Our friends over at Ursa published a blog post yesterday discussing crude inventories at Kyaukphyu in Myanmar, highlighting the seeming political nature of recent crude flows to the storage hub.

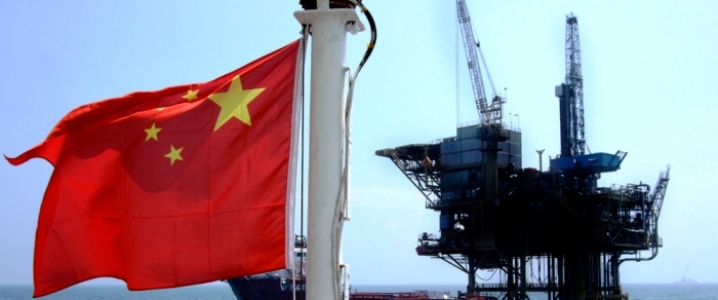

Crude is delivered to CNPC's Kabala terminal in Myanmar and is stored at Kyaukphyu before being transported by pipeline to the Yunnan refinery in China.

Since the terminal started up in April 2017, we can see from our ClipperData that there has been nearly 80 million barrels discharged there. Saudi Arabia is a steady supplier, accounting for about a half of all crude deliveries - and mostly Arab Medium - with volumes averaging about a VLCC a month (about 2 million barrels).

(Click to enlarge)

The terminal at Kyaukphyu - and hence the Yunnan refinery - typically imports light and medium sour grades, including UAE's Das and Upper Zakum, Qatari Al Shaheen, Omani export crude and Iraqi Basrah Light, but has also imported sweet grades - including Angolan Girassol and Azeri Light.

As the chart above illustrates, a couple of Iranian cargoes have been delivered in the last few months - including 1.1mn bbls of light sweet South Pars condensate in June. Although we are seeing a dip this month in total Iranian barrels into China, it is expected that Iran will increasingly try to muscle its way in, as it is muscled out of elsewhere.

Chinese imports of Iranian barrels are at 650,000 bpd through the first seven months of the year, after running closer to 600,000 bpd in recent years. Central China typically receives the most, but flows have dropped considerably to the region this year, instead heading to southern and northern destinations.

As our ClipperData illustrate below, Iranian grades into northern Chinese ports - and mostly Qingdao, Rizhao, Tianjin, Caofeidian and Dalian - have been on the rise in recent years, averaging over 300,000 bpd so far this year.

Related: Indonesia’s Oil Sector In Jeopardy As Elections Loom

Rising flows into northern China has been a common theme in the first half of the year, with total imports up over 8 percent on a year-over-year basis. That said, imports have dropped off considerably since May, after the government changed the tax structure for independent refiners. Nonetheless, Iranian imports into the region are holding up for now.

Imports of U.S. crude into northern China, on the other hand, look set for a bout of weakness. Nearly a half of U.S. crude imports to China make their way to the independent refiners in the north. Amid the threat of tariffs and trade wars, flows of mostly light sweet U.S. crude - WTI, Midland WTI, DSW and Bakken - have already slowed from the highs of Q2. While this lower trend should persist amid tighter price spreads, Iranian crude flows should continue apace.

(Click to enlarge)

By Matt Smith

More Top Reads From Oilprice.com:

- All-Time Low Spare Capacity Could Send Oil To $150

- The One Oil Industry That Isn’t Under Threat

- The $80 Billion Megaproject Splurge In Oil

The obvious answer is that China’s crude oil imports irrespective of their sources get used to keep the world’s biggest economy well oiled. However, if the question is about what happens to China’s crude oil imports from Iran under US sanctions, the answer is that China will never stop importing Iranian crude sanctions or no sanctions. On the contrary, China might even increase the volume of its Iranian crude imports partly because it will be getting a good deal from Iran and partly to retaliate against US tariffs and bolster the petro-yuan with which it will be paying Iran.

China is going ahead with buying Iranian crude thus ignoring US sanctions on Iran and daring the United States to impose sanctions on it. China can singlehandedly neutralize US sanctions altogether by deciding to buy the entire Iranian oil exports amounting to 2.5 million barrels of oil a day (mbd) as a retaliation against escalating US trade war against it and paying for them in petro-yuan.

However, China’s growing dependence on oil imports from the Middle East has created an increasing sense of ‘energy insecurity’ among Chinese leaders as these imports have to pass through the world’s most vital oil chokepoints, namely the Straits of Hormuz and Malacca.

China is overwhelmingly dependent on the Strait of Malacca as 80% of its oil imports pass through it and this vulnerability has led to several Chinese initiatives to find alternatives. The Strait links the Indian and Pacific Oceans, and is the main route for oil from the Middle East to reach Asian markets.

With the American Navy patrolling the southern end of the Strait of Malacca and the Indian Navy patrolling the northern end, China feels sandwiched in and strategically vulnerable. The former president of China, Hu Jintao, has referred a number of times to what he describes as the ‘Malacca dilemma’.

China’s answer to the “Malacca Dilemma” was the newly-opened China-Myanmar crude oil pipeline.

The 479-mile-long oil pipeline runs from the port of Kyaukpyu on Myanmar’s west coast and enters China at Ruili in Yunnan Province

The pipeline loads oil shipments from the Bay of Bengal, and ships it to China’s Yunnan province, where PetroChina has a refinery. The pipeline has a capacity of 442,000 b/d. There is also a natural gas pipeline that runs along the same route, with a capacity of 424 billion cubic feet per year.

Iraqi crude oil for instance could be shipped from Ceyhan on Turkey’s Mediterranean coast and from there through the Suez Canal to the Indian Ocean instead of through the risk-prone Straits of Hormuz and Malacca before reaching Myanmar and entering China.

China has also been considering a multi-billion-dollar pipeline that would carry crude oil from Pakistan’s coastal port of Gwadar to Western China.That initiative has not broken ground, although Gwadar figures into a much broader strategic plan for China, beyond oil shipments.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London