W&T Offshore, (WTI) is a "scavenger" of assets that have been poorly or under-developed in the past. It reaps a benefit of typically of not having to do much in the way of facilities infrastructure-type development, as these have been put in place by prior operators. This helps to keep capex pointed toward well construction, which is the very end of the line in field development.

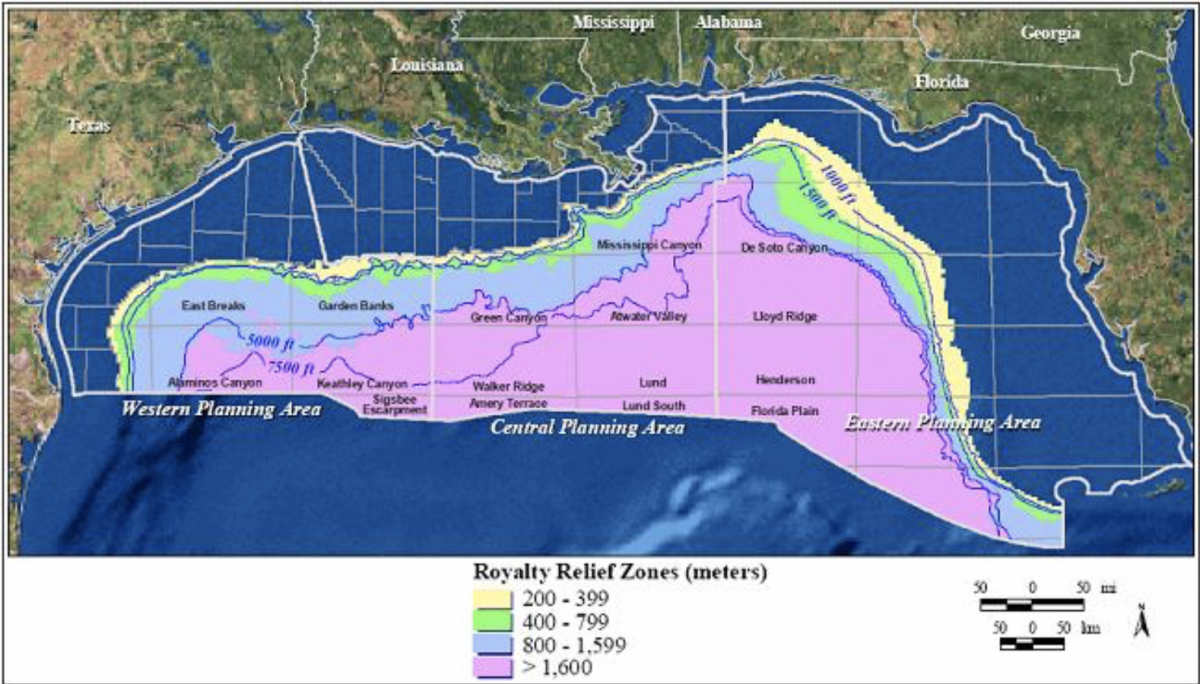

The Gulf of Mexico's-GoM, Continental Shelf (the areas in blue blocks) has largely been abandoned by the big guys, the Shell's, the BP's, the Chevron's and so on. The reason is largely these companies are so huge that finding a million or two barrels of oil just doesn't move the needle. Periodically these companies "high grade" their portfolios, which means to auction off assets that no longer fit into their core strategy. The shelf largely quit being "core" to the supermajors about twenty years ago, and was high graded away to other companies.

One man's table scraps, becomes another's meat and potatoes, as the saying goes, and smart operators like WTI move in. They pick over the logs, take a new look at seismic data with modern processing algorithms, and find substantial new reserves (substantial to them anyway), and set to work on development plans.

It should also be…

W&T Offshore, (WTI) is a "scavenger" of assets that have been poorly or under-developed in the past. It reaps a benefit of typically of not having to do much in the way of facilities infrastructure-type development, as these have been put in place by prior operators. This helps to keep capex pointed toward well construction, which is the very end of the line in field development.

The Gulf of Mexico's-GoM, Continental Shelf (the areas in blue blocks) has largely been abandoned by the big guys, the Shell's, the BP's, the Chevron's and so on. The reason is largely these companies are so huge that finding a million or two barrels of oil just doesn't move the needle. Periodically these companies "high grade" their portfolios, which means to auction off assets that no longer fit into their core strategy. The shelf largely quit being "core" to the supermajors about twenty years ago, and was high graded away to other companies.

