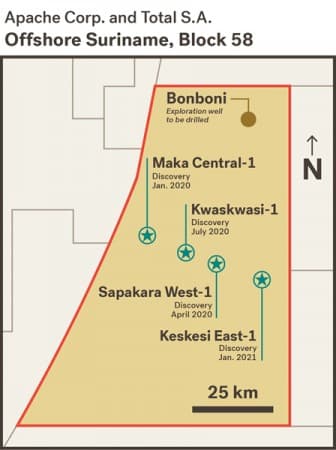

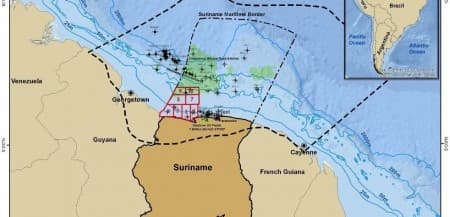

The Guyana-Suriname Basin, which the U.S. Geological Service estimates hold crude oil resources of up to 33 billion barrels, is in the midst of a massive drilling boom that has seen a swathe of major oil discoveries over the last six years. While most of those finds have occurred on the Guyana side of the hydrocarbon basin, the former Dutch colony of Suriname is rapidly catching up. The impoverished South American country, which has been hit particularly hard by the COVID-10 pandemic with gross domestic product shrinking 13.5% during 2020, is focused on launching its own great petroleum boom. In January 2021, Apache Corporation and 50% partner French energy supermajor TotalEnergies, formerly known as Total, made their fourth oil discovery in Block 58 offshore Suriname with the Keskesi East-1 well.

Source: Apache Corporation.

According to Apache, the well-encountered hydrocarbons in the upper Cretaceous-aged Campanian and Santonian intervals. The crude oil found in earlier discoveries had similar API gravities ranging from 34 to 45 degrees, indicating the presence of lighter petroleum grades. The liquids found had API gravities of 27 to 28 degrees in the Campaign level and 35 to 37 degrees in the Santonian.

Related: China's Private Oil Refiners Are Too Powerful For Beijing

The recent raft of discoveries sparked considerable speculation as to the potential crude oil resources held by Block 58, with analysts from investment bank Morgan Stanley calculating that it could hold over six billion barrels of oil equivalent. That estimate is supported by the block’s proximity to the prolific Stabroek Block in neighboring offshore Guyana, where ExxonMobil along with partners Hess and CNOOC have experienced considerable success. Exxon has determined that the Stabroek Block, where it has made 20 discoveries, holds around nine billion barrels of recoverable oil equivalent resources. Block 58, which is adjacent to the Stabroek Block, sits upon the same hydrocarbon trend boding well for further discoveries by Apache and Total, which is also the operator.

By early March 2021 however, greater than expected well pressure saw Apache and Total elect to cease drilling and release the Noble Sam Croft drillship, with the partners electing to focus on drilling the next prospect in the block, the Bonboni exploration well. Despite that setback, Apache and Total still expect first oil from Block 58 by 2025. The oil discoveries are not confined solely to Apache and Total’s operations. Malaysian national oil company Petronas with 50% partner Exxon discovered the presence of hydrocarbons at the Sloanea-1 exploration well in Block 52 offshore Suriname, which is adjacent and east of Block 58.

The abundance of recent quality oil discoveries saw energy industry consultancy Rystad Energy state in May 2021 that Suriname has at least 1.9 billion barrels of recoverable oil resources, which will keep growing as further exploration and development activities are undertaken. The consultancy expects production from Blocks 58 and 52 alone to reach 650,000 barrels per day by the end of this decade which will see Suriname become a major regional oil exporter.

Related:

This impressive slew of oil discoveries in such a short period, spurred on Suriname’s government and oil regulator state-controlled oil company Staatsolie to attract greater foreign investment in the impoverished former Dutch colony’s oil industry. The key to this was opening the 2020/21 shallow-water offshore bid round on 16 November 2020. That saw the regulator offer eight shallow water blocks to the south of Apache and Total’s Block 58 and north of onshore oilfields believed to hold up to one billion barrels of crude oil.

Source: Staatsolie.

The round closed at the end of April this year with global energy supermajor Chevron winning Block 5. Chevron is well-equipped to operate in Suriname because of its long history of operating in South America, including nearby Colombia as well as neighboring Venezuela and Brazil. A consortium comprised of Total and Qatar’s national oil company Qatar Petroleum was successful in bidding for Blocks 6 and 8. Staatsolie and the bidders are now in the process of drawing up production sharing contracts for the relevant blocks.

A key reason Suriname is an attractive jurisdiction for foreign energy companies is the favorable regulatory environment. Not only does the government offer 30-year production sharing contracts, the longest in the region thereby providing foreign energy companies with long-term legal certainty, but royalties of 6.2% after Guyana are the lowest in South America.

Staatsolie has a contractual right to a 20% participation share in each of the assigned blocks and has reputedly expressed interest in exercising that claim regarding Block 58. Suriname’s favorable regulatory environment contributes to the former Dutch colony having low projected breakeven prices. Analysts estimate that Block 58’s breakeven price is $45 per barrel once production starts in roughly four years, although analysts estimate it will fall as further oil discoveries are made and additional necessary infrastructure is put in place. It is important to note that Exxon’s operations in the neighboring Stabroek Block have projected breakeven prices of between $25 to $35 per barrel Brent, indicating that Block 58 and offshore Suriname’s overall average breakeven prices could fall considerably lower.

Suriname is poised to become a leading offshore oil exploration and production location in South America. The rapid rate at which quality oil discoveries are being made underscores the former Dutch colony’s tremendous hydrocarbon potential, with it sharing the prolific Guyana-Suriname Basin with its neighbor Guyana. Paramaribo’s creation of a favorable regulatory environment is an important incentive for attracting much-needed investment from foreign energy majors which are flocking to Suriname’s offshore petroleum industry. As that industry rapidly expands it will deliver a significant economic bonanza for a country which has been severely impacted by the pandemic.

By Matthew Smith for Oilprice.com

More Top Reads From Oilprice.com:

- The Best Oil Stocks As Prices Rebound

- Judge Blocks Biden’s Ban On Oil Leasing

- $100 Oil Predictions Soar As Analysts Warn Of Supply Crisis