Authored by Simon White, Bloomberg macro strategist,

Powell might not be overly worried about inflation - with his recent comments reiterating the Federal Reserve is on track to cut rates this year - but other central banks are not so relaxed. Gold’s new high signals global central banks are likely accumulating the precious metal in an effort to diversify away from the dollar, as persistently large fiscal deficits threaten to further erode its real value and lead to more inflation.

Gold’s move in recent days has been broad as well as pronounced (as well as hinted at by low gold vol), with the precious metal making 50-year highs versus three-quarters of major DM and EM currencies. The biggest holdings of gold after jewellery are for private investment - ETFs, bars and coins - followed by central banks’ official reserve holdings.

In recent years the swing buyers have been ETFs, which hold about 2,500 tonnes of gold. But ETF holdings have been falling even as the dollar price of gold has been rising.

The dollar has been stable and real yields (which anyway have a non-linear relationship with gold) are higher over the last three months. The bulk of seasonal buying, for instance Diwali in India, is likely behind us. Further, silver has not participated in the rise. It’s therefore a reasonable supposition the official sector, i.e. central banks, has been a significant driver of gold’s recent ascent to new highs.

Related: How To Profit From Europe’s $800 Billion Energy Crisis

In the runup to the pandemic, and again in the aftermath of Russia’s invasion of Ukraine, global central banks have continued to add to their gold holdings even as ETF investors (perhaps dazzled by the bright lights of crypto) have reduced theirs.

Over the last six months, China, Germany and Turkey have increased their gold holdings by the most (these are official holdings - when it comes to China, its true holdings are likely much higher than stated).

Central banks want gold as it is a hard asset, not part of the financialized system when owned outright. But the dominant reason is a desire to diversify away from the dollar. If you’re not on friendly terms with the US, then it is a way to avoid your reserve assets being seized, as happened to Russia.

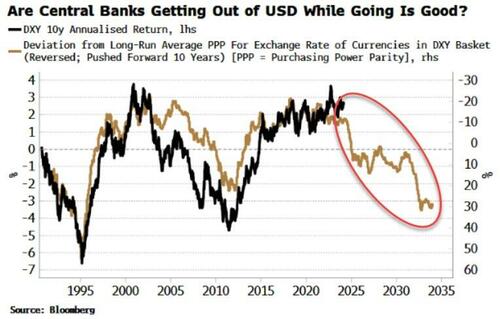

But central banks everywhere are quite possibly uneasy about owning too many dollars when the US is running large, inflation-causing fiscal deficits. The dollar is structurally overvalued on a purchasing-power-parity basis versus the main DM currencies. As the chart below shows, this points to dollar underperformance in the coming years.

Investors in gold ETFs may not see much risk from inflation and to the dollar, but central bankers are signaling very much the opposite.

By Zerohedge.com

More Top Reads From Oilprice.com:

- U.S. Seeks Semiconductor Supremacy with New Funding Initiatives

- Standard Chartered: OPEC’s Latest Move Is Bullish

- Turkmenistan Eyes Gas Export Breakthrough with Turkey