It’s common knowledge that most of the world’s oil is transported internationally by tankers. What might not be so commonly known is the fact that almost half of the crude shipped around the world passes through waters where piracy, the danger of terrorist attacks, or the possibility of local governments shutting down the waterway are all too real.

Business Insider has used new visualization tech to map the seven main chokepoints of the global crude oil routes. The map highlights the fact that four of these chokepoints – the biggest ones, at that – are in politically unstable or otherwise unfavorable regions, which could potentially threaten crude oil supplies around the world.

17 Million bpd Through the Strait of Hormuz.

(Click to enlarge)

FleetMon

The biggest chokepoint for tanker shipments is the Strait of Hormuz in the Persian Gulf, between Oman and Iran. The Iran-controlled passage is where 17 million barrels of crude pass through on a daily basis. One of the biggest risks with this route is Iran’s threat wielding regarding it.

Four years ago, Tehran threatened to close the passage, and it did so again earlier this year. In neither case, however, did the country act on its threats, but it does not mean that it won’t wave that weapon again, and won’t act on it next time, should the antagonizing between Tehran, Riyadh, and Washington continue.

The strait is only 21 miles wide at its narrowest point, but is wide and deep enough to handle even the world’s largest tankers. Alternate routes for oil normally going through this strait are several pipelines, but capacity is limited. Most of the oil exports traveling through this strait are bound for Asian markets.

15.2 Million bpd Through the Strait of Malacca.

(Click to enlarge)

FleetMon Related: Catching A Falling Knife: A Deepwater Buyout

Second from the top in terms of millions of barrels shipped is the Strait of Malacca, between Indonesia and Malaysia, where 15.2 million barrels are shipped daily. The place is dangerous geographically, what with the shallow waters. It’s also dangerous because of the sheer number of vessels that pass through it: up to 80,000 annually. Piracy is also rife in the area, causing additional concerns.

Malacca remains the shortest route between the Middle East and the Asian Markets.

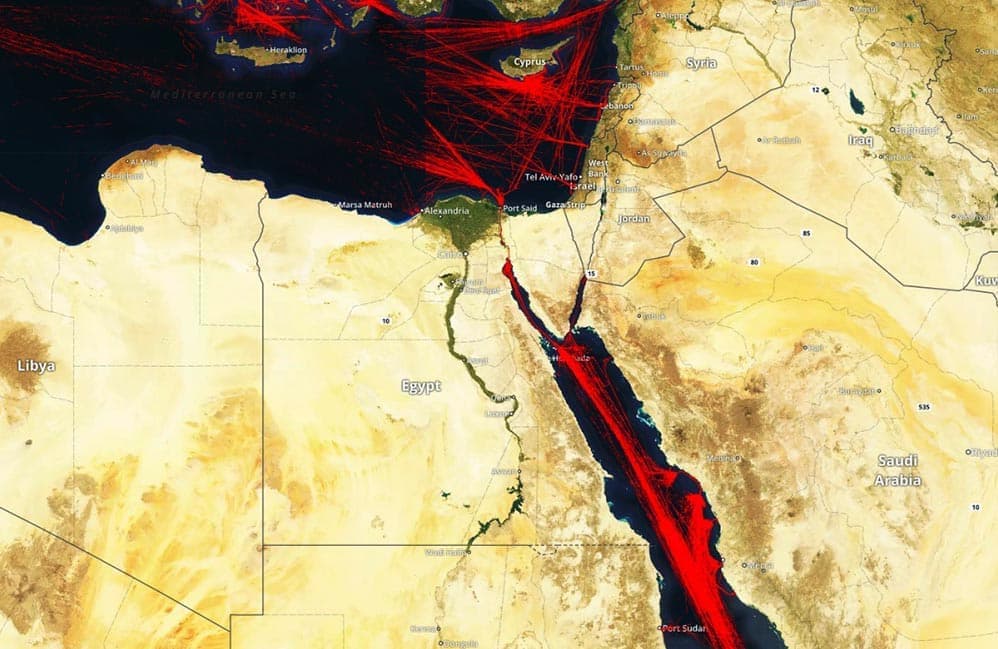

4.6 Million bpd Through the Suez Canal.

(Click to enlarge)

FleetMon

The Suez Canal in Egypt is where 4.6 million barrels of crude pass through every day. Egypt is still a politically unstable country following the Arab Spring revolution, and there is the ever-present problem of possible terrorist attacks on the infrastructure. And although it’s possible, it’s highly unlikely that Egypt, no matter how strained its relations with Saudi Arabia get, would close such a lucrative asset: this year, Egypt expects to get some US$5.7 billion in revenue from vessels using the freshly expanded waterway this year. Related: Why $25 NatGas Is Possible This Winter

3.8 Million bpd Through Bab el-Mandeb.

(Click to enlarge)

FleetMon

South of the Suez Canal is Bab el-Mandeb, another passage that accounts for 3.8 million barrels of crude daily. Since it passes between Yemen on the one side, and Eritrea, Djibouti, and Somalia on the other, shipments via Bab el-Mandeb are under constant threat from pirates and other militant groups operating in the area.

The four waterways above account for a combined 40.6 million barrels of crude every day. The rest of the chokepoints are not exactly in safe waters either, but much safer waters, perhaps except for the Bosphorus and the Dardanelles in Turkey, which account for around 2.9 million bpd of global oil shipments. Due to the nature of the current Turkish government with Recep Tayyip Erdogan at the helm, closing off the straits on a whim or as a demonstration of power to any of his many allies is never off the table.

The rest of the maritime world oil goes through the Danish Straits (3.3 million bpd)—mostly Russian crude for Europe—and the Panama Canal, which is the smallest of the seven, transporting 800,000 bpd on average. Some 4.9 million barrels of crude are also shipped by Cape of Good Hope by those who would rather avoid the chokepoints of Suez and Bab el-Mandeb.

The world this year will consume 95.33 million barrels daily, according to the Energy Information Administration. Of this, 52.6 million barrels will be shipped by sea. Any trouble at any of these chokepoints would easily push up international prices.

By Irina Slav for Oilprice.com

More Top Reads From Oilprice.com:

- Post-Election Oil Prices: Can We Expect A Plunge?

- OPEC Just Knocked $20 Off Its Oil Price Outlook

- Could Trump’s Victory Render OPEC’s Output Deal Irrelevant?

Further breakdown of stats would be also good. Like, how much %age of oil from which chokepoint makes it way to the US, or to China or to Europe. Hope the author will do a follow up article on this.