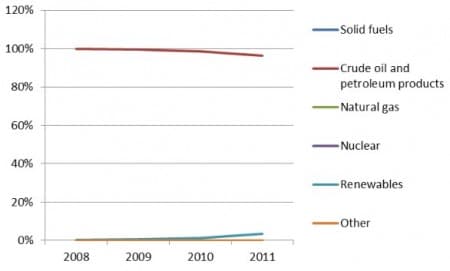

Cyprus is one of the most energy-deprived countries in the world when it comes to fossil fuels. Despite the discovery of significant natural gas reserves, the island state is still importing most of its energy. Although the growing use of renewables is decreasing the need for imports, the majority of the country’s electricity is still produced in power plants running on petroleum and diesel.

The gas bonanza in the Eastern Mediterranean is a boon for the region’s littoral states. Cairo and Tel Aviv have been able to move quickly and start production at their respective gas fields, which is improving energy security and earning money from exports. Egypt already possessed a sizeable energy infrastructure due to previous discoveries. Israel’s favorable business climate attracted capable energy companies to get the job done.

Cyprus, however, has to deal with technical and security related issues that impede a quick development of the country’s energy resources. While the gas deposits are sufficient to fuel the island state for decades, Nicosia has decided to import LNG in the short term.

The state-owned Natural Gas Public Company of Cyprus, DEFA, chose a consortium led by China Petroleum Pipeline Engineering to construct a floating storage and regasification unit, FSRU. Cyprus’s decision was primarily driven by European emission reduction rules, which require the substitution of relatively dirty oil products and coal for cleaner natural gas and renewables. Brussels is offering financial support to get the project done. Related: Iran’s $280 Billion Sanction Skirting Scheme

Mediterranean energy wealth

Nicosia, however, hasn’t given up on its goal of energy independence and the exporting of surplus energy. Since 2011 several gas fields have been discovered such as Aphrodite in 2011, Calypso in 2018, and Glaucus in 2019. Although these deposits together constitute a considerable amount, the relative depth of the Mediterranean and the absence of existing infrastructure raises production costs considerably.

There are several options for exporting Cypriot gas: one includes pipeline, and the other two transportation by liquefaction. Cyprus, Israel, and Greece have voiced interest in the construction of a pipeline from the Eastern Mediterranean to Europe, which is supported by the U.S. and EU. However, from a financial point of view it is the least likely option due to the high costs of construction estimated at $9.5 billion.

Cyprus’ preference, however, is to host a liquefaction facility of its own. Although there are no investment plans, the option is still on the table. This would improve the country’s energy security and strengthen its status as an LNG exporter.

Related: How Much Oil Is Up For Grabs In Syria?

A third option is to use Egypt’s existing transport and liquefaction capacity. Israel’s Delek Drilling and U.S.-based Noble Energy already signed an agreement to export $15 billion worth of gas to Egypt, which will benefit both countries financially and strategically.

Security concerns

Besides technical impediments, Turkey has become a major headache for Nicosia. Ankara is claiming a significant portion of the energy deposits, which according to international law are located in Cyprus’ exclusive economic zone. The EU and the U.S. support Nicosia in this matter and both have repeatedly warned Turkey not to continue illegal drilling in the concerning area.

Washington has strengthened its relations with NATO ally Greece with a revised defense deal to bolster its relative position in the region. More significantly, the U.S. Congress is on the brink of lifting a three-decade-old arms embargo regarding Cyprus. Turkey, obviously, strongly opposes the decision. However, due to Ankara’s confrontational and aggressive policies such as the invasion of Syria, it is unlikely that the lobbying effort will succeed.

United front

Despite Cyprus’ modest size, the island state is in a strong position concerning its conflict with Turkey. Ankara is facing a united front of countries opposing its policies. The discovery of natural gas in the region has brought Cairo and Tel Aviv closer too each other. Also, Cyprus and Greece have deepened their fraught relations with Israel, because of the newfound energy wealth.

Furthermore, the EU’s intention to wean itself off Russian gas is also in Nicosia's favor. The proximity of the gas fields to Europe and Cyprus' membership of the EU makes it an ideal alternative.

Despite the island state’s advantages, any looming conflict is bad for business. Uncertainty raises costs for companies, which in turn deters long-term investments.

By Vanand Meliksetian for Oilprice.com

More Top Reads From Oilprice.com:

- Russia Predicts The Death Of U.S. Shale

- Oil Rebounds On Rare Market Optimism

- One Of The World’s Largest Oil Companies Just Ditched The Dollar