On the morning of publication of the EIA-914 and EIA PSM reports today (October 31), providing US monthly oil production data for August 2018, Rystad Energy analysis indicates that the market should expect significant outperformance of US oil production compared to the EIA’s predictions.

The EIA’s current Short-Term Energy Outlook (STEO) suggests total US oil production growth of 90,000 bpd from July to August 2018 with nationwide oil production averaging 11.05 million bpd in August 2018. According to the EIA, 80,000 bpd of this growth should come from Alaska, whereas the predicted decline in production from the Gulf of Mexico nearly offsets the projected increase from the Lower 48 states excluding the Gulf of Mexico.

However, actual well production data and daily throughout figures from the TAPS pipeline suggests that this projection for Alaska is in fact too optimistic, with August 2018 oil production averaging 428,000 bpd, about 40,000 bpd below the EIA’s expectations. Nevertheless, preliminary production data for the US Gulf of Mexico suggest further growth potential of 60,000-70,000 bpd in August, starkly contrasting the STEO’s projected decline of 50,000 bpd. The growth is largely driven by Anadarko and Hess, which exhibit a combined jump in operated oil production of 66,000 bpd in August amid completion of temporary field maintenance as very limited volumes come from new wells.

Yet the most impressive addition is set to arrive from the Lower 48 states excluding the Gulf of Mexico.

The most recent data shows that wells and leases with complete reporting through August 2018 generated collective additions of 112,000 bpd from July to August. The Permian Midland, the Texas-side of the Permian Delaware and the Eagle Ford contribute 46,000, 30,000 and 30,000 bpd additions, respectively.

“It should be noted that the remaining volumes which have not yet been reported normally contribute positively to the final addition because the most recent month is the one that is most exposed to the reporting delay,” says Artem Abramov, Head of Shale Research at Rystad Energy. “Essentially, this makes us more confident that Texas added between 35,000 and 50,000 bpd in August in the most conservative scenario.”

(Click to enlarge)

Outside of Texas, we calculate a 22,000 bpd addition from North Dakota, which has already been confirmed by North Dakota Industrial Commission (NDIC). Both Colorado and New Mexico oil production climbed significantly in August, with growth of 40,000 and 37,000 bpd, respectively, in a conservative case. In Colorado, we are finally observing a delayed impact on production from strong fracking activity seen in the first half of 2018 amid resolution of in-basin gas processing bottlenecks. In addition, Wyoming has displayed capacity to achieve additions of 12,000 bpd in August, with growth driven primarily by a major round of completions by EOG Resources.

Related: EIA: Market Tightens As Outages From Iran, Venezuela Pile Up

“The market should be prepared for the potential high case scenario when EIA’s monthly data is published. In this scenario, Lower 48 excluding GoM adds 270,000 bpd in August. This might push US oil output to 11.3 million bpd,” Abramov says. “Downside risk exists, but we doubt that growth below 130,000 bpd is realistic, and even that is higher than the EIA’s STEO.”

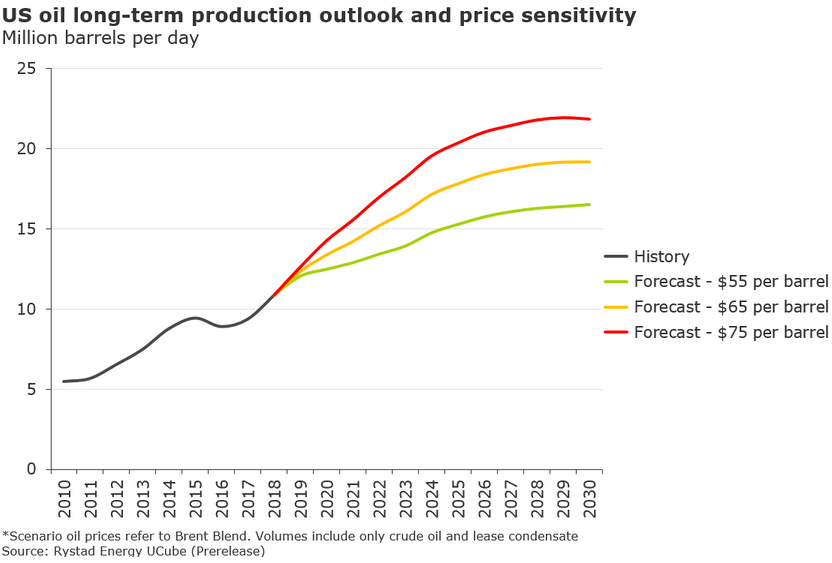

Long-term oil production potential from the US remains dramatic as long as oil prices stay above $50 per barrel. Even in a scenario of $55 per barrel we see US oil output growing to 16.5 million bpd by 2030. Moving to a price environment of $75 per barrel would unlock an additional 5.3 million bpd of volumes in 2030, but it also results in faster acceleration of base decline and earlier plateau in production.

“The shale industry is still in the middle of a long-term investment cycle,” says Per Magnus Nysveen, Senior Partner and Head of Analysis at Rystad Energy. “If a favorable price environment persists, we will see the US oil adding the equivalent of one Saudi Arabia over the next 10 years and with healthy profits seen as soon as the early 2020s.”

(Click to enlarge)

By Rystad Energy

More Top Reads From Oilprice.com:

- Cold Snap Could Send Natural Gas To $5

- Philippines Gas Crunch Forces Uneasy Alliance With China

- Equinor Strikes More Oil At Giant Johan Castberg Field