The breakout in Brent crude prices above $80 this week has prompted analysts at the sell side banks to start talking about a return to $100 a barrel oil. Even President Trump has gotten involved, demanding that OPEC ramp up production to send oil prices lower before they start to weigh on U.S. consumer spending, which has helped fuel the economic boom over which Trump has presided, and for which he has been eager to take credit.

But to hear respected petroleum geologist and oil analyst Art Berman tell it, Trump should relax. That's because supply fundamentals in the U.S. market suggest that the recent breakout in prices will be largely ephemeral, and that crude supplies will soon move back into a surplus.

Indeed, a close analysis of supply trends suggests that the secular deflationary trend in oil prices remains very much intact. And in an interview with MacroVoices, Berman laid out his argument using a handy chart deck to illustrate his findings (some of these charts are excerpted below).

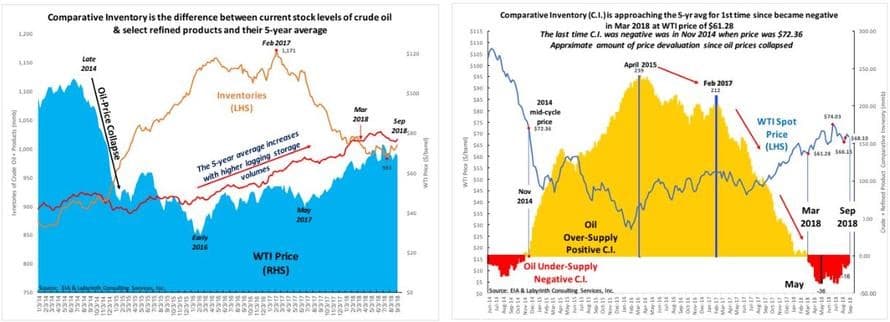

As the bedrock for his argument, Berman uses a metric that he calls comparative petroleum inventories. Instead of just looking at EIA inventory data, Berman adjusts these figures by comparing them to the five year average for any given week. This smooths out purely seasonal changes.

And as he shows in the following chart, changes in comparative inventory levels have precipitated most of the shifts in oil prices since the early 1990s, Berman explains. As the charts below illustrate, once reported inventories for U.S. crude oil and refined petroleum products crosses into a deficit relative to comparative inventories, the price of WTI climbs; when they cross into a surplus, WTI falls.

(Click to enlarge)

Looking back to March of this year, when the rally in WTI started to accelerate, we can on the left-hand chart above how inventories crossed below their historical average, which Berman claims prompted the most recent run up in prices. Related: The Future Of Global LNG Is Here

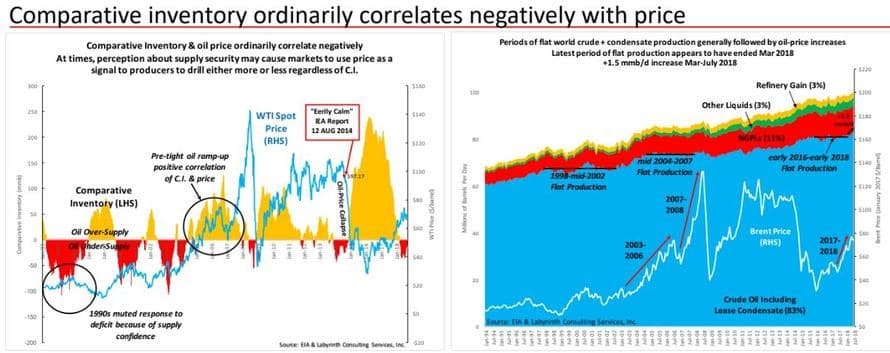

Comparative inventories typically correlate negatively to the price of WTI. But occasionally, perceptions of supply security may prompt producers to either ramp up - or cut back - production. One example of this preceded the ramp of prices that started in 2010 when markets drove prices higher despite supplies being above their historical average. The ramp continued, even as supplies increased, largely due to fears about stagnant global growth in the early recovery period following the financial crisis.

