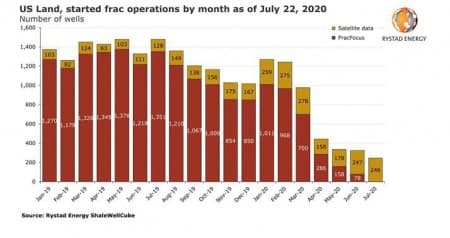

The Covid-19 downturn has caused a shocking decline in new fracking operations in the US, with monthly numbers plunging to a bottom of just 325 wells in June. A Rystad Energy analysis shows that new operations are now set to rise to above 400 wells in July, and recovery will be especially evident in the Permian Basin, where activity has nearly tripled.

Rystad Energy’s well count comes from both our own satellite data analysis and from our tabulation of FracFocus numbers. Our satellite data shows 246 newly started frac jobs this month, with 96 frac jobs beginning just last week.

“While there is only one week left in July, the availability of data varies across the tens of thousands of locations covered, with a possible reporting lag temporarily concealing additional fracking activity. We therefore estimate that the final July frac count might surpass 400 wells, and will return to levels last seen in April 2020,” says Rystad Energy’s head of shale research, Artem Abramov.

The magnitude of the frac activity recovery in the Permian, in comparison to other oil basins, has become much more evident. As of 22 July, we have identified 125 started frac jobs in the Permian for July. This activity is 15% to 23% higher than the well count for the full months of May and June 2020. On average, the Permian Basin has higher satellite revisit rates than other oil basins. This means that while other oil basins might also see recovering activity, the estimates around these recoveries are more uncertain. Related: Halliburton Looks Beyond Shale As Fracking Remains Unprofitable

The running rate of frac activity in the Permian has shifted from 15 to 20 wells per week in May and June, to 40 to 45 wells per week in the last three weeks. Last week, week 29, activity was particularly strong with 63 started frac operations based on our preliminary estimates. This level of activity has not been seen in the Permian since early April this year.

In all other oil basins including Bakken, Eagle Ford, Anadarko and Niobrara, our latest fracking activity estimates suggest fracking activity is around 35 to 40 wells per week since the beginning of July. Meanwhile, we estimate that 20 to 25 wells per week are currently being fracked in gas basins, which represents a significantly reduced activity level compared to the levels seen at the beginning of the year.

On the rig front, US land rig activity in oil basins seems to have hit rock bottom as the count of horizontal oil-focused rigs declined by one more rig last week, falling from 157 rigs to 156 rigs, a decline which originated from the Permian. Other oil basins saw a net zero change in the number of active rigs, as the addition of one rig in Eagle Ford was offset by a rig count decline in central Texas.

Gas-focused drilling saw another week of declines, decreasing from 63 active rigs down to 59. Most of these declines came from the Utica part of the Appalachian Basin, but Haynesville also lost one rig.

The cumulative decline in horizontal oil rig count, which began in the middle of March, has now reached 75%. However, the magnitude of weekly declines in the recent weeks has slowed considerably. The two-week decline rate peaked at 25.6% at the beginning of May 2020 and has now slowed to 3.1% by the middle of July.

“We anticipate nationwide horizontal oil drilling will remain relatively flat in the next few weeks, as some operators continue to implement modest downward adjustments, while others have started restoring drilling operations in the current $40 WTI price environment,” adds Abramov.

By Rystad Energy

More Top Reads From Oilprice.com:

- Oil Prices Hit Four-Month High On Vaccine Hopes

- Is The EU's Historic Green Stimulus Plan Ambitious Enough?

- Renewable Energy Is Seizing Market Share During The Pandemic