The Energy Information Administration (EIA) estimates that the world consumed 96.92 million barrels per day in 2016, with the top 10 consumers accounting for 60 percent of the total consumption. That’s nearly 100 million barrels per day.

At today’s average oil price of $60 per barrel for Brent crude, that’s $5.8 billion consumed. Every. Day.

The top three oil consumers—the United States (20%), China (13%), and India (5%) account for more than a third of the world’s consumption. Of those three, only the United States is a major oil producer. Saudi Arabia and Russia, who are two of the three top oil producers in the world, rank #5 and #6 when it comes to consumption.

Data Source: EIA

But that’s just the current daily average based on EIA data from 2016. Today, estimates are that we are chewing through 100 million barrels per day or more. But that hasn’t always been the case.

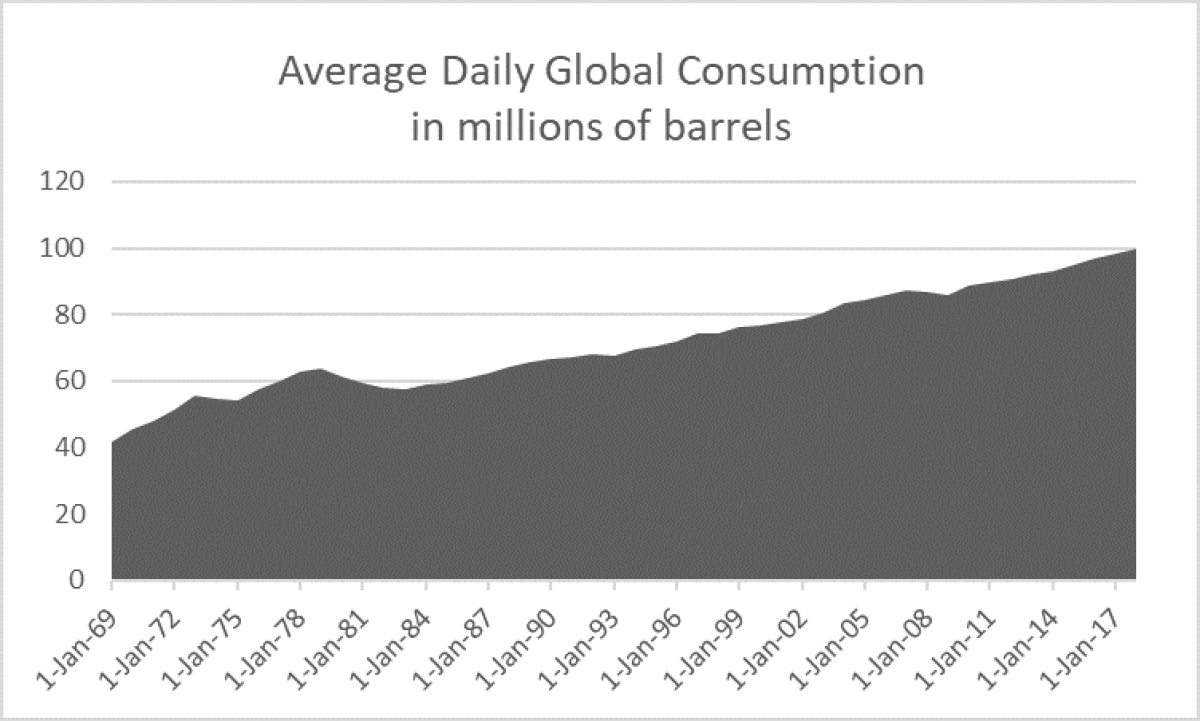

According to BP’s Statistical Review of World Energy, consumption has been on a steep uphill trajectory for decades, starting at about 40 million barrels per day consumed in 1969.

That’s the average daily rate. Annually, global consumption is even more impressive, reaching 36.4 billion barrels consumed in 2018, according to BP. That’s $2.184 trillion worth of oil consumption in a single year. In gallons, the world’s annual consumption is 1.134 trillion—roughly half the amount of water found in Lake Michigan.

Looking at the total consumption by decade, consumption has increased from almost 200 billion barrels in the ‘70s to nearly 350 billion barrels over the last decade.

All told, from 1969 to 2018, a fifty-year span, the world has consumed 1.306 trillion barrels of oil.

But what about the period before 1969? That data, while certainly less significant in the grand scheme of things because we’re talking about significantly less volume, is harder to track down. For the early years, production data is easier to come by, which is a reasonably fair substitution for consumption since you can’t consume what you didn’t produce, and producers wouldn’t produce barrels that are not being consumed. Related: Shale Bleeds Cash Despite Best Quarter In Years

From 1950-1969, world oil production totaled 151.4 billion barrels. In 1950, total world oil production was 3.8 billion barrels—just over 10 million barrels per day. To compare this with current production rates, the US, Saudi Arabia, and Russia each produce more than that.