(Click to enlarge)

The most rally that started around July 2017 correlated with a period of flat production between early 2016 and early 2018.

Meanwhile, speculators have been unwinding their long positions. Between mid-June 2017 and January 2018, net long positions increased +615 mmb for WTI crude + products, and +776 for WTI and Brent combined. Since then, combined Brent and WTI net longs have fallen -335 mmb, while WTI crude + refined product net long positions have fallen -225 mmb since January 2018 and -104 mmb since the week ending July 10. This shows that, despite high frequency price fluctuation, the overall trend in positioning is down.

(Click to enlarge)

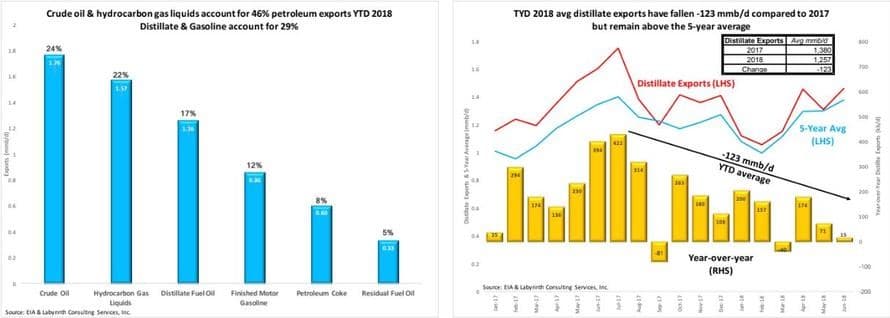

And as longs have been unwinding, data show that the U.S. export party has been slowing, as distillate exports, which have been the cash cow driving U.S. refined product exports, have declined. Though they remain strong relative to the 5-year average, they have fallen relative to last year. This has accompanied refinery expansions in Mexico and Brazil.

(Click to enlarge)

Meanwhile, distillate and gasoline inventories have been building.

(Click to enlarge)

Meanwhile, U.S. exports of crude have remained below the 2018 average in recent weeks, even as prices have continued to climb.

(Click to enlarge)

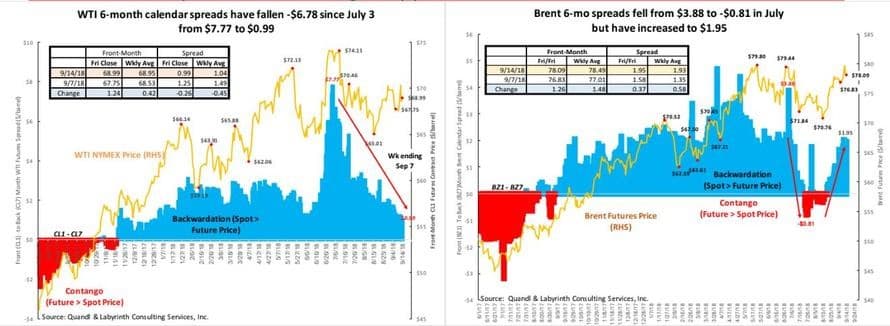

This could reflect supply fears in the global markets. The blowout in WTI-Brent spreads would seem to confirm this. However, foreign refineries recognize that there are limitations when it comes to processing U.S. crude (hence the slumping demand for exports).

(Click to enlarge)

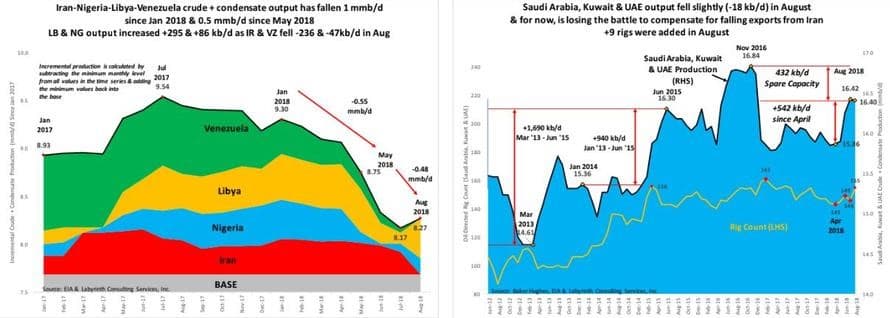

In recent weeks, markets have been sensitive to supply concerns thanks to falling production in Venezuela and worries about what will happen with Iranian crude exports after U.S. sanctions kick in in November.

