The fracking revolution in the U.S. has considerably changed the global oil market and the strategic calculations of market participants. The initial entry of shale oil producers caused a crash in prices due to the sudden flooding of the market in 2014. The steep decline in prices led to a landmark deal between the largest oil producers. The agreement to reduce production by 1.8 million barrels per day significantly raised prices to a more sustainable level to the benefit of producers.

Currently, the world is facing several risks that could again significantly impact the price of oil, only this time, not a downward revision but upward. Obviously, lower prices are favorable to consumers for whom the sharp decline in 2014 was profitable. However, the looming perfect storm of geopolitical and technical problems threatens to destabilize the market.

Internal trouble in several regions has decreased supply. The civil war in Libya and unrest in Venezuela has taken hundreds of thousands of barrels per day off the market. President Trump’s confrontational policy towards Iran and the imposition of sanctions risks tightening the global oil market even further.

In the past, shale producers have proven to fill some of the gap left by others. The relative efficiency and speed with which shale producers are able to increase or decrease output, has made them extremely reactive to prices. However, trouble looms ahead as a problem independent from oil production itself risks derailing some of the prospects: transportation bottlenecks.

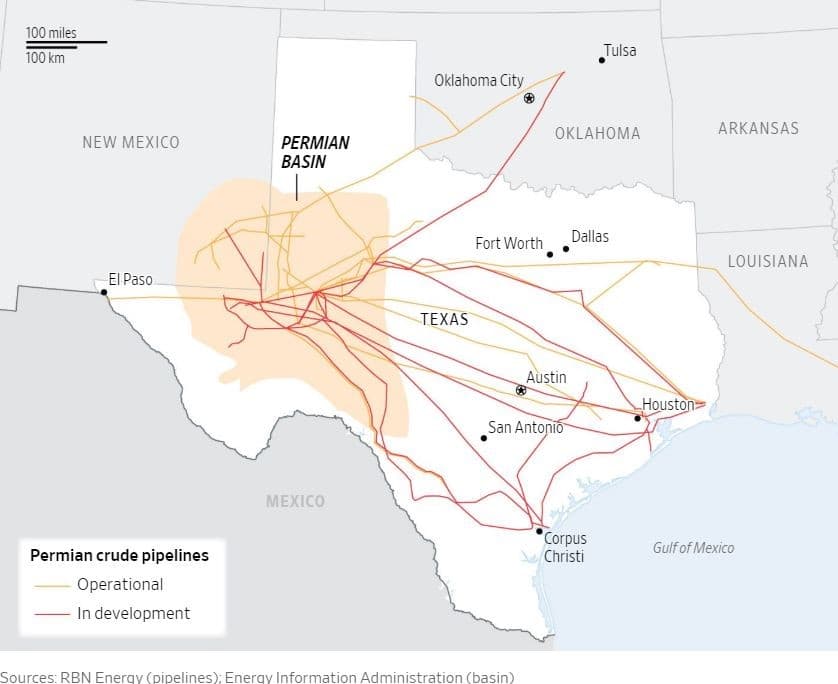

The Permian shale is one of the most productive areas globally with a production of 3.5 million barrels per day. To put that into perspective, it is comparable to the average daily oil production in the United Arab Emirates. However, the inland position of the production area requires significant pipeline infrastructure to export to international markets and refining facilities on the Gulf of Mexico. Road transportation is not an option as it is too expensive, costing on average between $12 and $18 dollars per barrel for a two-way trip. Related: Saudi King Stepped In To Call Off Aramco IPO

Several companies, however, have already made plans for additional pipelines. One of those is Epic Midstream Holding. The company intends to build its first pipeline in the Americas from the Permian base towards Corpus Christi. The pipeline was designed to carry 440,000 barrels per day, which was more than sufficient during the planning stage. The enormous production growth in the Permian, however, has prompted the company to reconsider its capacity. Plains All American Pipelines and Philips 66 are considering the same with a total capacity of 1.8 million barrels.

(Click to enlarge)

The investment in infrastructure is a welcome development for producers, but their patience is also being tested. Obviously, construction will take some time, with most pipelines set to become operational in 2019 or 2020. In the meantime, producers are expected to curtail the rapid development of additional wells as there is no capacity to transport those extra barrels.

The IEA, for its part, predicts U.S. oil production to grow by 1.7 million barrels in 2018 and 1.8 million in 2019 in its June Oil Market Report (110,00 less than in its previous report). The bulk of the growth should come from the largest and most productive field: the Permian basin. The downward revision of the IEA acknowledges the production constraints due to bottlenecks. Related: Can The U.S. Bring Iranian Oil Exports To Zero?

Traditionally OPEC members’ spare capacity has prevented major price swings. However, the more members pump oil to compensate for reductions in other regions, e.g. Iran and Venezuela, the less capacity remains to utilize during a later stage. Saudi fears of Iranian domination of the Middle East has led to increased support in Riyadh for Trump’s goal to reduce Iranian export of oil zero barrels per day.

President Trump vehemently detests the Iran Nuclear Deal its predecessor made. However, domestic issues currently weigh more than Iran as midterm elections loom. Rising fuel prices could hurt Republican support and the administration is aware of this fact, which could explain Washington U-turn towards its policy regarding waivers on the import of Iranian crude.

The administration seems aware of the impact the absence of Iranian oil could have on the global oil market which already is tight with limited available spare capacity.

By Vanand Meliksetian for Oilprice.com

More Top Reads From Oilprice.com:

- The Permian Could Soon Have Too Much Pipeline Capacity

- Aramco To Lose ‘Forever-Right’ To Saudi Oil Resources

- Mexico’s New President To Deal Blow To Oil Industry