Oil price lost 44% of its value late last year. That price collapse was a signal to tight oil companies to stop over-producing. The message will be repeated until action results.

From October 3 to December 24 2018, WTI fell from $76.41 to $42.53 (Figure 1).

Figure 1. The oil-price collapse of 2018.

Source: Quandl and Labyrinth Consulting Services, Inc.

Since then, WTI has recovered to nearly $60/barrel and Brent to about $68. Market observers seem to have largely forgotten the scale of price collapse just a few months ago. Although the magnitude of that collapse was not as great as in 2014-2015, the rate of decline was greater. That is because it occurred more quickly.

In 2018, WTI price fell an average of -$0.42 per day for 81 days. In 2014-2015, it fell -$0.29 per day for 218 days (Figure 2).

Figure 2. Rate of price collapse in 2018 was greater than in 2014-2015.

Source: Quandl and Labyrinth Consulting Services, Inc.

Analysts are making fairly aggressive calls for 2019 average Brent price of $74 and $83 in 2020. I hope those calls are right but I am less optimistic. That is because the world remains over-supplied with oil.

The balance between world oil production and consumption moved from a deficit of -0.24 million barrels per day (mmb/d) in 2017 and early 2018 to a surplus of +0.44 mmb/d beginning in the third quarter of 2018 (Figure 3).

Figure 3. The world is over-supplied with oil.

Source: EIA STEO and Labyrinth Consulting Services, Inc.

It is likely that the production surplus will persist through 2019 and possibly 2020 based on EIA forecasts for production and consumption. EIA’s forecast for quarterly WTI price is below $65 per barrel through 2020. Related: Morgan Stanley: Oil To Rise To $75 This Summer

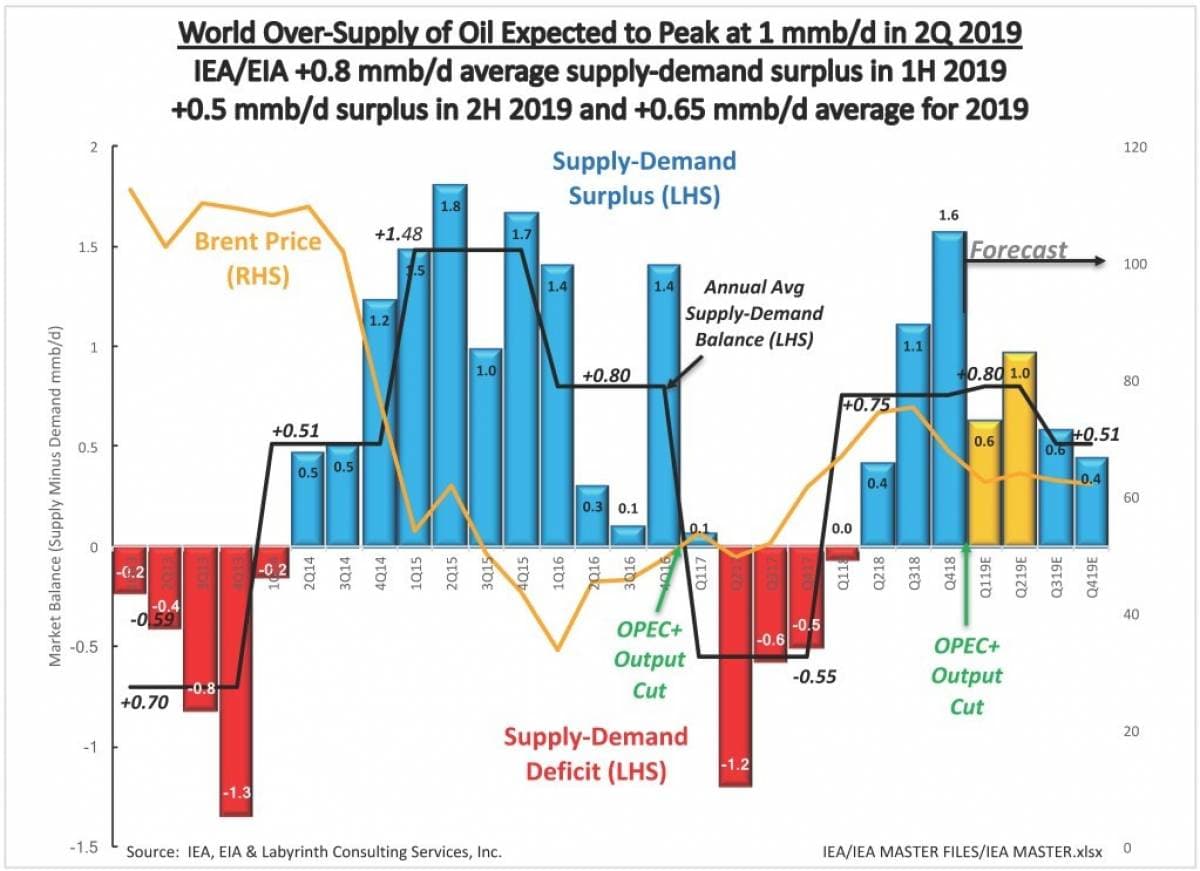

The global supply and demand outlook is similar. World oil supply-demand balance reached an over-supply of +1.6 mmb/d in the 4th quarter of 2019. It has fallen to around +0.6 mmb/d today (Figure 4).

Figure 4. World over-supply of oil expected to peak at 1 million barrels of oil per day in the second quarter of 2019.

Source: IEA, EIA and Labyrinth Consulting Services, Inc.

Forecasts based on EIA supply and IEA demand suggest that the surplus will rise to +1 mmb/d in the second quarter and then, decline through the rest of the year.

Market sentiment has turned bullish since OPEC+ cuts were announced late last year even though concern remains about the strength of the global economy and the status of U.S.-China trade talks.

I am less concerned about those demand-side issues than about the ongoing over-production in the world generally and in the Permian basin in particular. Despite talk of fiscal restraint by shale companies and more limited capital supply from credit markets, production continues to increase.

I share Khalid Al-Falih’s concerns that world inventories are moving in the wrong direction for a sustainable price recovery beyond recent gains. Some analysts seem to forget that world oil prices have been on OPEC+ life support since late 2016 and apparently need even stronger measures in 2019.

The oil-price collapse of 2018 should have sent a clear message to producers to change their behavior or risk further crushing price reactions going forward.

By Art Berman

More Top Reads From Oilprice.com:

- U.S. ‘’Oil Weapon’’ Could Change Geopolitics Forever

- Trump’s Last Chance To Subdue Gasoline Prices

- Oil Prices Shoot Up On Large Inventory Draw

You said that shale was a fraud.

Now you tell us that the price of oil fell faster in Q4 2018 but that was because equity and commodity prices fell at light speed.

With ExxonMobil and Chevron both saying they are increasing CAPX to the Permian and to shale, I think you should revisit your bearish attitude on shale's economics.

Clearly, XOM and CVX see something that you don't.