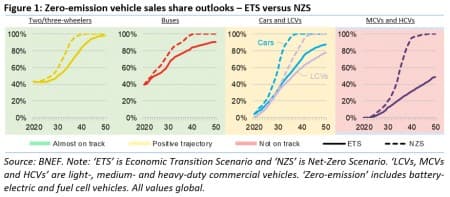

In its latest annual Electric Vehicle Outlook, BloombergNEF (BNEF) forecasts global sales of zero-emission cars rising from 4% of the market in 2020 to 70% by 2040. This, based on the firm’s Economic Transition Scenario – which assumes no additional policy measures.

According to the research provider, the equivalent for buses sees their zero-emission sales rise to 83% by 2040. In fact, buses – together with two/three-wheelers, which are heavily used in developing countries – are on track to hit net-zero emissions by 2050, just on the basis of established trends in relative economics.

Zero-emission light commercial vehicles, on the other hand, are expected to grow from 1% today to 60% of their market over the same time period, thus showing a positive trajectory, while medium and heavy commercial vehicles to just over 30%, from almost zero now.

In this year’s report, BNEF also added a Net Zero Scenario for the road transport sector. The scenario shows that zero-emission passenger cars, for instance, would have to hit almost 60% of sales in their segment globally by 2030, not 34% as they do in the Economic Transition Scenario – that’s 55 million EVs sold in that year, as opposed to 32 million.

In the view of the experts at BNEF, since 2030 is just around the corner and many governments have committed to achieving net-zero carbon emissions by 2050, policy will be needed very soon to make investments for a higher rate of EV penetration. According to their research, this is particularly true for countries that do not already have tightening vehicle CO2 emissions or fuel economy standards. Related: NNPC: Lack Of Investment Could Push Oil To $200

“Policymakers need to take urgent action in the heavy truck segment, which is far from being on course for net-zero,” Nikolas Soulopoulos, commercial transport team lead at BNEF, said in a media statement. “In addition to introducing tighter fuel economy or CO2 standards for trucks, governments may need to consider mandates for the decarbonization of fleets. They should also consider incentives to push freight into smaller trucks, which can electrify faster than larger ones.”

In economic terms, BNEF estimates that electric vehicles represent a $7 trillion global market opportunity between today and 2030, and $46 trillion between now and 2050, under the Economic Transition Scenario.

This also means that, by 2040, the charging network needs to grow to over 309 million chargers across all locations, under the same scenario.

According to Bloomberg NEF, home chargers alone would have to reach 270 million, public chargers 24 million, workplace chargers 12 million and bus and truck chargers 4 million. Installing all of these would require over $589 billion of cumulative investment in the next two decades.

What this means for battery metals

“Lithium-ion battery demand from EVs is set to rise sharply, from the current 269 gigawatt-hours in 2021 to 2.6 terawatt-hours per year by 2030 and 4.5TWh by 2035,” the report reads. “Demand under the Economic Transition Scenario for battery metals, such as lithium itself, cobalt, nickel and manganese, will also soar – the relative increases depending on the chemistries that are chosen. But supply of metals is projected to be adequate to meet that, although more investment will be needed, both in mining and refining.”

The firm points out that under the Net Zero Scenario, all the figures would have to be much larger. For chargers, $939 billion would be required in investment by 2040 to install 504 million units. For the electric vehicles themselves, the total market opportunity reaches $80 trillion cumulatively by 2050.

The NZS, however, would require large amounts of recycled battery metals because cumulative lithium demand would exceed currently known reserves by 2050.

“With universal battery recycling, however, not only does primary lithium demand remain below known reserves, but there is also the prospect of a fully circular battery industry, with the supply of recycled lithium exceeding total annual demand by mid-century,” the report reads.

For Bloomberg, achieving the net-zero emissions scenario by 2050 requires an immediate increase in policy action and investments in public transit and active mobility.

In this sense, the market researcher’s analyses have shown that at the municipal level, tighter regulations for vehicles entering urban areas are likely to help make the economics of zero-emission vehicles more attractive, especially for commercial fleet operators.

By Mining.com

More Top Reads From Oilprice.com:

In 2020 the global automotive motors market size amounted to $20.32 bn and is projected to grow to an estimated $33.30 bn by 2030. Also in 2020, 3 million EVs were sold at an estimated value of $210 million based on an average EV unit price of $70,000. The value of the EV sales in 2020 amounted to only 0.63% of the market.

Based on an average annual growth of 5.31%, the global car market in 2030 is estimated at $33.30 bn and not $7 trillion market as BNEF’s Economic Transition Scenario suggests. A 43% EV share of the market amounts to $14.32 bn which translate into sales of 205 million EVs, an impossibility particularly that EV sales amounted to only 3 million in 2020. This leads me to believe that BNEF Economic Transition Scenario is unrealistic.

There are currently 2 billion internal combustion engines (ICEs) on the roads worldwide compared with 10.9 million EVs or 0.55% of the total.

And yet, there is extraordinary hype about EVs by the media. But when Akio Toyoda, the President of Toyota, the world’s biggest car company, says there is too much hype surrounding EVs and also notes that the electricity needed to charge EVs would strain grids and increase carbon emissions, the world should listen attentively.

The ease of charging and also the availability of charging points are always on EV drivers’ minds particularly when they are embarking on a long journey of hundreds of miles. Therefore, it is not surprising that 18% of EV drivers and 20% of plug-in buyers in California are switching back to gasoline cars.

There will be a need for some 300 million charging points by 2040 needing estimated cumulative investment of over $589 billion in the next two decades.

This is one very major reason why EVs will never prevail over ICEs. The other is the need for global expansion of electricity generation costing trillions of dollars to be able to charge the supposedly millions of EVs that will be on the roads. How would this expansion be sourced: solar, nuclear or hydrocarbon?

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London

Start building millions of electric cars & trucks yearly, and watch what happens to the cobalt and nickel price. The price of lumber today should give you a clue.