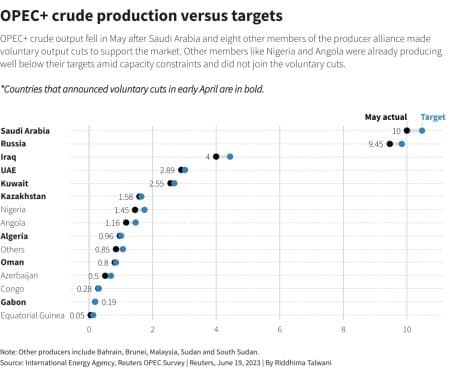

- The review of OPEC+ production quotas at the oil group’s Vienna meeting earlier this month will consolidate the control of Middle Eastern powerhouses, to the detriment of African countries that have struggled to maintain output.

- The five largest oil producers of OPEC+ (Saudi Arabia, Russia, Iraq, UAE, and Kuwait) all have major state-owned oil firms, implying that investments into new projects will not be an issue, but Nigeria and Angola rely on Western majors for know-how and their lowered production target might decrease their investment appeal.

- Capacity additions from Saudi Arabia, the UAE, and Kuwait over the 2020-2025 period will amount to 1.2 million b/d, double the capacity that Nigeria and Angola are expected to lose over the same period.

- Angola’s production capacity has dropped to 1.1 million b/d this year whilst Nigeria’s is at 1.5 million b/d, with African members now accounting for a mere 10% of OPEC+ production capacity.

Market Movers

- Saudi national oil company Saudi Aramco (TADAWUL:2222) and France’s TotalEnergies (NYSE:TTE) have signed an $11 billion deal to build a new petrochemicals complex at the Satorp site in Jubail.

- US LNG developer Venture Global LNG signed a 20-year supply deal with Germany’s SEFE for the delivery of 2.25 million tonnes of LNG per year, making it the largest LNG supplier to Germany.

- The Nigerian operations of UK-based energy major Shell (LON:SHEL) are getting ever more cumbersome, with Nigerian authorities now investigating a recent oil spill on the Trans Niger pipeline.

Tuesday, June 27, 2023

The Wagner group's attempted mutiny in Russia this weekend grabbed plenty of media attention, but it has had a very limited impact on oil prices. Similarly, prices have failed to register the Tianjin speech of Chinese Premier Li Qiang, promising more robust stimulus measures from Beijing. Instead, markets have been focused on sluggish US demand, with WTI having switched into contango in its prompt months. Despite a slight US stock draw expected this week, demand in the country looks weaker than a month or two ago.

Saudi Arabia Still Hopes for Strong H2. Saudi Aramco CEO Amin Nasser stated that oil market fundamentals remain „sound” for the second half of 2023 and that demand strength in China and India will overpower the recession risks in developed markets, seeking to placate recessionary fears.

Malaysian Production to Peak in 2024. Petronas, the national energy company of Malaysia, expects its domestic oil and gas production to peak at 2 mboepd by 2024 all the while keeping it 60-70% weighted towards gas, indicating the country will need to buy more LNG from 2025 onwards.

For the First Time Ever, Europe Imports More LNG than Pipeline. Europe imported 170 billion cubic meters of LNG in 2022, up 57% year-on-year and marking the first time in history when liquefied imports surpassed pipeline deliveries, depressed by drastically reduced Russian gas supplies.

Canada Wildfires Emit Record Volumes of Carbon. According to the EU’s Copernicus climate monitoring service, Canadian wildfires have released a record 160 million tonnes of carbon this year, equivalent to Indonesia’s emissions from burning fossil fuels, and the fires are still not over.

Bad News Coming for Canada’s Offshore. After Equinor (NYSE:EQNR) delayed its key Bay du Nord project in offshore Canada, the country’s offshore exploration drive suffered another blow as BP’s (NYSE:BP) Ephesus exploration well, targeting a multibillion-barrel-play offshore Newfoundland, seems to have come up dry.

