OPEC+, which meets later Thursday via video conference, has shown little signs it plans to waver from its plan to raise oil production gradually, despite pressure from senile presidents and consuming nations to temper high prices.

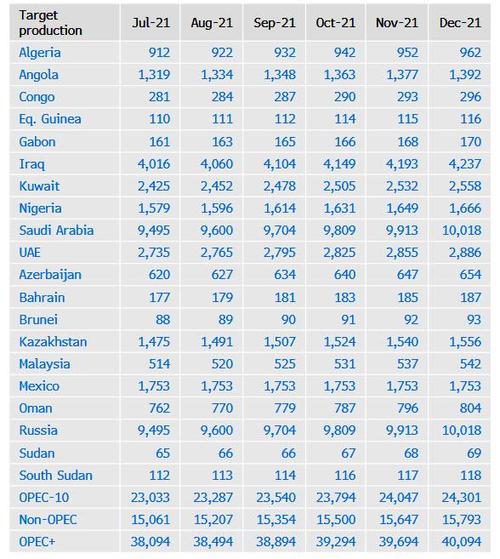

The OPEC+ alliance’s plan is to raise output by 400k b/d each month to remove previous cutbacks. That’ll increase the collective December target for 20 nations to 40.094m b/d...

... and all analysts in a Nov. 2 Bloomberg survey expect OPEC+ to ratify that today

Meanwhile, overnight Bloomberg reported quoting delegates and diplomats, that the U.S. had asking OPEC+ to increase production in December by between 600k-800k b/d, between 50% and 100% higher than the planned increase. And since OPEC+ will throw up all over this proposal - previously, both the Iraqi (Oct. 30) and Nigerian (Oct. 25) ministers said the planned 400k b/d increase is enough - the report noted that the US will accept the minimum 400k b/d increase if it comes with a pledge for other OPEC+ members to compensate if some fall short. Earlier this week we learned that OPEC delivered only about half of its October output increase as Angola and Nigeria struggled to pump more.

Sepratately, the U.S. and other consuming nations could potentially release oil from government- strategic stockpiles if they deem it an emergency, although such a move would hardly look prudent at a time when the entire world is pretending to care about the environment.

Going back to today's OPEC+ meeting, Saudi Arabia cautioned that the coronavirus pandemic, which caused demand to plunge in 2020, is not yet over, while Iran has emerged as another variable: with nuclear talks due to resume Nov. 29, there’s a growing possibility of an eventual lifting of U.S. sanctions, potentially unleashing more than 1m b/d of crude for export on global markets.

And with oil prices having tumbled in the past three days as algos and CTAs misread Biden's leverage in controlling what OPEC+ can and can not do, we are finally seeing some reversal as the grown ups finally take control.

By Zerohedge.com

More Top Reads From Oilprice.com:

- Oil Prices Slide On Fears Of Tighter Fed Policy

- The Energy Crunch Is Adding Billions To Oil Tycoons’ Net Worth

- The Oil Omen: First Large U.S. Shale Driller To Pledge Flat Output In 2022