Delta Air Lines Inc. delivered a profit in the third quarter but warned soaring jet fuel prices might result in an unprofitable fourth quarter.

Since August, spot prices for New York Harbor Jet Fuel have risen 37%. Delta expects fuel prices between $2.25 and $2.40 a gallon in the quarter, up from $1.94 in the third.

Fuel costs accounted for 20% of Delta's adjusted operating expenses in the third quarter. Soaring costs are "going to be a limiter on our ability to post a profit in the quarter. At these current fuel levels, it looks like we'll have a modest loss," CEO Ed Bastian said.

Delta expects to carry over the robust travel demand from summer through the fall/winter season as more people are vaccinated and travel continues to open up worldwide. He said business "wasn't derailed by the COVID variant."

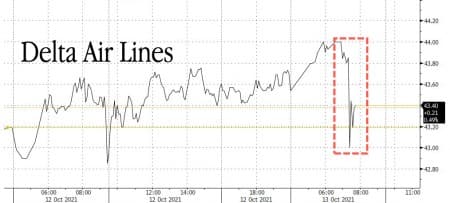

Shares of the carrier stumbled to $43.40 in the premarket.

Bastian said bookings have increased in the past month, and corporate travel is booming, hitting a fresh pandemic high. He said domestic business travel had recovered about half, adding that overall travel could continue to rise as travel bans are removed.

In the past, airlines have been able to pass through higher costs to consumers, but that remains a question for Delta this quarter as consumers become more price sensitive. "In the short term, that's our biggest inflationary pressure," Bastian said.

Citi analyst Stephen Trent said in a pre-earnings note: "Going into 2022, investors seem likely to ponder the pace of the demand recovery, especially on the Trans-Atlantic corridor, balanced against recent crude oil price pressure."

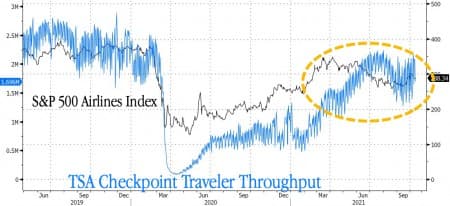

As for airline stocks as a whole, they have yet to surpass pre-pandemic levels and have stumbled lately as TSA Checkpoint Numbers Total Traveler Throughput has sagged since August.

It seems that Bastian is questioning the Federal Reserve's "transitory" narrative as soaring energy costs begin to drag on profits.

By Zerohedge.com

More Top Reads From Oilprice.com:

- Will The U.S. Be Spared From The Global Energy Crisis?

- Canada’s Oil Stocks Are Trading At Bargain Basement Prices

- This Key Indicator Is Pointing To Higher Oil Prices