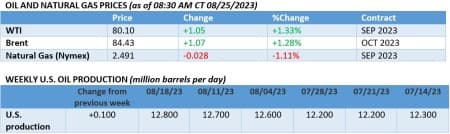

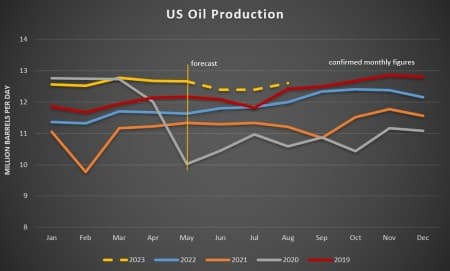

Oil prices are on track for a weekly loss due to the prospect of new oil flows entering the market, but bullish fundamentals are helping to stop any significant drop.

Friday, August 25, 2023

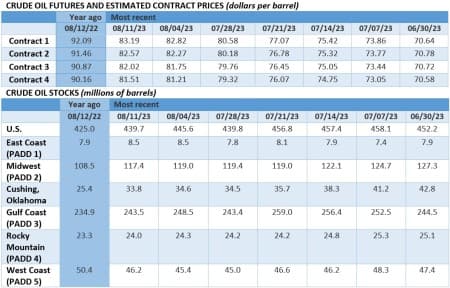

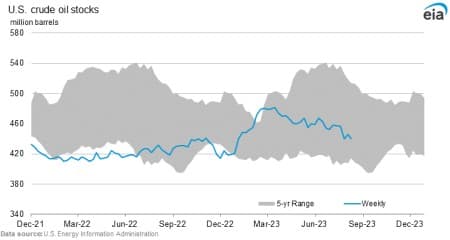

The prospect of Kurdish oil exports returning to the market and rumors of a US-Venezuela rapprochement have weighed heavily on oil prices this week, but healthy US crude inventory draws and lower-than-expected product stock levels in Europe have countered some of that downward pressure. Unless the US Federal Reserve’s Jackson Hole meeting today provides unexpected turns, oil is headed towards another, albeit very minor, weekly loss.

Chevron Unions Threaten Australia Strike Disruption. Whilst Woodside’s tentative deal with its offshore workers’ union alleviated fears of an LNG supply shock, Chevron’s (NYSE:CVX) union could move ahead with industrial action at the Gorgon and Wheatstone terminals after 99% of workers authorized a strike.

US Slaps Sanctions on Myanmar Jet Fuel. The US Treasury expanded sanctions against Myanmar to include any companies or individuals that help the Asian country procure jet fuel used in military raids by the junta, with the previous round of sanctions targeting Myanmar’s state-owned banks.

Fuel Subsidies Soar Above 7 Trillion, IMF Warns. According to new estimates from the International Monetary Fund, global subsidies for fossil fuels rose by $2 trillion over the past 2 years to surpass $7 trillion in 2022, with explicit government-paid subsidy costs accounting for less than 20% of those funds.

Panama Canal Cannot Handle the Drought. Panama Canal authorities expect that current restrictions on daily vessel transit, capping the number of tankers at 32 per day and restricting their deadweight, will remain for at least 10 months as a prolonged drought continues to decimate water levels in Panama.

Cheniere Signs a New LNG Deal with Germany. US LNG exporter Cheniere Energy (NYSEAMERICAN:LNG) signed a new term supply deal with Germany’s BASF (ETR:BAS) to provide it with 0.8 million tonnes of LNG per year starting mid-2026, the fourth such deal concluded in 2023 so far.

China Uses BRICS Meeting to Lock in Africa Deals. China concluded an array of power deals with South Africa on the sidelines of the BRICS summit in Johannesburg, seeking to help extend the lifespan of coal plants, build transformer and solar PV panel plants in the African country, and upgrade the Koeberg nuclear power station.

US Lease Sale 261 Defies Biden Phase-Out. Building on the success of the previous lease sale in March which saw 32 oil majors bid for tracts in the Gulf of Mexico, the US Bureau of Ocean Energy Management indicated it will hold the new lease sale in the GoM on 27 September, offering 12,395 blocks.

Shell’s Selling Its Singapore Refinery. According to media reports, UK-based energy major Shell (LON:SHEL) is considering the sale of its Singapore refining and petrochemical plants, tapping Goldman Sachs (NYSE:GS) to explore a potential sale with China’s Sinopec emerging as a prospective buyer.

Freight War Premiums Soar on Black Sea Trouble. Ukraine’s drone warfare and Russia’s missile attacks in the Black Sea ratcheted up war risk premiums in the region, with additional shipping charges soaring to $1 million as insurance companies demand higher fees from ship charterers due to higher risks.

Turkish Straits Navigation Suspended Amidst Fires. More than 150 vessels, including 23 tanker and 33 dry bulk vessels, have been halted at the northern and southern entrances of Turkey’s Dardanelles straits amidst raging wildfires in coastal regions, with northbound shipping resuming by late Thursday.

Indonesia Nickel Probe Sparks Rally. Prices of nickel ore in Indonesia soared by more than 10% in recent weeks above $160 per nickel unit as the country’s Attorney General Office launched an investigation into illegal mining and suspended operations at a key mine operated by state-owned Antam.

North Dakota Appeal Weakens As Bakken Matures. Canadian producer Crescent Point Energy (TSE:CPG) announced it had reached a deal to sell its Bakken assets to an unidentified private operator for 500 million, seeking to focus on its Canadian acreage in the Duvernay and Alberta Montney basins.

China Eyes Nuclear Buildout in Saudi Arabia. According to the WSJ, Saudi Arabia is in advanced talks with China’s state-owned nuclear company CNNC to build a nuclear plant in the Middle Eastern kingdom’s Eastern province, near the border with Qatar, upending US plans to do the same.

By Michael Kern for Oilprice.com

More Top Reads From Oilprice.com:

- Nigerian Military Destroys 8 Illegal Refining Sites In Niger Delta

- Tanker Suspected Of Carrying Iranian Oil Offloads Near Texas

- Money Manager Sees $120 Oil Surprising Bears

Prominent among the bullish factors is China’s economy growing at 6.3% during the first half of 2023 compared with 1.2% for the United States and 0.8% for the EU.

Moreover, the prospect of new oil flows entering the market soon from Venezuela, Iraqi Kurdistan and Iran are virtually nil and therefore they have no chance whatsoever of easing growing concerns about global supplies.

Based on the above, oil prices will resume their rally with Brent crude hitting $90 a barrel before the end of this year.

Dr Mamdouh G Salameh

International Oil Economist

Global Energy Expert