Total estimated world oil consumption, from 1950 to 2018, then, is estimated at 1.457 trillion barrels.

But what about before 1950?

Unfortunately, the world’s record-keeping ability was a bit inferior to today’s methods. Not every producing country kept good tabs on the amount of oil it pumped out of the ground, and even fewer countries kept good records on how much oil it consumed. For this reason, estimates for how much oil the world was consuming prior to 1950 vary wildly. And clearly, the record-keeping ability is worse the farther you go back in history. And to figure out how much oil the world has consumed, you’d have to get into your Way Back machine to 1850.

Hungarian Academy of Science Theory

In 2008, a pair of chemists from the Academy of Sciences estimated that the world had pumped 100 billion tonnes of crude. This equates roughly to 733 billion barrels of oil. We can assume that this estimation including production through 2007. From 2008 to 2018, the world has used an additional 371.2 billion (BP), which would bring the total oil used since the beginning of time to 1.104 trillion—below the usage of 1.457 trillion barrels in the calculations above, derived from multiple sources.

The discrepancy in how many barrels that the world has consumed to date indicate that no one really knows for sure just how many barrels have been pumped out of the ground.

But using the estimates above, if we’ve used somewhere between 1.1 trillion and 1.5 trillion barrels of oil since the beginning of time, what’s next?

Oil Demand Growth

Oil demand growth is set to slow in the coming years. But slowing demand growth doesn’t mean zero demand growth, and cries of “peak oil” are still nowhere in sight. So while the world may be using 100 million barrels per day right now, oil consumption, according to the EIA, is expected to grow by an average of 1.1 million barrels per day in 2019. In 2020, the growth is expected to be 1.4 million barrels per day. These forecasts are adjusted often, however, and demand growth projections have been revised downward in recent weeks as analysts predict weakening economies and therefore demand stemming from the US/China trade war.

OPEC has estimated that demand will grow by 7.3 million bpd from 2019-2023, and 14.5 million bpd from 2019 through 2040. This means that by 2040, the world will be using almost 42 billion barrels per year.

To compare this to how much oil the world has left in reserve, as of 2018, the world has 1.497 trillion barrels of oil, according to OPEC, with 79.4% of those reserves held in OPEC countries, and 64.5% of OPEC’s reserves are located in the Middle East. Venezuela and Iran—two sanctioned countries—together hold 30% of OPEC’s reserves. Nigeria and Libya—who also have had security risks that have hindered production--hold another 5%, This puts 35% of the world’s oil at risk of staying in the ground.

But while OPEC holds the lion’s share of the world’s oil, over the next decade, most of the new oil supply will come from the United States.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- Aramco IPO Could Spell Disaster For Big Oil

- Is Renewable Hydrogen A Threat To Natural Gas?

- U.S. Is Now Largest Oil… And Gas Producer In The World

At this investment decline rate future cumulative production could be as little as 387 billion boe (= 100 mboe/d * 365 d/y / 0.0965/y).

Suppose more moderately the decline in future oil and gas investment falls only at 5%/y. This would suggest that only 730 billion boe will be produced in the future.

Either way, 378 Bboe to 730 Bboe, future production looks to be only a fraction of 1.5 trillion boe in reserves will ever be produced.

In sum, upstream oil & gas investment has already peaked. Reserves are 2 to 4 times greater than will ever be needed. Likely oil reserves have peaked or economically should have already peaked. Investment will continue to decline as weak demand growth does not support prices high enough to warrant sustained investment level. Eventually this leads to production decline.

The math you are doing is hilarious, 2014 prices drove investment to all time highs, then a lower commodity price caused investment to decline. It's temporary. Oil demand is growing and investment will be steady. Oil company execs aren't dumb, they don't keep spending money they don't have like Tesla.

Oil is by an insane margin the most economical energy source on the planet and has created our civilization. Is Tesla going to exploit all the children of The Congo to make their car batteries so rich do-gooders in San Francisco can stop using oil? James, use your math skills and do a proper cradle-to-grave analysis of electric cars and lets see what is worse for the environment and humanity, oil vs. electric.

What is strange for me is the desition of governments to push the world on poverty.

I could not believe on ecological reasons.

Cannot immagine why really.

I would like to dream a better world pushing more oil consumption in always more efficient way, promoting knowledge as the base of wealth. More wealth needs always of more people skilled. Then more oil to be burned for more promoting skills.

Oil is not the problem, but the solution for people who doesn't want to return at 1700 periods.