Source

One man's table scraps, becomes another's meat and potatoes, as the saying goes, and smart operators like WTI move in. They pick over the logs, take a new look at seismic data with modern processing algorithms, and find substantial new reserves (substantial to them anyway), and set to work on development plans.

It should also be noted that some deepwater acreage in the GoM is being high-graded now as well. An example would be ExxonMobil, (XOM) putting their deepwater GoM stuff on the block.

Recently WTI's stock has fallen by ~40%+ over the last several months on a weak first quarter and the general disdain for everything oil currently. We think at near current levels the stock presents an opportunity to pick up a quality player in the GoM. In this article we will review relevant financial data from Q-1 and a success case that might drive the stock higher when sentiment changes.

The investment thesis for WTI

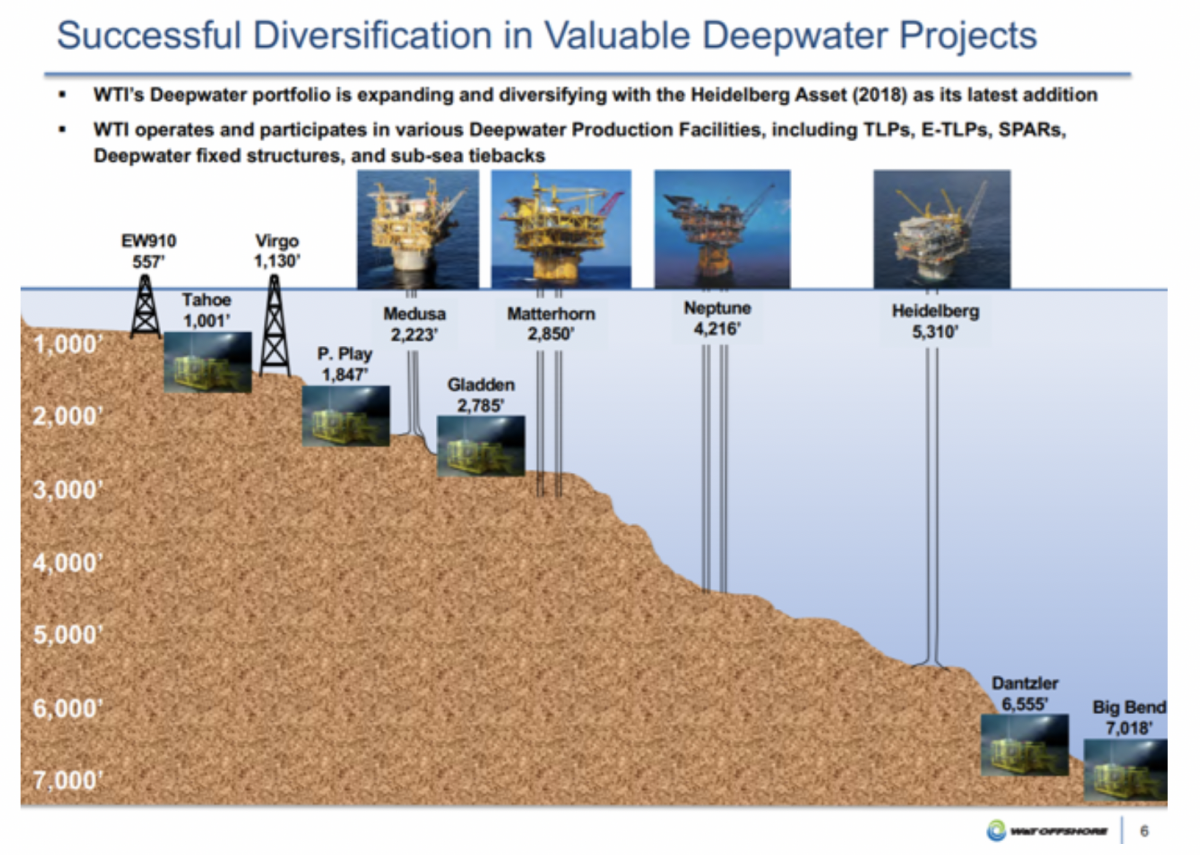

W&T Offshore is play on low decline assets (conventional reservoirs) matched to legacy infrastructure required for development. This infrastructure means they can go after oil traps in big deepwater reservoirs that have been derisked through decades of prior production. All the while avoiding the massive capex burdens that the prior owners incurred.

