Just a day after the Saudis allegedly threatened the hegemony of the almighty petrodollar, Saudi Aramco began the sale of its first-ever dollar bonds with an order-book of around $40 billion.

Ahead of the launch, Sergey Dergachev, sr. portfolio manager at Union Investment in Frankfurt said "It will be definitely a jumbo deal with at least four tranches,” said “Demand should be huge." He was right with six tranches now reportedly being marketed for an offering which is expected to be $10 billion but will likely be increased materially.

Demand for the most highly anticipated sale of the year totaled $30 billion as of Sunday night, Aramco Chairman and Saudi Energy Minister Khalid Al-Falih told Bloomberg TV early on Monday, but according to the latest Bloomberg report, it is already $40 billion and rising fast. Dergachev speculated that demand could even surpass the record $53 billion in bids that Qatar received for its $12 billion bond sale last year.

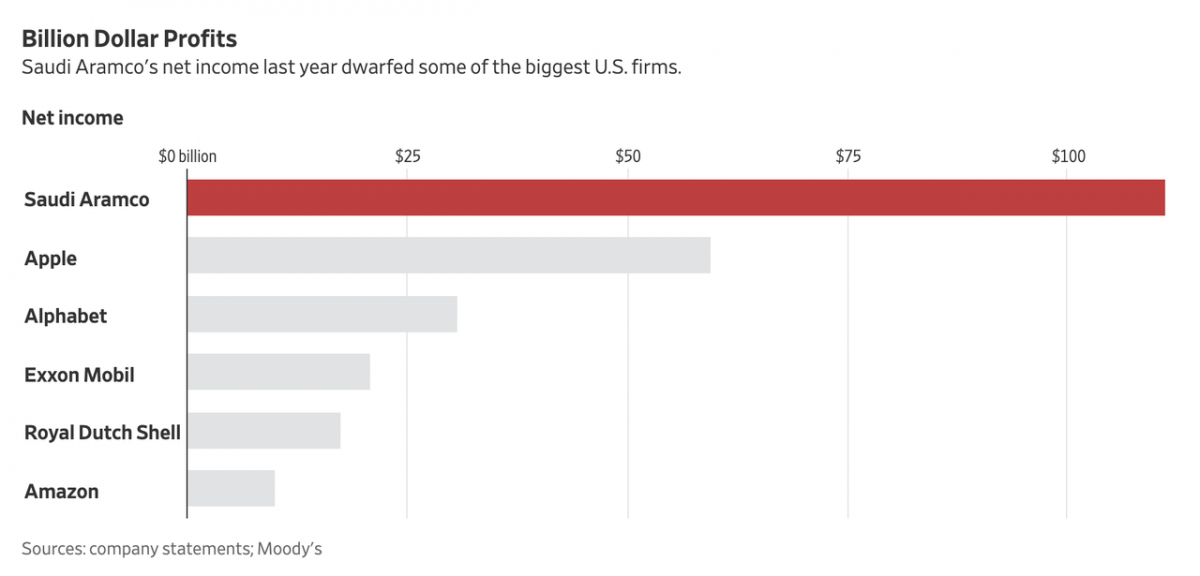

As we reported last week, entering the bond market forced Aramco to open its books after decades of speculation about its earnings and production. The Aramco prospectus revealed massive profits which beat out tech giants like Apple and publicly-traded rivals in the energy space like Exxon-Mobil and Royal Dutch Shell, establishing the energy behemoth as by far the world's most profitable company. In 2018 alone, Aramco's profits exceeded $110 billion on $360 billion in revenue. That's nearly double Apple's $60 billion profit, and five times Shell's ($23.9 billion). Thanks to the surge in oil prices last year, Aramco's net income climbed by 50% from $75.9 billion in 2017. Related: Oil Markets On Edge As Military Clash Looms In Libya

In fact, with Aramco already pulling in a gargantuan cash flow, many are asking why the company needs a relatively modest $10bn on top. In any case, Aramco got the fifth-highest investment-grade ratings at both Moody’s Investors Service and Fitch Ratings, the same as Saudi Arabia’s sovereign grade.

So as Aramco goes to market, Bloomberg reports that the oil giant is offering six-tranche debt, with Initial Price Thoughts as follows:

- USD 3Y Fixed -- T+75 area

- USD 3Y Floating Rate Notes -- Libor + equivalent

- USD 5Y Fixed -- T+95 area

- USD 10Y Fixed -- T+125 area

- USD 20Y Fixed -- T+160 area

- USD 30Y Fixed -- T+175 area

While Aramco may raise about $10 billion from the sale, according to the kingdom’s energy minister as Saudi Arabia combines the oil producer with chemical maker Saudi Basic Industries Corp, the likely proceeds will be far greater thanks to the 4x oversubscription for the bonds.

As a reminder, Aramco is turning to the dollar bond market as the company is starting to raise cash ahead of the purchase of a $69 billion majority stake in domestic petrochemical giant Sabic. The bond sale represents an alternate way for Saudi Arabia to raise money and diversify from oil after an IPO of Aramco was postponed last year. Saudi Arabia has valued Aramco at a whopping $2 trillion, though not all investors are convinced it’s worth that much.

As Bloomberg notes, the success of the sale is hugely important for banks, such as JPMorgan and Morgan Stanley, which are working on the company’s behalf. They are also eager to run an initial public offering by Aramco - the world’s most profitable company - if and when it comes, which would bring lucrative fees for the selected banks.

In a rare appearance that underlines the bond sale’s significance, JPMorgan’s Chief Executive Officer Jamie Dimon spoke at a lunch in New York Thursday to market the deal, according to one of the people.

Citigroup, Goldman Sachs, HSBC and NCB Capital are also managing the bond sale. Related: The World’s Cheapest Natural Gas

With demand for the bonds clearly sky high, some investors remain torn on whether that interest will allow Aramco to pay yields lower than what its owner does, the Saudi Arabia government. On the one hand, Aramco is immensely profitable and produces endless cash flow. In addition, investors who manage high-grade corporate debt are showing interest in buying the Aramco bonds. All of that could bring the borrowing cost lower than that of the government, according to Nikolay Menteshashvili, an analyst with Insight Investment in London.

But others see it differently. They say Aramco is inextricably linked to the Saudi government, which is subject to a variety of risks including low oil prices. That’s why Jim Barrineau, head of emerging-market debt at Schroders Plc, said he wouldn’t be interested in buying Aramco’s bonds at a rate lower than the government’s.

“For an emerging market investor, it’s just the level relative to the sovereign that matters," Barrineau said. (Updates bond offering, pricing timeline in bullets.)

The deal is expected to price tomorrow, so we would not be surprised to see leakage higher in Treasury yields on rate-locks and rotation.

By Zerohedge

More Top Reads From Oilprice.com:

- Oil Hits $70 On Libya Unrest, Crisis In Venezuela

- Nigeria Boasts Oil Production Cost of $23 Per Barrel

- Platts Survey: OPEC Oil Production Down To More Than 4-Year Low