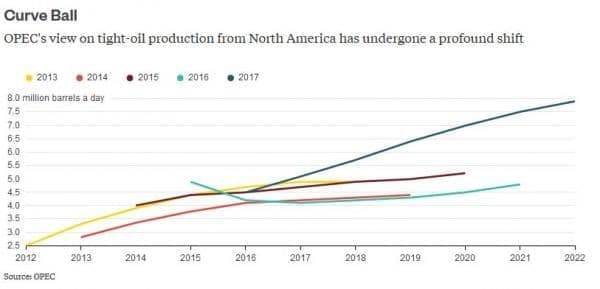

True to its perpetually optimistic form, OPEC, which only last week for the first time conceded the threat posed by rising US shale production...

(Click to enlarge)

... sharply raised its demand forecast for cartel oil in 2018, ahead of a key meeting of the group’s ministers later this month. According to OPEC's monthly market report, the oil exporters said the forecast demand for its oil next year had been increased by around 400,000 barrels a day from the previous month to 33.4mmbpd, about 0.46mmbpd higher than in 2017. Overall, the cartel now expects global demand growth to rise by 1.53 million barrels a day in 2017 - an upward revision of 74kbps from the October report citing better than expected performance from China - and 1.51 million barrels a day in 2018.

The increase comes on the back of the recent global economic strength, which has exceeded many analysts’ expectations, helping to draw down inventories that built up during the crude glut since late 2014. Furthermore, the rise in demand has combined with the 1.8mmbpd in production cuts by OPEC and non-OPEC nations since January of this year to help tighten the market, pushing the price of Brent back above $60 a barrel for the first time in two years.

As the FT adds, cartel analysts said demand for Opec crude is expected to reach 34m b/d in the second half of next year, roughly 1.4mmbpd above what they pumped last month, according to secondary sources. As usual, oil demand is contingent not only on overall confidence (i.e. the stock market), but also whether the global economy is expanding or contracting, which all boils down to whether China is creating lots of new debt each month.

On November 30, OPEC is set to meet to decide whether to extend the cuts beyond March next year. Saudi Arabia and Russia, who have led the cuts, have both indicated they back extending the cuts deep into 2018 to keep drawing down stocks.

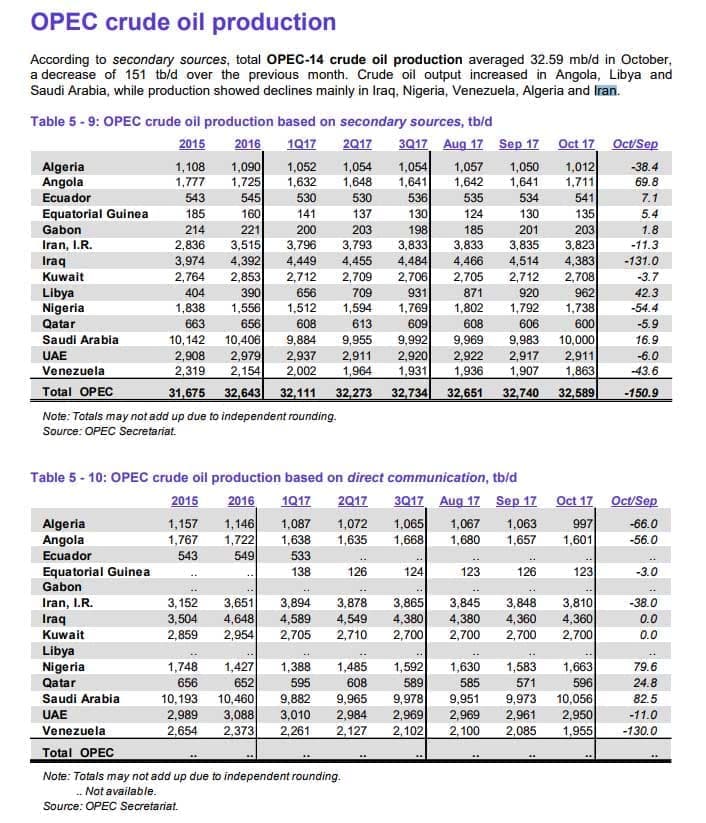

In the monthly report, OPEC also said Monday that crude oil production fell last month by 151,000 barrels a day. Crude output by members of the Organization of the Petroleum Exporting Countries dropped by 0.46 percent, to 32.59 million barrels a day in October, compared with the month prior. That decline was aided by reduced production in Iraq, Nigeria, Venezuela, Algeria and Iran. Production in Saudi Arabia rose by 17kpbd to 10 million barrels daily.

As the WSJ notes, the report "highlights the cartel’s increasingly successful efforts to rebalance the oil market by withholding production to reduce the global supply glut and boost prices." To be sure, none of the numbers below incorporate last week's striking FT report, according to which Saudi Arabia may be hiding 70mm barrels in above ground storage to give the impression of higher demand.

(Click to enlarge)

Related: Is China Heading Toward An Energy-Debt Crisis?

As the WSJ adds, the “high conformity levels” of the OPEC and non-OPEC participants in a deal to reduce crude output “have clearly played a role in in supporting stability in the oil market and placing it on a more sustainable path,” the report noted.

OPEC said commercial inventories in the Organization for Economic Cooperation and Development—a group of industrialized oil-consuming nations, including the U.S.—fell in September to just below 3 million barrels—154 million barrels above OPEC’s target of the last five-year average.

By Zerohedge

More Top Reads From Oilprice.com:

- Is Peak Permian Only 3 Years Away?

- Houthi Rebels Threaten To Attack Saudi Oil Tankers

- OPEC Chairman: Output Cuts Are The ‘’Only Viable Option’’