Energy independence is an important precondition for any country which allows for relatively unbound foreign and economic policies. China’s growing reliance on imports concerning fossil fuels is a major headache for Beijing. Therefore, increasing domestic production is high on the agenda. Despite some successes in exploration and production activities, import reliance is expected to rise over the next couple of years. Beijing has instructed its three domestic energy champions PetroChina, CNOOC, and Sinopec, to increase spending on domestic resources. In the next five years, these companies have vowed to invest 517 billion yuan ($77 billion), which is a growth of 18 percent year-on-year.

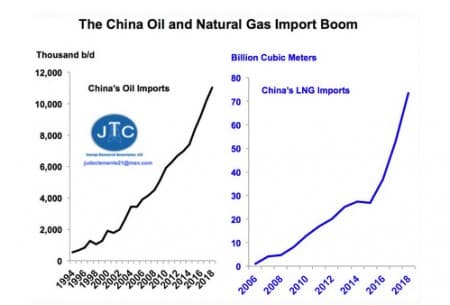

These investments have already achieved reversing falling domestic oil production. According to the U.S. Energy Information Administration (EIA), the production of petroleum and other liquids in China has increased to 4.9 million barrels per day (mbpd). Despite the increase, foreign oil dependency has reached 70 percent and the number is expected to grow.

Announcements of the discovery of new oil and gas fields are not a rare occasion in China these days. According to media group Netease, some 200 million tonnes (around 1.5 billion barrels) of oil and 300 million tonnes of gas have been discovered in November only.

CNOOC has started using China's first domestically designed and produced self-operated large-scale deepwater rig and the world's largest oil and gas storage platform on the coast of Hainan. The company also made a significant discovery in the shallow waters of the Pearl River Mouth Basin. Due to growing investments, the Chinese energy sector is hitting new records this year.

Despite these successes, the industry is facing an uphill battle due to insatiable domestic demand for oil. Stellar economic growth has led to a booming market for energy, but the level of reliance on fossil fuels is different. Dependence on coal is limited due to significant domestic production and gas has a moderate share in the national energy mix. Oil, however, is the biggest challenge.

Although the share of natural gas in the energy mix is relatively moderate at the moment, major growth is expected. Primarily a policy shift in Beijing is the lead cause behind rising demand. Rising levels of income and energy consumption have created rampant air pollution in most parts of China. Also, many households still use coal for heating purposes. The Chinese coal-to-gas policy is intended to gradually shift towards cleaner natural gas.

Due to rising demand, natural gas will make up approximately 10 percent of the energy mix by the end of this year. This will increase to at least 15 percent by 2030. The Chinese energy market has been reformed to lower the threshold for foreign and smaller companies to enter the market. First, rules have been changed such as the requirement of the participation of a Chinese company in business endeavors. Second, ownership of infrastructure and production activities have been decoupled meaning producers cannot own infrastructure to prevent discrimination of competitors.

Related: Large Oil Trader Trafigura Books Strongest Trading Year Ever

Despite these reforms and growing domestic production, the Chinese market is increasingly dependent on imports. The origin of almost 50 percent of the gas in China in 2019 can be traced abroad, which is imported through pipelines and shipped as LNG.

Over the years, Chinese companies have invested significantly in LNG regasification capacity. Currently, Japan is the largest importer of LNG in the world. The seemingly insatiable appetite for energy in China will make it the biggest import before 2022. Also, Beijing is exploring the possibility of a second gas pipeline from Russia while the first Power of Siberia just started operations.

While the world is still focused on defeating Covid-19, the Chinese economy has returned to growth. During the past year, the Asian giant's market was one of the few bright spots of the global energy market. According to Reuters, the Chinese economy is expected to expand by 2.1 percent in 2020 and bounce to 8.4 percent in 2021. This means that dependence will remain a serious problem for the Chinese leadership in the foreseeable future.

By Vanand Meliksetian for Oilprice.com

More Top Reads From Oilprice.com:

- Oil Wells On Fire After Attack On Iraqi Oilfield

- Oil Market Hopeful As Vaccinations Begin

- Finding A Way Around The World's Largest Oil Chokepoint

Despite the very destructive COVID-19 pandemic, China’s economy not only reversed a decline of 7% in GDP during the first half of 2020, but is projected to end 2020 having grown by 2.1% and is expected to bounce to 8.4% in 2021 compared with 6.1% in 2019.

Two quintessential objectives occupy China’s strategic thinking. The first is securing its oil and energy needs peacefully. The second is ensuring its energy security. These objectives have a huge impact on China’s energy policy and also its foreign policy.

The growing dependence on oil and gas imports has created an increasing sense of ‘energy insecurity’ among Chinese leaders who tend to believe that dependence on imported oil and gas leads to great ‘strategic vulnerability’.

Oil, however, is the biggest challenge. China’s dependence on oil and gas imports has been phenomenal. In 2020 crude oil imports accounted for 77% of its consumption and this is projected to rise to 87% by 2030.

China has sought to do so through three initiatives. One is increasing domestic energy production. Another is its ‘Strings of Pearls’ (SOP) policy which aims to defend the shipping lanes that are vital to its oil lifeline, namely the Straits of Hormuz and Malacca. A third measure is the diversification of its oil and energy import sources. This manifested itself in China’s growing investments in both Iraq and Iran.

That is why China has announced a week ago the lifting of restrictions on foreign investments in all energy sectors, including fossil fuels, new energy sources, and electricity generation excluding nuclear power in order to enhance exploration, increase domestic energy production and reduce dependence on imports.

China has also enhanced its oil and gas imports from Russia. Russia owns and runs oil and gas pipelines to China providing vast quantities of crude oil, natural gas as well as LNG. This helps China overcome issues of energy security related to crude oil shipments from the Gulf having to pass through the very critical chokepoints of the Straits of Hormuz and Malacca.

Moreover, China is now fully involved in the development of three of Iraq’s supergiant oilfields virtually giving it control of Iraq’s oil industry. In Iran, China now owns 80.1% stake in Phase 11 of Iran’s supergiant South Pars natural gasfield having acquired French oil giant Total's 50.1% share after the French company exited Iran in the aftermath of the re-imposition of US sanctions.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London