So with minimal capex exposure they can substantially boost production with successful wells, thereby increasing cash flow. When this cash flow is reported, the stock should respond favorably, other external factors that drive the industry not-withstanding.

It is also a play on oil prices. If you think the risk for oil is to the upside, buying WTI slightly below current prices will likely result in significant capital appreciation. The inverse is also true.

First a look at a recent success

In early June WTI announced their deepwater program had seen some success with a Drill Stem Test, DST on the (17.5% owned) Gladden Deep well that will be put online in the latter half of this year. This discovery, in about 3,000' of water, identified about 7 mmboe and was drilled to TD at 18,234 feet MD. 3,000 feet of water depth is an area of the GoM that the big operators blew through in the 1990's on their way to developing the technology they now deploy in the Ultra Deep Water, UDW sector. They are done in that water depth now, creating an opportunity for "gleaners" like WTI. Another key thing is that working in that water depth is de-risked. That doesn't mean that problems can't happen, but in reality, it is no riskier than working on the shelf.

Tracy W. Krohn, W&T's Chairman and Chief Executive Officer commented,

“We are very pleased to announce our first deepwater discovery in 2019 at Gladden Deep. This is an excellent example of how quickly we can drill highly-economic subsea tie-back wells and have them placed on production and generating free cash flow within a year.”

Source

It is encouraging that this well was deemed a success as it validates a 4-well campaign that will produce oil to Murphy's, (MUR) Medusa SPAR, first installed in Mississippi Canyon, Block 582 in 2003. Medusa has a rated throughput capacity of 40K BPOD. Through its Callon Petroleum acquisition, WTI has fractional ownership of the Medusa SPAR. These three additional wells, Moneypenney, Oldfield, and Resolution collectively target about 100 mm bbl of stranded oil.

So, how are they able to do this?

