The Chinese word ‘crisis’ consists of the characters for ‘danger’ and ‘opportunity’. The unprecedented situation in global energy markets has provided traditional producers with an opportunity to displace incumbents in primarily the U.S. The price war Saudi Arabia started after Russia refused to reduce output in early March has decimated budgets of energy-dependent countries and oil companies. Riyadh and Moscow are playing with fire.

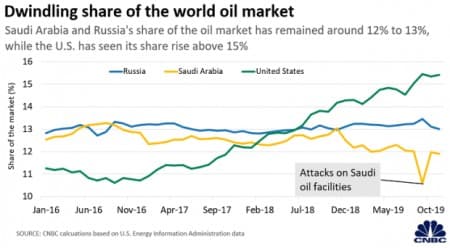

The world's no. 2 and 3 producers of oil are devastating America's energy industry where prices went negative a week ago for the first time. Just before OPEC+ agreed on a historical deal, U.S. senators were threatening to remove American troops from Saudi Arabia if Riyadh didn’t adhere to plans to reduce production.

Despite the political risks, Aramco has sent dozens of ships with 40 million barrels of oil to its refineries in the U.S. Furious lawmakers are calling it an economic ‘Pearl Harbor’. It is a bold move for a country heavily dependent on Washington’s security umbrella. According to Christian Malek, the head of EMEA oil and gas equity research at J.P. Morgan, “The Saudis recognize that they have one last big cycle coming, they want to make sure they position for that but equally they have a very important relationship with the U.S. and particularly Trump.”

Despite the risks, one could argue that Riyadh reached two of its goals after starting the price war. First, it got most producers on board to bear the burden and proportionately reduce production cuts. Second, the accord reaffirmed Riyadh’s leadership of OPEC and energy geopolitics. However, it is to be seen whether the victory is ‘Pyrrhic’.

COVID-19’s devastating effects on the global economy has reduced demand significantly. China and Europe are the largest net importers of oil in the world, making it extremely important markets for producers. Russia’s refusal to support Saudi Arabia’s proposal to reduce production in early March was partly caused by countries’ perception of risks concerning their essential markets.

Riyadh’s energy industry was hit much harder by China’s draconian measures when most of the country was closed for business during the first three months of this year. While Chinese buyers are also very important to Russian energy companies and Moscow has vested political interests in Beijing, most of its oil heads west instead of east. Approximately a third of the EU's oil imports originate in Russia.

Premium: 2 Stocks To Consider As Oil Nears $15

Moscow only agreed to reduce production after European markets were hit equally hard by COVID-19. Saudi Aramco, in response, has been targeting buyers aggressively in Russia’s backyard. To lure customers, Aramco is offering discounts and payment deferrals for up to 90 days. While Russian and Saudi negotiators provide cooperative statements in the OPEC+ context, market share is highly contested.

Riyadh’s aggressive position in the European market is somewhat offset by the structural advantages of Russian exporters. Due to historic reasons, European markets are connected to Moscow's oil fields by pipelines which significantly reduces transportation costs and provides flexibility. While Aramco is bound to the availability of tankers, Russian producers have fewer constraints. Also, European refiners have contracts to import certain levels of oil from Russia.

Besides Europe, Riyadh is also upping the ante in Asia where Aramco has cut prices by $3 to $5 per barrel, which is the second drastic cut in two months. Concerning East Asia, Russia again has a structural advantage over Saudi Arabia. The ESPO pipeline with a daily capacity of 1.6 million barrels in Eastern Siberia ends in the port city of Kozmino and a second branch leads into China to service clients directly. As in Europe, pipeline imports are cheaper, more flexible, and have shorter transportation times compared to Middle Eastern oil.

The importance of Chinese buyers in the current climate is only exasperated by Europe's drop in demand. Shipments of Russian oil that are already in European ports are diverted to mainland China. Some 800,000 tons were loaded from Baltic ports in the second half of March and 500,000 tons in early April. China is buying a record 1.6 million tons of Russian oil in April.

The Saudis are making good on a promise they made: flood the market with oil. It is a risky strategy in a world where storage capacity around the world could be full in a couple of weeks. While the energy industry seems to be heading full speed towards a cliff, exporters in Russia and Saudi Arabia prefer to maintain their market share instead of saving the industry. Only time will tell where this strategy will lead to.

By Vanand Meliksetian for Oilprice.com

More Top Reads From Oilprice.com:

- How Oil Prices Could Go To $100

- Could Brent Crude Oil Prices Ever Fall Into Negative Territory?

- Big Oil’s Dilemma: Cut Dividends Or Cut Operations

Russia’s oil strategy is to consolidate and increase its market share in the two markets that matter to it, namely China and the European Union (EU). Russia looks for opportunities to exploit and establishes presence with military precision but without fanfare. Russia is helped in its endeavours by President Putin who isn’t only the world’s most astute statesman but also one of the most knowledgeable persons in the world about energy. That is how he made Russia the world’s superpower of energy.

Contrast this with Saudi oil strategy which can be described as muddled, rash and very short-sighted. Examples abound.

Since the early 1980s Saudi Arabia has unsuccessfully wielded the oil price war weapon three times: one in early 1980s to help the United States undermine the former Soviet Union. The second time in the aftermath of the 2014 oil price crash and the third in the aftermath of the OPEC+ meeting on the 6th and 7th of March when Russia refused to agree deeper production cuts. Saudi Arabia never persisted with its strategy and was forced to reverse it having virtually bankrupted itself without achieving its goals. How did the Saudis think they could flood a market sagging under the weight of a glut estimated at 1.8 billion barrels as a result of the coronavirus outbreak. What did they think the American response would be to their shipping some 40 million barrels of oil to the United States at a time the American domestic market was groaning under the weight of glut due to the outbreak and a lack of storage both of which eventually precipitated the collapse of the WTI oil price to negative. Saudi Crown Prince Mohammed bin Salman deserves better oil advisors.

Saudi Arabia tried to undermine Russia’s oil market share in the EU by offering substantial discounts to undercut Russia’s Urals crude. It failed because it was offering the cuts to a market where oil demand has virtually collapsed as a result of the outbreak.

Saudi Arabia has tried to increase its market share in the world’s largest energy market, China at the expense of Russia. Despite discounts of $3-$5 per barrel offered to Chinese buyers, Russia has been gaining market share at the expense of Saudi Arabia first because China has vested strategic interests with Russia and second because Russia has a structural advantage over Saudi Arabia. Russian piped oil exports are cheaper than Saudi oil exports shipped on board tankers particularly at a time of rising shipping rates. Russia’s ESPO pipeline with a daily capacity of 1.6 million barrels a day (mbd) in Eastern Siberia delivers oil to service clients in China directly. As in Europe, pipeline imports are cheaper, more flexible, and have shorter transportation times compared to Middle Eastern oil.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London

Huge up day for Tesla remains hardly surprising as well.