After the recovery in global oil and gas drilling seen in 2018, this year the pace of drilling growth around the world is set to step up, albeit moderately, analysts at World Oil forecast.

The undisputed leader in drilling activity last year was the United States, with shale production surging, and it will continue to lead growth in global drilling activity in 2019 as well.

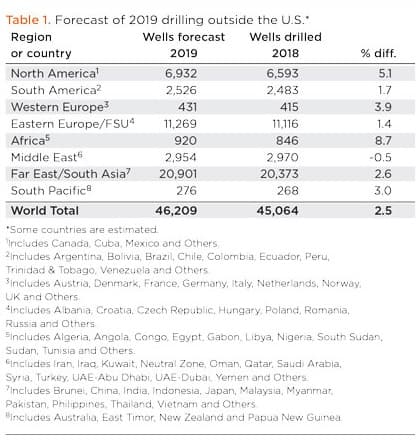

Excluding the United States, the world’s drilling activity is set to increase by 2.5 percent to 46,209 wells expected to be drilled in 2019, following more modest 1.6-percent growth in drilling in 2018, World Oil has estimated.

Source: World Oil

World Oil analysts have forecast drilling activity across eight major regions, in which they have included selected countries, typically the biggest oil and gas producers in each of those regions. The eight regions are North America excluding the U.S, South America, Western Europe, Eastern Europe/former Soviet Union (FSU), Africa, the Middle East, Far East/South Asia, and South Pacific.

All but one of those eight regions are expected to see a higher number of wells drilled this year compared to 2018. The only exception would be the Middle East, where drilling activity is set to slightly decline by 0.5 percent. Nevertheless, World Oil sees 2019 as a very strong year for the major producers in the Middle East.

Another key takeaway from the forecasts is that growth in offshore oil and gas drilling will outpace the overall global drilling market. While total global drilling activity—excluding the U.S.—is set to rise by 2.5 percent this year, offshore drilling is expected to grow by just over 6 percent to 2,204 wells. The most active offshore drilling areas will include East Canada, Brazil, Norway, Angola, Nigeria, Saudi Arabia, Abu Dhabi, China, and India, according to World Oil.

Last month, research firm Rystad Energy said that global deepwater liquid production is set to jump by 700,000 bpd from 2018 to reach a record-high of 10.3 million bpd in 2019 thanks to new fields coming on stream in Brazil and the U.S. Gulf of Mexico. In addition to Brazil and the United States, the other biggest deepwater producers will be Angola, Norway, and Nigeria, according to Rystad. Related: U.S. Oil Rig Count Falls As Prices Slide

Breaking down drilling activity by the eight main regions, World Oil finds that North America, including Canada and Mexico and excluding the U.S., will see activity rise by 5.1 percent this year. Drilling in Canada is expected to remain flat this year as the oil industry is implementing a production cut mandated by the province of Alberta in order to cope with the glut amid constrained takeaway capacity. Mexico’s rig count has increased over the past few months, and although new President Andrés Manuel Lopez Obrador is halting tenders for new oil and gas blocks and reviewing all previous contracts with foreign firms, there is still hope that he would not entirely backtrack on his predecessor’s energy reform, World Oil reckons.

South America will see drilling up by just 1.7 percent this year, with hot spots Brazil and Guyana offsetting a massive 15.8 percent decline in Venezuela and weaker Argentina, where the economic slump continues.

Western Europe’s drilling is forecast to increase by 3.9 percent, driven by high activity offshore Norway and UK drilling growing at a pace similar to the 5.7 percent rise in 2018.

Eastern Europe/FSU activity is set to rise by 1.4 percent this year after 4.3 percent growth last year, which was driven by record Russian production thanks to ramp-ups from its biggest oil producer Rosneft.

Drilling in Africa is expected to grow at the fastest pace among all regions, by 8.7 percent, with Angola and Egypt leading the way.

Middle East activity is set for a 0.5-percent drop, but top OPEC producers Saudi Arabia, Iraq, and the UAE are all set for growth—by 5.4 percent, 1 percent, and 2.5 percent, respectively.

The Far East/South Asia will see drilling up 2.6 percent, following a 12-percent jump in 2018, with Chinese drilling expected up by 2.5 percent as major energy companies aim to boost domestic oil and gas production.

In the South Pacific, drilling will increase by 3 percent, with Australian activity up 2 percent, according to World Oil.

By Tsvetana Paraskova for Oilprice.com

More Top Reads From Oilprice.com:

- Is This The End Of A Record-Breaking Oil Rally?

- Will Trump Take Action Against OPEC?

- Is U.S. Oil Returning To China?

If I were in business , I'd have sectors of the Company offering , Atmospheric Water Generator Station , Wind Turbine Energy Operations , and both Gold Mining and leasing Land that which Oil and Gas are hidden below the earth. This is an asset.