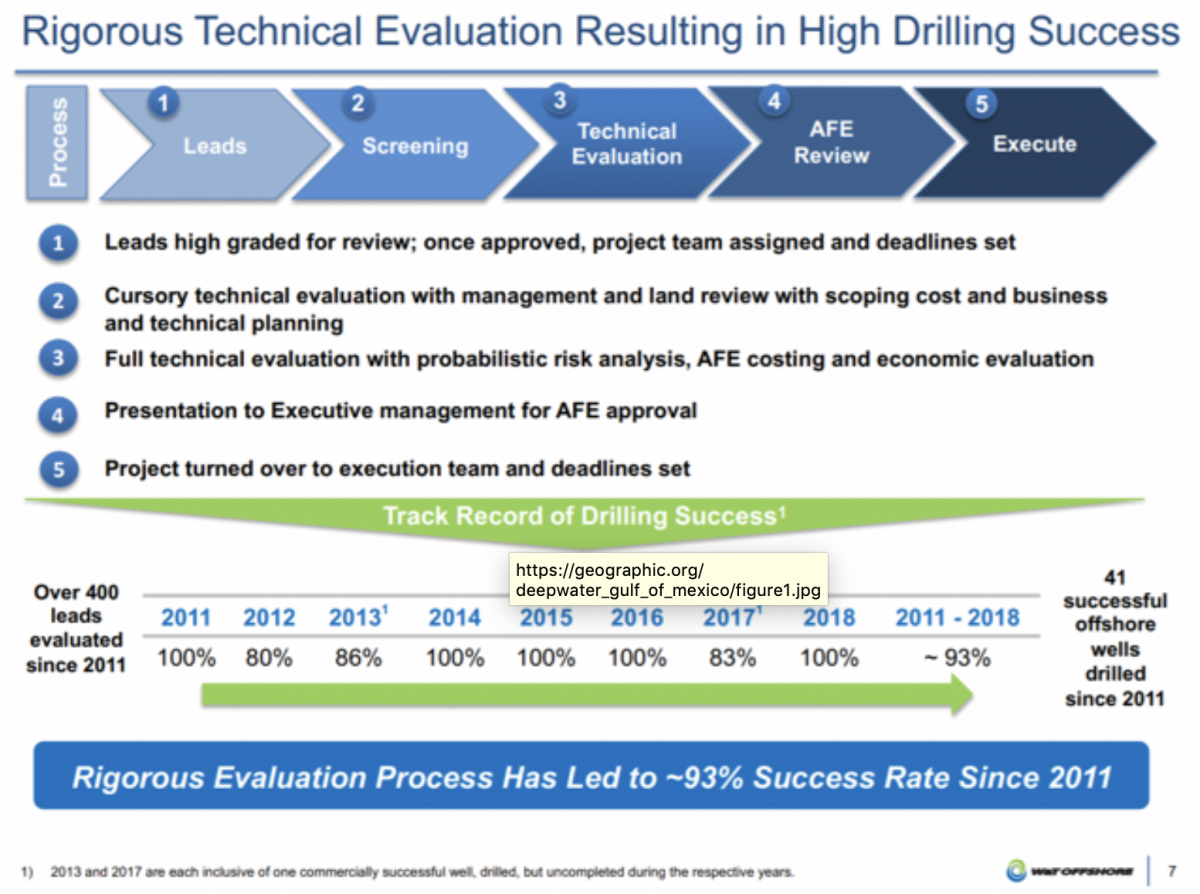

WTI is organized like a mini-major with lead generation done in-house by staff engineering teams. Now they have some high powered help through their Strategic Partnership with Baker Hughes General Electric, (BHGE). Baker has the field evaluation expertise that WTI calls upon to prove up a prospect for development, and vertical integration to be able to manage the physical installation from drilling the well to hooking up the flow lines. This also helps to control service and equipment costs.

Source

I am not sure how this compares with other GoM operators. Success rates in the GoM these days are fairly high. Consider that, we've been active in this province for over 60 years, and in that time have moved from the relative dark ages, to actually being able to visualize reservoirs in 3-D. That said, a 93% success rate is a confidence builder in my book.

Source

You can see the company is a significant deepwater player with substantial facilities in place to evaluate these stranded oil prospects. These facilities are key. You could not create these SPARs and platforms for the investment WTI has made thus far.