(Click to enlarge)

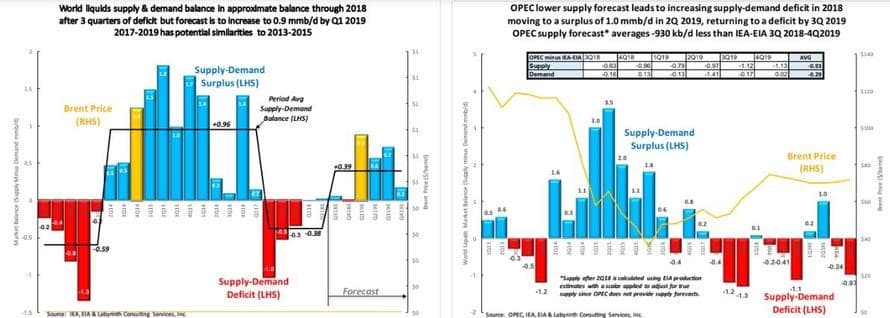

But supply forecasts for the U.S. are telling a different story than supply forecasts for OPEC.

Related: Schlumberger To Buy Russia's Leading Drilling Company

In the U.S., markets will likely remain in equilibrium for the rest of the year, until a state of oversupply returns in 2019. But OPEC production will likely continue to constrict, returning to a deficit in 2019.

(Click to enlarge)

Bottom line: According to Berman, the trend of secular deflation in oil prices remains very much intact. While Berman expects prices to remain rangebound for the duration of 2018 - at least in the U.S. - it's likely markets will turn to a supply surplus next year, sending prices lower once again.

By Art Berman via Zerohedge

More Top Reads From Oilprice.com:

- Shell CEO: $80 Oil To Boost Energy Infrastructure Investment

- Traders Turn Bullish Ahead Of Iran Sanctions

- Creating Fuel From Thin Air

Contrary to what you and Art Berman are saying, oil prices are heading upward underpinned by very robust global oil market fundamentals, inability of OPEC/Russia to add more than the 650,000 barrels a day (b/d) which Saudi Arabia and Russia combined have already done and persistent question marks about Saudi proven reserves and production and spare capacities. This has nothing whatsoever to do with the forthcoming US sanctions on Iran. Under such circumstances, a $100 oil price is not an if but a when. Moreover, I am on record having been arguing for a quite a while that US sanctions on Iran are doomed to fail and that Iran will not lose a single barrel from its oil exports.

Therefore, you and Mr Berman should have another think about oil prices and try to understand the dynamics of the global oil market before hazarding another projection on oil prices.

Furthermore, an oil price higher than $100 a barrel is good for the global economy in that it stimulates global oil investments, it also enables oil-producing countries to get a reasonable revenue and thus spending more on exploration and expanding their oil production capacity to meet future demand and it also enables the global oil industry to balance its books and start new projects.

The world could be heading towards a global oil supply gap by 2020/21 resulting from a drought of investment since the 2014 oil price crash. The global oil market needs 15 mbd by then to meet global demand and also to offset a 5% annual depletion rate almost equivalent to Iraq’s current oil production.

However, judging by current trends, it will be virtually impossible to add 15 mbd between now and 2021. Oil prices reaching $120 a barrel could not therefore be discounted.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London

So if oil is NOT going to $100/bbl and there isn't a sanctions change vis a vis Iran....it's because of shale oil production.

Thanks, Art !! LOL