The splendidly-directed movie 'There Will Be Blood' by P.T. Anderson is about the early days of the oil boom.

There is an epic scene between actors Daniel Day Lewis and Paul Dano, in which Daniel Day Lewis says: 'I DRINK YOUR MILKSHAKE!'.

This is a century-old hat-tip to directional oil drilling, as Daniel Day Lewis' character has used slant drilling to drain an oil reservoir under an adjacent piece of land.

This is a somewhat poignant turn of phrase at the moment, given that Iran is about to have oil sanctions applied on it, and everyone is jostling to drink their milkshake - stealing their market share as their production and exports drop back.

We recently highlighted how Iraq appeared to be muscling in on Iran's market share into Northwest Europe based on our projections, and this is now playing out in delivered barrels. Iran has delivered absolutely nothing-nada-nil into France or the Netherlands this month, when it is typically a regular supplier. Based on our projections, nothing is set to be discharged in the coming weeks.

Iraq, on the other hand, has already delivered over 7 million barrels to these two countries so far in August, higher than any monthly volume in the last year - and we still have a week of the month left to go. Two million barrels of Basrah Light have been discharged in France, hot on the heels of two deliveries totaling 2mn bbls last month - after a six-month absence.

(Click to enlarge)

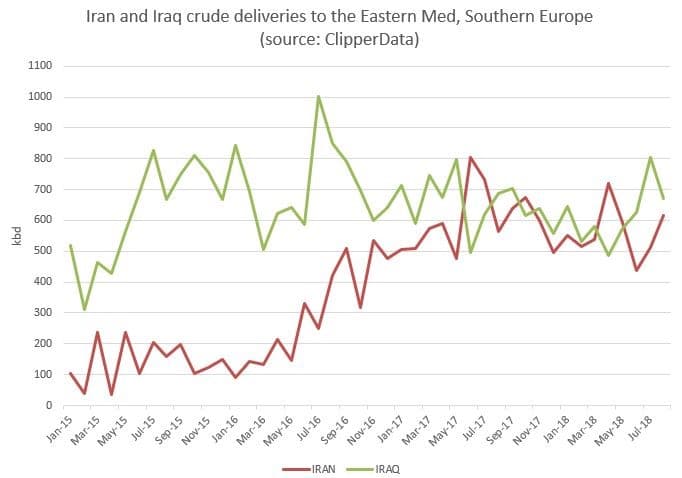

But Iran isn't having Iraq drinking its milkshake everywhere. If we look at deliveries into Southern Europe and the Eastern Mediterranean this month, it is still holding its own versus Iraqi grades. This is a result of record volumes into Italy, as well as flows into Spain and Turkey continuing apace.

(Click to enlarge)

Asia is also shaping up as a key battleground, and Iran is getting trounced in India, given that companies such as Reliance Industries are keen to keep good relations with the United States and halt Iranian imports. (In an interesting twist of fate, deliveries of US grades to India have reached a record so far this month).

According to our ClipperData projections, crude loadings this month bound for India (of which 90 percent has already been delivered) have risen by over 200,000 bpd from Iraq, while dropping by nearly 600,000 bpd from Iran - down by three-quarters on the prior month. Related: Oil Ends Nearly Two Months Of Losses

(Click to enlarge)

But it isn't only India that is seeing a dramatic change in flows - and it isn't only Iraq that has a milkshake craving.

Core OPEC (Saudi, UAE, Kuwait) loadings bound for Asia this month are up over 800,000 bpd versus July, while Iran's loadings are down nearly 700,000 bpd. As Iran's absolute loadings drop, it is having to cede its Asian market share, and other OPEC members are more than happy to suck it up.

(Click to enlarge)

By Matt Smith

More Top Reads From Oilprice.com:

I have been saying since the US sanctions on Iran were re-introduced that the sanctions are doomed to fail miserably and that Iran will not lose a single barrel from its oil exports.

My reasoning is based on five market realities. The first is that the overwhelming majority of nations of the world including US allies and major buyers of Iranian crude are against the principle of sanctions on Iran as unfair and will not therefore comply with them and will continue to buy Iranian crude whether in violation of the sanctions or by a US waiver as would be the case with Japan, South Korea and Taiwan.

The second is the petro-yuan which has virtually nullified the effectiveness of US sanctions and provided an alternative way to bypass the sanctions and petrodollar.

A third reality is that China which is being subjected to intrusive US tariffs and Russia which has been battling US sanctions since 2014 will ensure the failure of US sanctions against Iran as a sort of retaliation against US tariffs and sanctions against them.

A fourth reality is that China can singlehandedly neutralize US sanctions by deciding to buy the entire Iranian oil exports amounting to 2.5 million barrels of oil a day (mbd) as a retaliation against escalating US trade war against it and paying for them in petrodollar.

A fifth reality is that 95% of Iran’s oil exports go to countries who declared that they will not comply by US sanctions, namely China (35%), India (33%), the European Union (20%) and Turkey (7%). The remaining 5% of Iran’s oil exports goes to South Korea and Japan who have already said they will apply for a US waiver and most probably they will get.

India will never halt its imports of Iranian crude no matter what pressure the United States puts on it. India announced that it doesn’t recognize any sanctions but UN sanctions and that it will ignore US sanctions on Iran and continue to import Iranian crude. In June 2018 India imported 705,000 b/d of Iranian crude compared with 464,000 b/d in June 2017. This is not the action of a country planning to comply with US sanctions on Iran.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London