Back in December we discussed how US oil inventories had been drawn down by a hundred million barrels from their peak last March, channeling Dr Evil from Austin Powers.

In recent weeks we have been on tour, presenting our six-month proprietary outlook, and have been highlighting the case of another 100 million barrels - this time via the cumulative drop in Saudi crude exports over the last year.

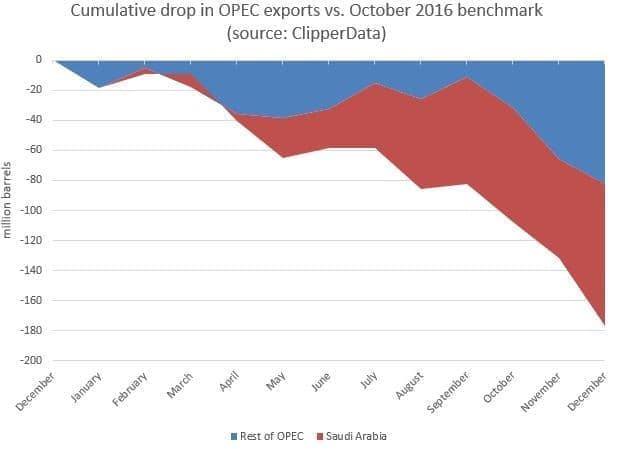

The chart below shows the cumulative drop in OPEC exports in 2017 versus the October 2016 reference level. It highlights that OPEC on the aggregate reduced imports by a total of ~180 million barrels (meeelion barrels) last year.

Breaking down that 180 million-barrel drop, Saudi Arabia accounted for about 100 million barrels - the driving force behind the rebalancing effort.

While others also showed compliance with the OPEC production cut deal by cutting exports (such as Kuwait and Angola) these efforts were offset by rising exports elsewhere from the likes of Libya and Nigeria. On the aggregate, OPEC members minus Saudi accounted for just under half the drop in exports last year:

(Click to enlarge)

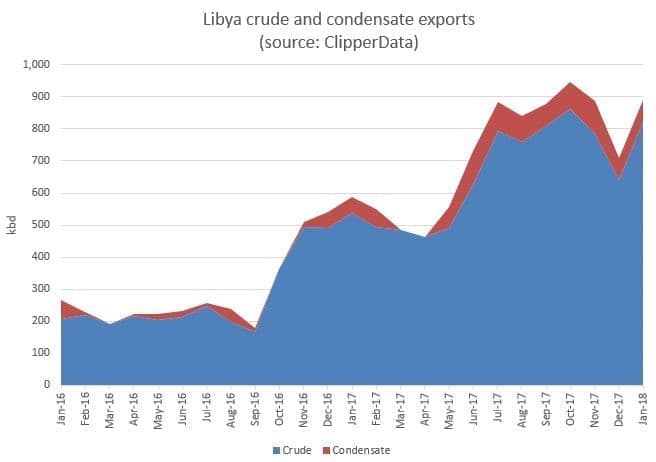

Libya, who wasn't part of the OPEC production cut deal, increased crude exports last year by an average of nearly 300,000 bpd versus October 2016's reference level. This essentially canceled out the export cut by Saudi Arabia (albeit, a swap of heavier crude for lighter barrels - a key theme in the global crude market).

Libyan crude exports peaked in October, before geopolitical tension in the region scuppered production once more. Production at oil fields in the Jikharra area, which flows to the ports of Zueitina and Ras Lanuf, were impacted in early November due to protests. Exports out of Ras Lanuf accordingly dropped to a six-month low in November, and to a five-month low out of Zueitina in December.

Following this, there have been an increasing number of incidents ratcheting up tension in the region - from worker abductions to fuel shortages to heavy clashes.

One of the biggest influences on crude flows, however, came from an attack on the Waha pipeline in late December, which caused a production loss estimated at 70,000 - 100,000 bpd. The pipeline was repaired in early January, and flows have rebounded again.

(Click to enlarge)

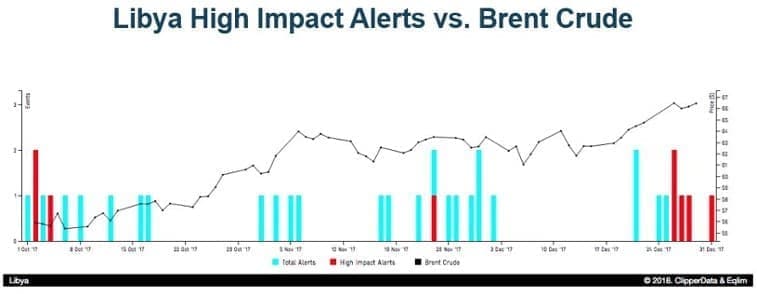

We here at the good ship ClipperData have a new product, which combines algorithmic data mining and quantitative impact analysis to help our clients separate signal from noise. The product is called 'Impact Alerts', and can be explained via the chart below. Related: Have Oil Prices Hit A Ceiling?

The recent events in Libya described above, as well as others which have disrupted crude flows and caused prices to rally, have been sent to clients as 'Impact Alerts'. As disruptive influences have risen in Libya, the frequency of our high impact alerts have increased, along with the price of oil (hark, below).

With the oil market much more precariously balanced than it was just six months ago, geopolitical events and supply outages are having a much more profound impact on the oil market. That is why we have launched this service - to instantly quantify these disruptive events and speed up decision-making. (And the bonus for us is that we are increasingly better informed, always a good thing).

(Click to enlarge)

By Matt Smith

More Top Reads From Oilprice.com:

- Can The Shale Boom Avoid These Bottlenecks?

- Goldman: Oil To Top $80 Within Six Months

- Why Natural Gas Prices Just Tanked