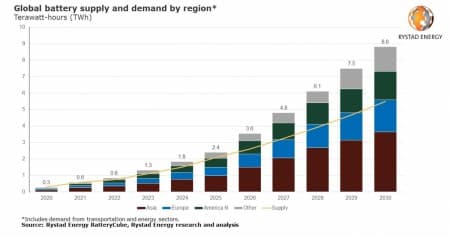

As the energy transition quickens and countries and consumers strive to decarbonize, global battery demand could surge exponentially and approach nine terawatt-hours (TWh) annually by 2030, 15 times the levels seen in 2021.

Rystad Energy research shows that although global battery demand in 2021 stood at 580 gigawatt-hours (GWh), more than double 2020’s total, global supply was still able to keep up. However, that is set to change in the coming years as the appetite for battery technologies in passenger vehicles and stationary storage grows significantly, straining the supply chain.

This demand projection is in line with a 1.6-degree global warming scenario and the changes required to energy systems. It is also unconstrained by any potential supply issues. In terms of components, lithium-ion batteries will dominate the market this decade, although sodium-ion battery demand will materialize by 2030.

Passenger electric vehicles (EV) will be the most significant contributor to future battery growth, accounting for about 55% of total demand by the end of the decade. Demand for these batteries is expected to hit 4.9 TWh by 2030, more than 13 times higher than 2021’s comparatively tiny total of 373 GWh.

Stationary storage will be the next-most significant contributor, with a projected demand of more than 2.5 TWh in 2030, 29% of the total market. The need for storage is set to soar from 139 GWh in 2021 because of the more prominent role that volatile renewable energy sources will play as the world shifts away from fossil fuels. This will increase the need for electricity to be stored when renewable power output is high to periods when output falls, such as times when wind speeds are low wind as happened in Europe last year. Repurposed EV batteries are a viable option for stationary storage, but they will only start to play a significant role from 2040 onwards with enough depleted EV batteries only available by then.

Light to medium-heavy commercial vehicles will mainly be electrified in the future, contributing about 1 TWh of demand by 2030. Electrified aviation and shipping will also have battery needs, but the total demand from these sectors will not significantly impact the global picture.

“Battery demand growth is inevitable as the energy transition quickens, but global supply will fall short without substantial investment or improvements in battery technology in the immediate future. Based on announced targets, battery supply will hit 5.5 TWh by 2030, meeting only about 60% of the expected demand. Gigafactories are being built quickly worldwide, and this supply outlook will likely change. Still, the importance of these continued investments cannot be understated,” says Marius Foss, head of global energy systems at Rystad Energy.

Asia, specifically China, will dominate the regional battery demand breakdown by 2030. Under the 1.6-degree scenario, Asian demand will account for 41% of the global battery market, reaching 3.6 TWh. To meet domestic and international demand, China is targeting 50% of global cell production by 2030, accelerated by the ambitious expansion plans of domestic producers such as CATL, Gotion High-Tech and SVOLT. The pressing demand of its domestic market and offtake agreements with several top-tier automakers globally are driving the steep cell-making capacity expansion planned in the region.

European and North American battery demand will also steadily increase by the end of the decade, reaching 1.9 TWh and 1.7 TWh respectively. The Middle East and South American markets will increase significantly too but will not come close to the three largest regions. Africa’s demand is projected to increase gradually over the next few years, after which it will surge more than 350% from 50 GWh in 2027 to 227 GWh just three years later.

Several regions are accelerating efforts to develop a domestic supply chain to avoid over-reliance on battery imports from Asia. North America saw 10 major plant announcements in 2021, seven of which are part of joint ventures between cell makers and automakers. Joint ventures comprised about 77% of the newly announced projects in the region last year. In Europe, battery supply expansion seems motivated by reducing Asian dependence to support automakers’ plans. More than half of the planned projects are intended to localize production capacities, with European cell makers accounting for about a third of total capacity expansions announced last year.

By Rystad Energy

More Top Reads From Oilprice.com:

- Ukraine War Could Wipe Out 1 Million Bpd In Local Oil Demand

- Can Guyana Unlock Its True Energy Potential?

- Why China Should Want Russia’s Invasion To End