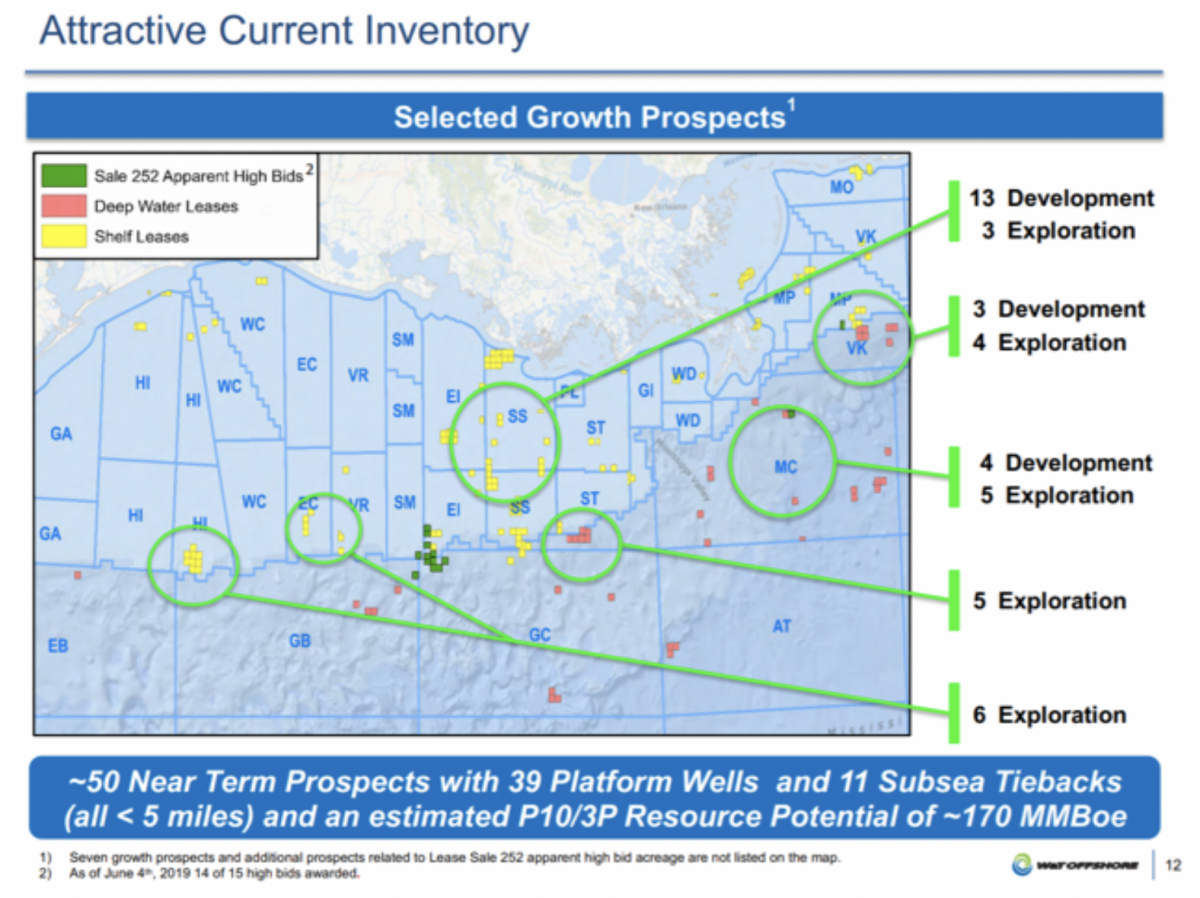

Prospect Inventory

Source

Worth mentioning on top of the Monza JV now moving toward completion at the half way point, are the blocks that WTI picked up in BOEM lease sale 252.

Financial Review

Revenues were off in Q-1 about 13% thanks to some extended well shut ins due to pipeline repairs and facilities work at three of their biggest fields, which lead to lower production of about 10% QoQ. This hit the same time as recent oil price declines and led to lower crude realizations for the quarter.

The good news is the repairs are behind them and production has recovered from 33K BOEPD to over 37K BOEPD. So QoQ comparables should be improved for Q-2.

Capex risks have been reduced through the Monza JV currently at about the half way point in execution. The input of partners, Harborvest, and Baker Hughes along with a commitment of $361 mm in direct funding, have reduced WTI's capex for 2019 by $55 mm.

Hedges. WTI has about a third of its daily production hedged above $60.00/bbl. A strategy that bit them in Q-1 to the tune of about $55 mm of unrealized commodity prices. Now that oil has declined further, this will accrue to their benefit.