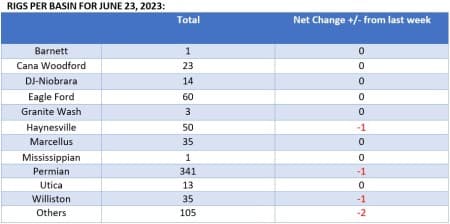

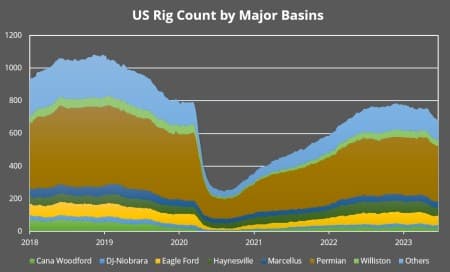

US Oilfield Activity Keeps on Slowing. The most recent oilfield activity survey conducted by the Federal Reserve Bank of Dallas shows that the index fell to zero in Q2 from 2.1 in the previous quarter, with oil executives reporting rising costs for a 10th consecutive quarter.

Libya Might Collapse Again. The alternative government in eastern Libya has threatened to blockade oil exports again, following 11 months of orderly coexistence, accusing the Tripoli government of wasting billions of oil revenue dollars that are channeled through the national oil company NOC.

Nigeria Owes Billions to Oil Traders. As Nigeria’s new government scrapped the country’s crude-for-products swap deals, it turns out the African country accumulated some $3 billion in debts to trading companies such as Vitol or BP and is 4-6 months behind schedule in repaying them with crude.

Netherlands Seals the Fate of Its Giant Gas Field. The government of the Netherlands has finalized its decision to shut down the Groningen field, jointly operated by Shell (LON:SHEL) and ExxonMobil (NYSE:XOM) and still holding billions of cubic meters in untapped reserves, due to tremors related to drilling.

EU Bans No-Notice STS Transfers. In its upcoming 11th sanctions package levied against Russia, the European Union will bar tankers that have failed to give a 48-hour warning of ship-to-ship transfers happening in European maritime space from entering ports across the political bloc.

Wind Energy Major Crumbles as Design Flaws Mar Outlook. Siemens Energy (ETR:ENR), one of the world’s largest wind turbine producers, has seen its market value almost halve since reports emerged that 15-30% of its turbines are exposed to design flaws in rotor blades and bearings that would take years to replace.

US LNG Gains Further Traction in China. US LNG developer Cheniere Energy (NYSEAMERICAN:LNG) signed a 20-year supply deal with China’s ENN Natural Gas (SHA:600803), starting from mid-2026 and reaching 0.9 mtpa in 2027, marking the third such deal in 2023 alone.

Key Russian Gas Field Paralyzed After Mass Fighting. Gazprom’s Kovykta field, a key element in the Power of Siberia pipeline that sends Russian gas to China since its launch in December 2022, has been debilitated after a mass fight of more than 500 migrant workers from Central Asia.

By Michael Kern for Oilprice.com

More Top Reads From Oilprice.com:

- Where Are Oil Prices Going? It's Complicated

- Energy Regulator Claims Canadian Oil Production Will Plunge 76% By 2050

- Mass Fighting Breaks Out At Giant Russian Gas Field

Global oil demand and the fundamentals of the global oil market are robust and led by China’s economy and the Asia-Pacific region which is the vibrant half of the global economy accounting for 51% of global GDP with the fastest economic growth and the lowest inflation rates.

Western disinformation tried unsuccessfully to pin the blame on China for the weakness in oil prices but when this failed, it changed its tack to blame concerns about global demand.

Still, this has nothing whatsoever to do with China’s economy or global demand or market fundamentals and everything to do with the United States shaky banking system amid fears that further hikes by the US Federal Bank could cause a collapse of one or two more US commercial banks thus triggering a global banking or financial crisis reminiscent of the 2008 subprime financial crisis.

Dr Mamdouh G Salameh

International Oil Economist

Global Energy Expert

There is a lot of ridiculous chatter about the US Federal Reserve engineering a "soft landing" as well which is not bullish for the entire commodity complex but especially true for those bullish on "the goo."