Risks

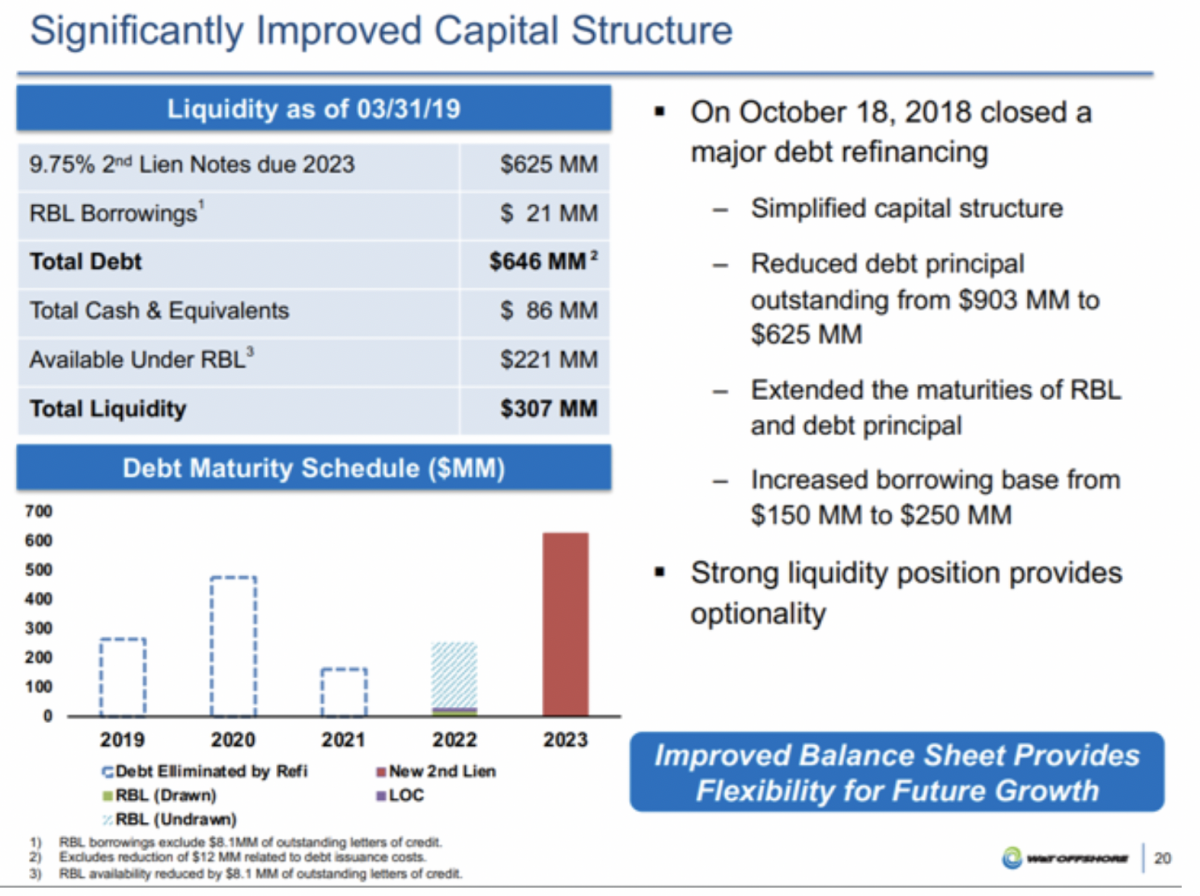

Source

In a tightening credit market and in an industry that is out of favor at the present time, WTI managed to place a $625 mm offering that essentially rescheduled and reduced their overall indebtedness. This reduced their long term debt by a third to ~$547 mm. The notes are due in 2023, so the company has some breathing room.

For reference, WTI currently has an EV/EBITDA ratio of 3.85, well in what is considered a “healthy” range. Investors start to become nervous when this ratio exceeds 10.

Your takeaway

No investment in oil related securities can be wisely considered without putting it in the larger framework for expectations for oil.

There are three key drivers for the oil market presently.

- Inventory data from EIA, showing a draw of 12.8 mm bbl last week, as U.S. refineries finally perked up and began to make gasoline for the summer driving season.

- Global concerns about the impact of trade barriers on growth, currently easing and supportive for energy prices.

- Interruption of supply fears due to Iran sanctions.

The rhetoric coming out of Washington and Tehran is pretty strident currently. The downing of the U.S. drone brought the world very close to a cataclysmic event, a wider war between the U.S. and Iran. Thankfully President Trump listed to his more dovish advisers, and called off the retaliatory strike.

I have to agree with the President's reasoning and applaud his craftiness in not taking this step. There was no appetite for this strike broadly in the country, and he would have been excoriated in the press when news of the deaths of the Iranian troops made the rounds. Killing a few Iranian Revolutionary Guard Corps, IRGC commandos would do nothing to further our core interests-stopping Iran's nuclear program, and would have likely been met with a response from the IRGC. The U.S. would of course then had to take out another missile battery, or some such, and we’d have been off to the races figuratively speaking. Wars are much easier to start than to stop. If the last 20 years has taught America anything, it should be that.

Attacking the American drone was a desperation step by Iran’s ruling theocracy to entrap it into retaliating. Now, giving them a pass on knocking this drone out of the sky, America assumes the “moral high ground” in a press for "negotiations." Negotiations that their population may "demand" of their leaders. Make no mistake, sanctions are having a profound effect on the average Iranian's life.

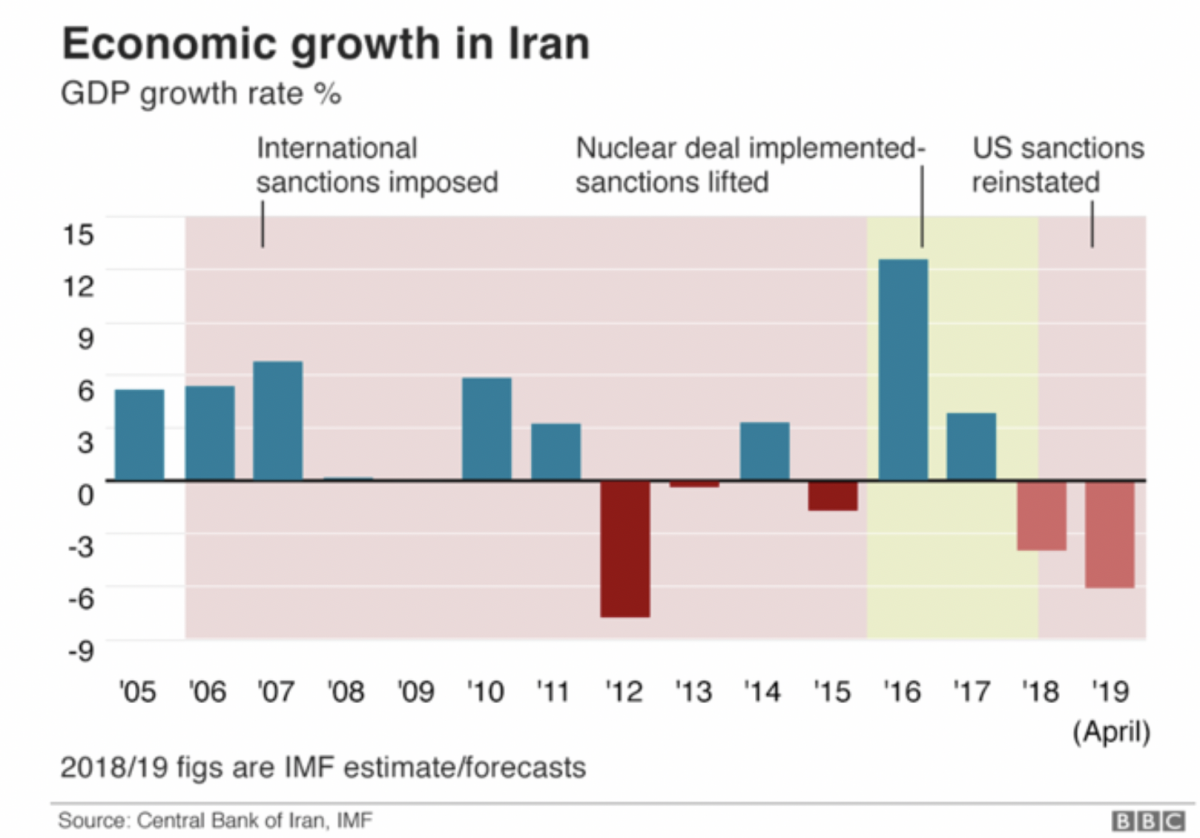

Things are hard in Iran now, the U.S. re-imposition of sanctions is having a real effect on their economy. The graphic below suggests that Iran's economy is actually shrinking. That means in spite of a growing population the country's economic output is falling. This is the very definition of hardship on a personal level.

Source

If you're an average Iranian, it means your money is worthless, the Iranian Rial has lost 60% of its value YoY. It means there are less goods and services you can afford to buy, inflation is over 30% YoY. It means if you're a new graduate, looking for a job, there are no jobs to be had. Iran's youth unemployment is approaching 27%, and new graduates nearing 40%.

Source

This is an untenable situation that cannot persist for very long. People will demand change. And, that, of course, is the ruling theocracy's deepest fear. Because when change comes from within, (as real change surely must), it has much more profound and permanent results, than when it is forced from external sources. Its how the theocracy took control of this country in the first place, now so many years ago.

Investment Summary for W&T Offshore

Given the three factors discussed so far, I expect the most recent backdrop for oil of oversupply/under-demand worries will shortly resume its dominance. Inventories have been building for most of this half year, and the world is consumed by the trade spat with China. Until we get some kind of deal regarding trade with the Chinese, I don't see a positive catalyst long term catalyst for oil.

While the indicators this week are bullish for crude, I do not expect a strong rebound in oil equities until there are obvious trend reversals for oil inventory growth, the global economic growth story becomes less bearish, and no war erupts with Iran.

I would monitor W&T in this context and wait for a slightly better entry point nearer $4.00, as its closing price recently has returned it to the $5.00 range. Around $5.00 or higher it could prove to be a value trap. Assuming an entry point around $4.00/share is obtained, I would let it run in the bull case to the $6.00 range, and put stops in at that point to protect profits.